🔥Breaking: Maersk Q4 2025: Volumes Hold, Rates Fall!

❓Markets normalized — yet Maersk still finished at the top of guidance. Execution… or survival mastery?

🏛️About Us /✨Media Kit / 📊2026 Outlook / 👑Gold (*Last 18 Seats)

🔥Greetings Maritime Mavericks,

Q4 2025 confirmed a new container shipping reality:

📉 Freight rates kept falling

📦 Volumes still grew

⚓ Gemini delivered cost savings

🏗️ Terminals closed a record year

📦 Logistics kept improving margins

And Maersk announced another strong efficiency move:

⚙️ Corporate overhead costs will be reduced by $180M annually

👥 About 1,000 corporate roles (~15%) will be eliminated

Freight markets were weak — but Maersk still delivered good results through efficiency improvements, network redesign, and infrastructure strength.

Let’s break down Q4 2025 in 10 fast questions:

1️⃣ Why did Maersk’s revenue fall in Q4?

2️⃣ How severe was freight rate pressure?

3️⃣ How did Ocean perform overall?

4️⃣ Is Gemini delivering measurable results?

5️⃣ What happened in Logistics & Services?

6️⃣ Why were Terminals so strong?

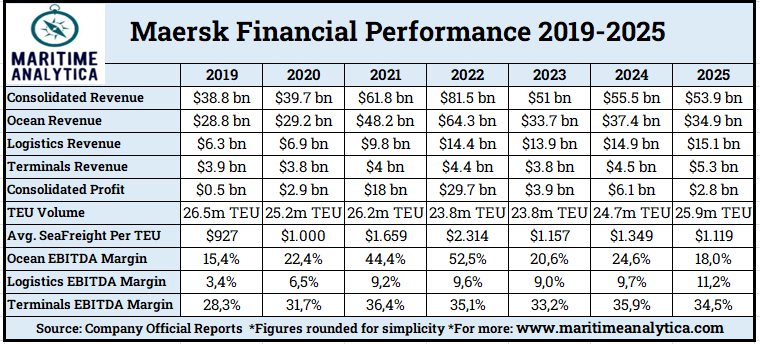

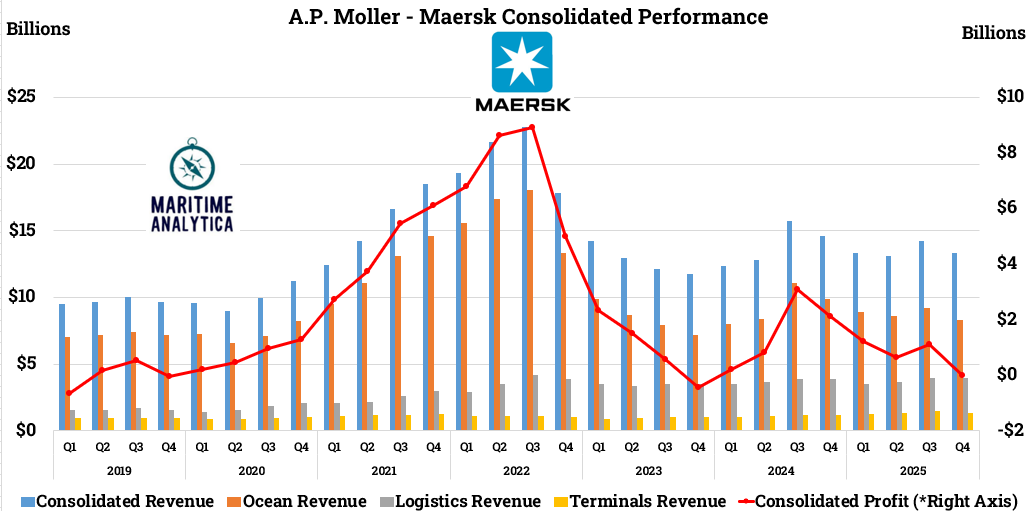

7️⃣ How strong was full-year 2025 performance?

8️⃣ What is happening with shareholder returns?

9️⃣ What are the biggest risks entering 2026?

🔟 What does Maersk expect for 2026?

Along with Top 3 Signals for 2026, CEO Vincent Clerc — Key Signals, and Maritime Analytica — Final Words.

Ready? Let’s dive in.