🚢 Container Shipping Weekly: All You Need to Know – W06/2025 🌟

🌎 Your essential guide to navigating freight rates, charter trends, and market shifts every week!

🌟Follow us: Website / YouTube / LinkedIn / Survey / Q3 Report!

🔥Greetings, Maritime Mavericks!

🌊 2025 is proving to be a year of volatility across the shipping sector. Freight rates, charter prices, and fuel costs are shifting, while container carriers navigate fluctuating market conditions. Stay ahead with the latest insights! 🚢

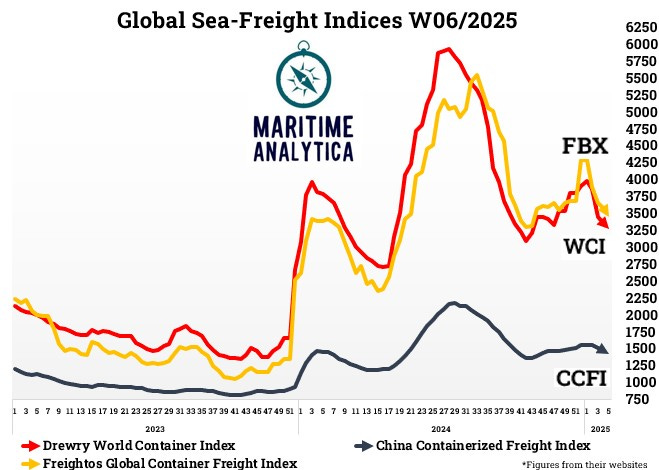

📊 Sea-Freight Indices: Market Stabilizing After Volatility

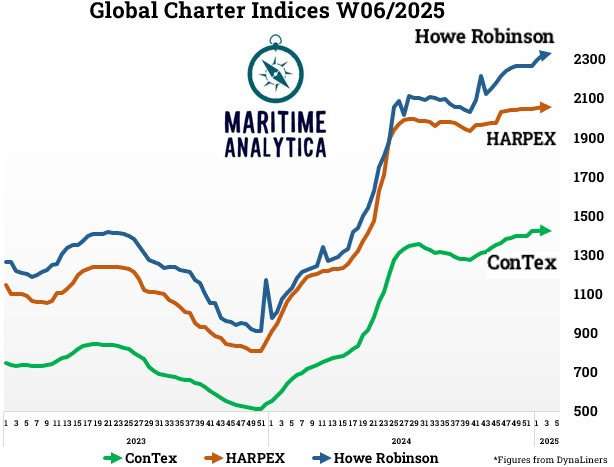

🚢 Charter Market: Red-Hot Demand for Tonnage

⛽ Bunker Prices: Softening Trends Across Fuel Markets

📈 Shipping Stocks Surge Amid Middle East Turmoil

🚀 Dominate the Shipping Industry—Be Seen. Be Heard. Stay Ahead!

Gain premium visibility among 100,000+ industry decision-makers with high-impact LinkedIn and newsletter features. Elevate your brand, outshine competitors. 📩 Secure your spot now: info@maritimeanalytica.com

📊 Sea-Freight Indices: Market Stabilizing After Volatility

🔻 FBX & WCI: Rates have come down from late 2024 highs but remain well above pre-pandemic levels.

📈 CCFI: Steady Chinese export demand, though rapid growth has eased.

⚠️ Key Insight: The Red Sea crisis initially drove up rates due to longer routes, but extra vessel capacity has softened the impact.

💡 Did You Know? The crisis added over $1 billion in extra shipping costs in Q1 2024 due to Cape of Good Hope rerouting.

🚢 Charter Market: Red-Hot Demand for Tonnage

📈 Howe Robinson: Hitting record highs, signaling a tight charter market.

📊 HARPEX: Charter rates remain strong, especially for mid-sized vessels.

🛳 Con-Tex: Growing demand for feeder vessels due to regional trade expansion.

⚠️ Key Insight: Shipowners are locking in long-term charters to maximize earnings amid tight vessel availability.

💡 Did You Know? Some container ships built in the early 2000s remain highly sought after due to limited tonnage supply.

⛽ Bunker Prices: Softening Trends Across Fuel Markets

📉 MGO & VLSFO: Prices have declined amid weaker crude oil markets.

🛢 Brent Crude: Easing after a volatile 2024, reducing cost pressures.

📉 IFO380: Continues to be the most cost-effective option, despite tightening environmental restrictions.

⚠️ Key Insight: While traditional fuel costs are declining, alternative fuels like LNG and biofuels are seeing increased adoption due to IMO and EU emissions regulations.

💡 Did You Know? Over 500 LNG-powered ships are now in operation, marking a major shift in the industry's fuel strategy.