🔥CMA CGM Q3 2025: Volatile Markets, Bold Moves!

❓ Rates down. Margins squeezed. Trade flows reshaped. So how did CMA CGM still manage to grow, expand, and invest across five continents?

🎖️Join Us / ✨Media Kit / 📊Exclusive Report / 🎥YouTube / 🏛️About Us

🔥 Greetings, Maritime Mavericks!

Q3 2025 was the definition of a turbulent global shipping market:

⚠️ Geopolitical tensions reshaped every major trade lane

🚢 U.S.–China trade saw stop-and-go episodes

🌊 Red Sea & Gulf of Aden disruptions continued

🏗️ Capacity oversupply pressured rates

💱 Demand softened across key economies

And yet…

CMA CGM did not retreat.

Instead, the Group doubled down: investing in terminals, expanding fleets, buying logistics platforms, growing its intermodal network, and strengthening the French flag.

This is the story of a company playing the long game — even in the worst market.

Let’s break down Q3 2025 in 10 simple, powerful questions, the same way we analyzed Maersk and Hapag-Lloyd — clear, fast, and brutally insightful.

1️⃣ Why did CMA CGM’s Group revenue fall in Q3 2025?

2️⃣ How did CMA CGM’s Shipping business perform?

3️⃣ Why did volumes grow if the market was bad?

4️⃣ How did Logistics perform in Q3 2025?

5️⃣ What happened inside “Other Activities” — Terminals, Air Cargo, Media?

6️⃣ What major strategic moves did CMA CGM make in Q3 2025?

7️⃣ What progress did CMA CGM make on sustainability?

8️⃣ How does CMA CGM compare to Maersk and Hapag-Lloyd this quarter?

9️⃣ What is the biggest risk for CMA CGM heading into 2026?

🔟 What does CMA CGM expect for Q4 2025 and for 2026 overall?

and

🚨 THE BIG PICTURE

🔝 Top 3 to Watch in 2026

Ready? Let’s go…

1️⃣ Why did CMA CGM’s Group revenue fall in Q3 2025?

Because the market softened across shipping, logistics, and freight management.

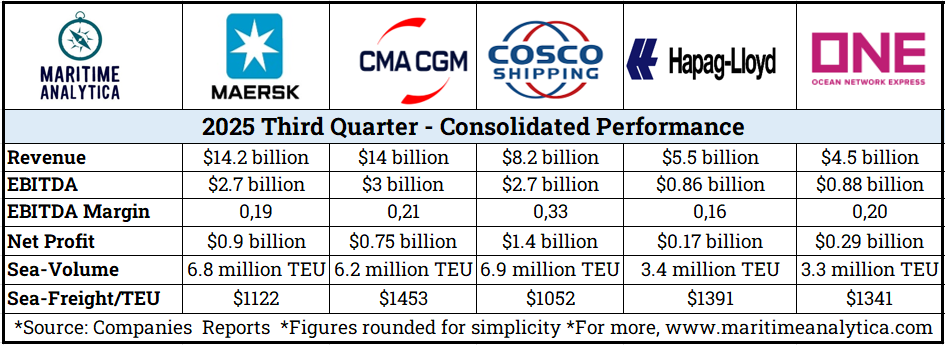

Q3 2025 revenue: $14.0B (–11.3% YoY)

EBITDA: $3.0B (–40.5% YoY)

EBITDA margin: 21.0% (down 10.3 pts)

Net income: $749M (–72.6% YoY)

💡 This is the same pattern we saw at Maersk and Hapag-Lloyd — revenue resilience, but margin compression.

What makes CMA CGM different?

It has four engines (Shipping, Logistics, Terminals, Air Freight) that do not move in the same direction.