🚨Breaking: What Could Maduro’s Arrest Mean for Global Container Shipping?

🔥Maduro’s Arrest: A New Risk for 2026?

🏛️About Us /✨Media Kit / 📊2026 Outlook

🔥Greetings Maritime Mavericks,

The arrest of Venezuela’s president sent shockwaves across global politics.

Headlines exploded, markets reacted, and speculation spread fast.

But container shipping does not move on emotions or headlines.

It moves on volumes, routes, ports, and contracts.

So, the real question is not political. It is operational: what could this actually mean for container shipping?

📊What shipping market is really pricing on January 5?

🚢Direct container impact: almost zero (globally)

⚓Where impact is real: local Venezuela logistics

⛽The real shipping hit is tankers, not containers

🌍The risk that actually matters

🧠Final words for carriers, shippers and industry

Let’s dive in…

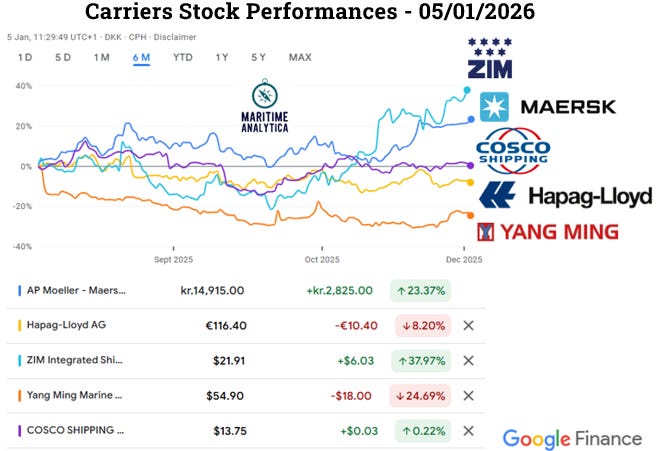

📊What shipping market is really pricing on January 5?

If this event had real implications for container shipping earnings, January 5 was the first day markets would have repriced risk.

They didn’t.

Looking strictly at that single trading day:

ZIM → No panic rally, no sell-off. Volatility stayed contained.

Maersk → Calm trading. No defensive move, no geopolitical repricing.

COSCO → Flat behavior. Political risk already embedded.

Hapag-Lloyd → No sudden drop despite heavy headlines.

Yang Ming → Continued weakness, driven by cycle — not Venezuela.

On day one, the market treated this as a non-event for container shipping — no shock pricing, no sector rotation, no fear trade.

💡When markets ignore breaking geopolitical news, it usually means nothing material changed for container volumes, routes, or earnings.

🚢Direct container impact: almost zero (globally)

Here is the hard reality: