🔥Container Shipping Weekly: Insights into Market Indices

🌎Your essential guide to navigating freight rates, charter trends, and market shifts every week - Trusted By 13,698 Leaders from 149 Countries!

🌟Follow us: Website / YouTube / LinkedIn / LinkedIn Newsletter / 🔥Q3 Report!

🔥Greeting Maritime Mavericks,

📊 The container shipping industry is evolving rapidly. This report deciphers freight indices, charter trends, and eco-fuel shifts to help you stay ahead. From 2024 surges to regional route insights, gain the edge in a volatile market. Dive in and discover the strategies shaping tomorrow.

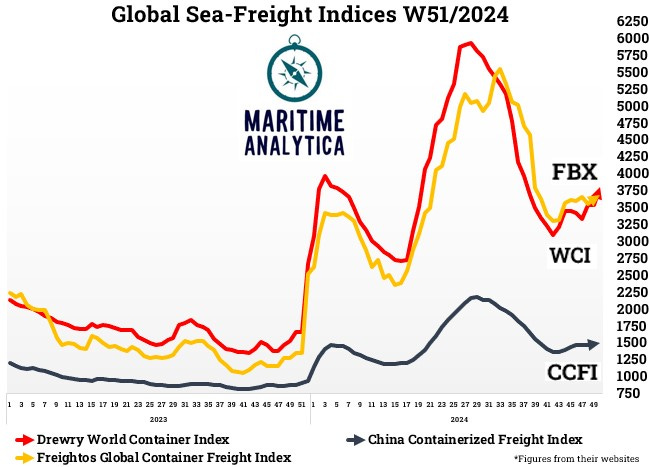

📊Sea-Freight Indices: Peaks & Trends

WCI and FBX: Peaked mid-2024 (Q3), stabilized by year-end.

CCFI Stability: Consistently stable, reflecting steady Chinese export activity.

Correlation Insight: WCI and FBX move together, signaling demand-supply alignment.

Regional Routes:

China to N. Europe: Peaked mid-2024, then eased.

China to US West Coast: Q2 surge, stabilized post-season.

China to Med: Gradual rise, moderate peak.

China to US East Coast: Mid-year spike, then stabilized.

🏅Maritime Analytica's View: Use FBX and WCI to predict seasonal spikes and plan cost-efficient contracts.

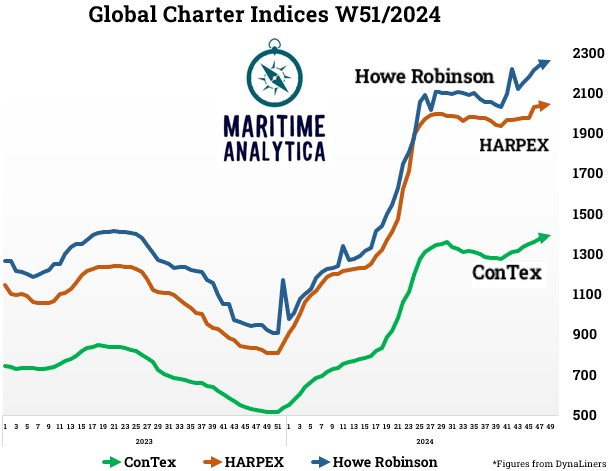

🚢Charter Rates Climb as Demand Intensifies

Howe Robinson: Consistently rising, signaling sustained vessel charter demand.

ConTex: Late-2024 rebound reflects stronger demand for smaller vessels.

HARPEX: Stable growth, covering broad container ship market needs.

Correlation: All indices point to strengthening global charter markets.

🏅Maritime Analytica's View: Tightened Q1 2025 capacity demands early planning to avoid premium rates in Asia-Pacific.

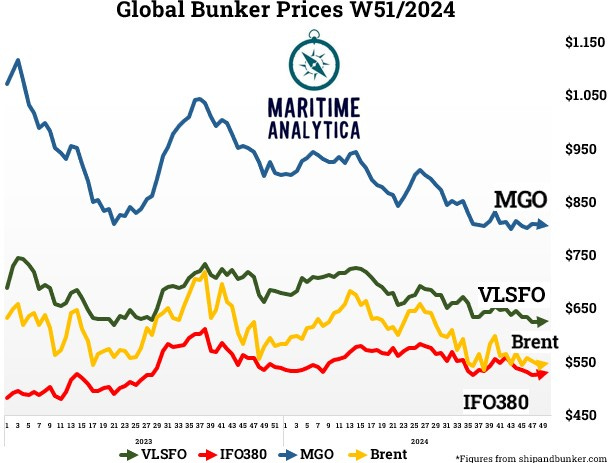

⛽Bunker Price Relief: Key Trends in 2024

VLSFO and MGO: Prices declined slightly; eco-fuel demand keeps MGO higher.

Crude Oil Influence: Brent crude stabilized, lowering operating costs.

Eco-Fuel Push: MGO dominates compliance-friendly fuel options.

Regional Trends: Asia-Pacific pricing stable; Europe faces volatility.

🏅Maritime Analytica's View: Invest in eco-fuels for cost-efficiency and compliance; monitor Brent for budgeting strategies.