🚢 Container Shipping Weekly: Must-Know Market Indices & Trends - 2024 🌟

🌎 Your essential guide to navigating freight rates, charter trends, and market shifts every week – Trusted by 13,967 leaders from 150 countries!

🌟Follow us: Website / YouTube / LinkedIn / Survey / 🔥Q3 Report!

🔥Greeting Maritime Mavericks,

🌊 The container shipping tides are changing rapidly—are you ready to navigate the currents? From market surges to stock highlights, here’s your weekly insider summary to stay sharp in the new year!

✨Help Us Shape Future of Maritime Analytica

We know how busy you are, and we truly appreciate your time. We’re working hard to serve you better and make Maritime Analytica even more valuable—but the best feedback comes from you, our valued readers. That’s why we’d be grateful if you could share your thoughts through this short survey. Your insights are key to helping us tailor our content to your needs.

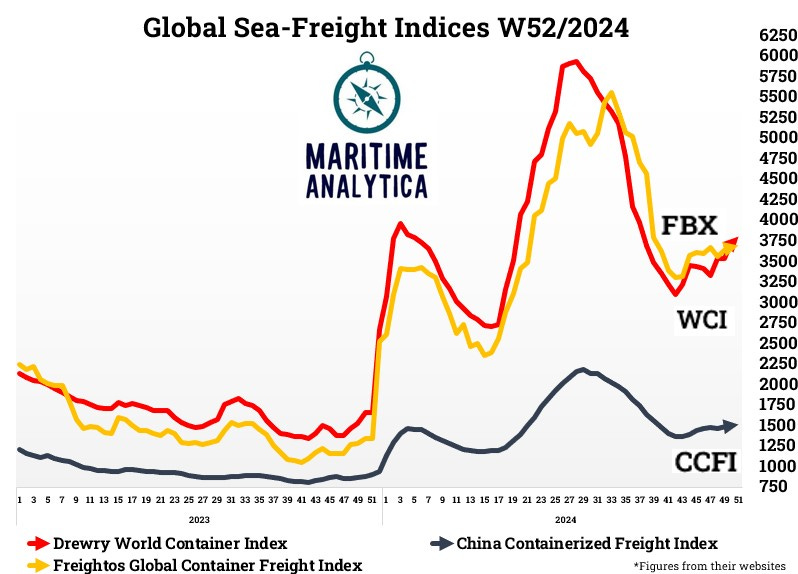

📊 Sea-Freight Indices: Market Pulse

📈 WCI & FBX peaked mid-2024 but stabilized toward year-end.

🌏 CCFI: Reflects steady Chinese exports despite global headwinds.

🏅 Maritime Analytica’s View: WCI and FBX trends provide key signals for negotiating cost-effective contracts. Keep an eye on Q1-2025 for early planning to leverage seasonal pricing dips.

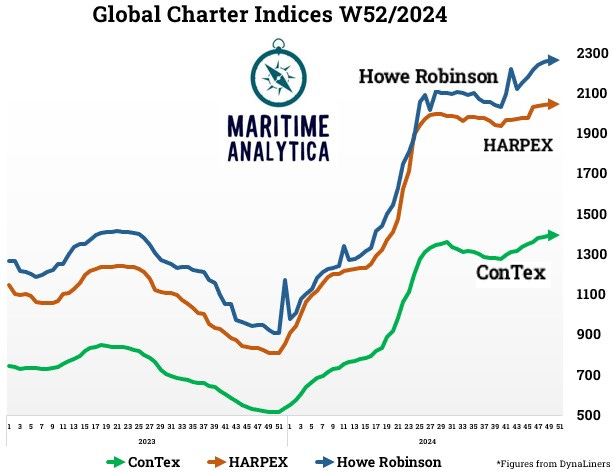

🚢 Charter Rates Surge: Market Tightening

Howe Robinson Index: 📈 A consistent upward trend, reflecting robust demand.

ConTex Index: Rebounded in late 2024, indicating stronger demand for smaller vessels.

HARPEX: Stable upward growth, meeting demand for varied vessel sizes.

🏅 Maritime Analytica’s View: Early Q1 bookings are crucial to avoid Asia-Pacific premium rates.

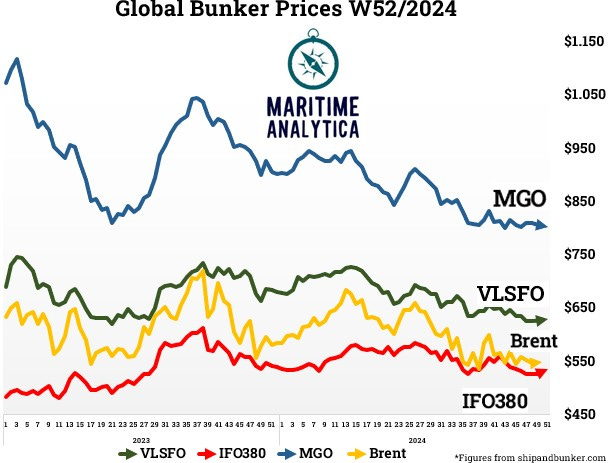

⛽ Bunker Prices: Key Trends in 2024

MGO & VLSFO: Prices declined slightly after mid-year highs, though MGO remains higher due to eco-fuel demand.

Brent Crude: Stabilized around lower levels, easing operating costs.

IFO380: Lower-priced options remain appealing for cost-sensitive operators.

🏅 Maritime Analytica’s View: Stay ahead by integrating MGO into compliance-friendly strategies and track Brent crude for budget planning.

🌱 Did You Know? Lower bunker prices have delayed some shipping companies' shift to biofuels, despite pressure from upcoming EU ETS regulations in 2025.

📈 Global Carrier Stocks: Who's Winning?

ZIM Integrated Shipping: Exceptional growth (+56.91%), maintaining its lead.

Evergreen: Strong performance (+42.37%), reinforcing resilience.

Yang Ming: Impressive gains (+39.82%).

Maersk: Declined (-7.47%), reflecting ongoing diversification pressures.

Hapag-Lloyd: Solid increase (+5.30%), showcasing its efficient operations.

🏅 Maritime Analytica’s View: ZIM and Evergreen continue to outpace peers, but market diversification remains crucial for resilience.

🚀 We’re stronger with your input! Join our conversation and help us grow!

🏅 Why Maritime Analytica Premium Membership?

🌐For more 👉 info@maritimeanalytica.com / www.maritimeanalytica.com