🔥Breaking: ZIM Q3 2025 — Revenue Crashed. Cash Held. Margins Survived.

❓In one of the toughest markets of the decade, how did ZIM still stay profitable?

🎖️Join Us / ✨Media Kit / 📊Exclusive Report / 🎥YouTube / 🏛️About Us

🔥 Greetings, Maritime Mavericks!

Q3 2025 was not a friendly market — not even close.

📉 Freight rates collapsed (–35% YoY)

📉 Volumes slipped (–5% YoY)

📉 Revenue dropped (–36% YoY)

📉 Net income fell (–89% YoY)

And still…

💰 ZIM stayed profitable.

💵 ZIM generated strong cash.

📊 ZIM raised guidance instead of lowering it.

🚢 ZIM kept a modern, flexible fleet.

This was not luck. This was discipline.

Let’s break it down.

1️⃣ Why did ZIM’s revenue fall 36%?

2️⃣ How bad was the freight rate collapse?

3️⃣ If revenue crashed, how did ZIM still deliver profit?

4️⃣ What kept ZIM’s cash flow strong?

5️⃣ What does ZIM’s balance sheet really look like?

6️⃣ What happened to ZIM’s volumes across trade zones?

7️⃣ How is ZIM reshaping its fleet strategy?

8️⃣ Why did ZIM raise its full-year 2025 guidance?

9️⃣ What is the biggest risk for ZIM going into 2026?

🔟 What does the 2026 outlook signal for ZIM?

and

🔝 Top 3 to Watch in 2026!

Ready? Let’s dive in…

💡This analysis is part of the Maritime Analytica — Global Container Shipping Outlook 2026. For more become Gold Member or buy the report separately.

1️⃣ Why did ZIM’s Q3 revenue fall 36%?

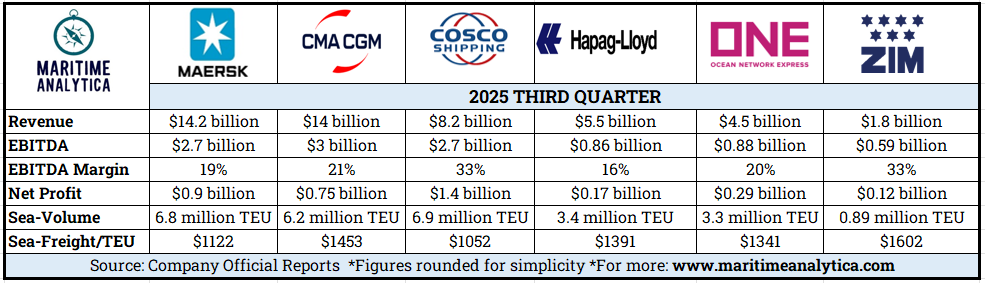

Revenue: $1.78B (–36% YoY, Q3)

Freight rate/TEU: $1,602 (–35% YoY, Q3)

Volume: 926k TEU (–5% YoY, Q3)

💡This is the classic 2025 story: too many ships, too much geopolitics, too much volatility.

2️⃣ How bad was the freight rate collapse?

Q3 rate: $1,602/TEU (–35% YoY)

9M rate: $1,622/TEU (–14% YoY)

💡This is a full reset from the high-price era — back to a “normal” market while costs remain elevated.