🚢 Container Shipping Weekly: Must-Know Market Indices & Trends - Week 2/2025🌟

🌎 Your essential guide to navigating freight rates, charter trends, and market shifts every week – Trusted by 14,036 leaders from 150 countries!

🌟Follow us: Website / YouTube / LinkedIn / Survey / 🔥Q3 Report!

🔥Greeting Maritime Mavericks,

🌊 The global container shipping market is shaping up for an exciting year. Stay ahead of the curve with our latest weekly insights to make smarter, data-driven decisions!

🌟 Why Choose Maritime Analytica Premium?

"Maritime Analytica makes global trade simple. Their data-driven insights save me time and help me stay ahead." — Jon Monroe, Monroe Consulting

"Concise, timely, and engaging—a must-read for maritime professionals." — Marco Di Massa, Hempel Marine

"Clear, visual, and indispensable—Maritime Analytica simplifies global logistics." — Nikolai Bozhilov, Unimasters Logistics

👉 Join now and stay ahead in the maritime world!

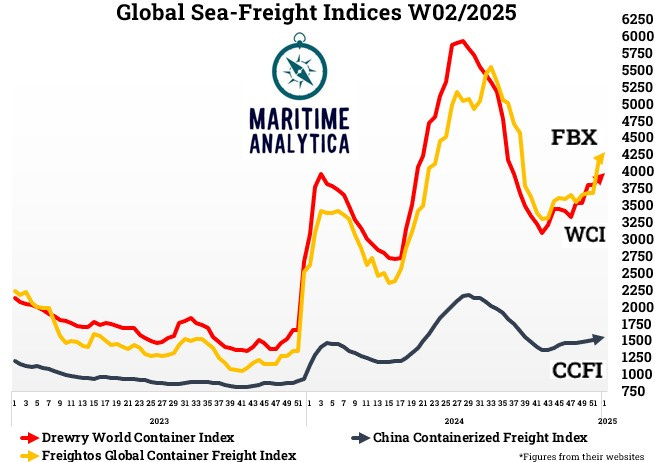

📊 Sea-Freight Indices: Market Pulse

WCI & FBX: Continuing their recovery phase after the volatile peaks in 2024. Recent trends point toward an upward trajectory in early 2025.

CCFI: Chinese exports remain steady despite global economic uncertainties, signaling resilience in the trade lane.

🚨 Industry Insight: East and Gulf Coast port operations stabilized after a new six-year labor agreement was reached. This move averts potential disruptions and solidifies the region's reliability for shippers.

🏅 Maritime Analytica’s View: Prepare for Q1 2025 with robust contracts as indices stabilize. Seasonal rate dips may provide strategic opportunities for cost savings.

💡Did You Know? The Drewry World Container Index (WCI) once dropped by 85% in 2023 from its 2021 peak, marking one of the fastest corrections in recent maritime history.