🔥Hapag-Lloyd CEO Rolf Habben Jansen on Q2'25: "Margins Under Siege, Volumes on the Rise!"

🚨 Gemini boosts reliability, but rising costs hit Hapag’s Q2 margins!

🎖️Subscribe /✨Sponsorship /📊Exclusive Report /🙏Rate us /🎁Send Gift

🔥 Greetings, Maritime Mavericks!

Global shipping is navigating its toughest balancing act yet.

Demand is strong, but profits are sinking fast.

Hapag-Lloyd’s Gemini network is hitting 90%+ schedule reliability, yet at a massive cost.

ETS fees, Red Sea disruptions, and high fuel prices are reshaping the entire cost base.

Rolf Habben Jansen explains how Hapag is adapting to survive today while building the fleet of tomorrow.

Ready? Let’s go…

🔥Maritime Analytica - Exclusive Report is Ready!

🔥10 Must Know from Hapag LLoyd CEO on Q2 and Global Shipping

1️⃣ "I think in the end this year is going to turn out better than many people thought initially."

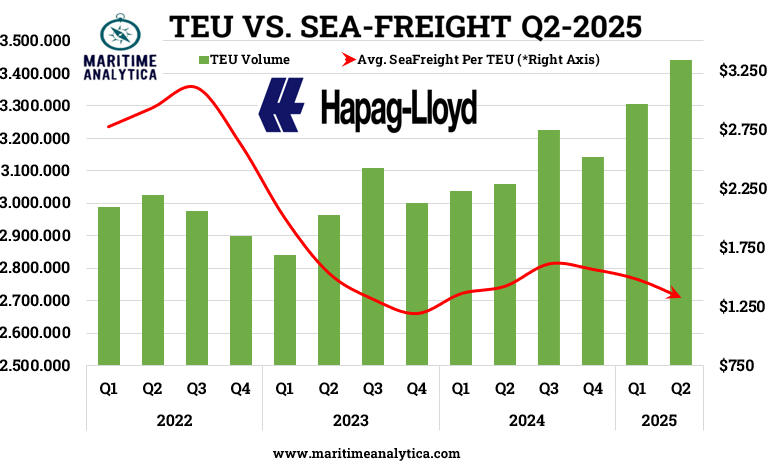

🏅 Maritime Analytica Insight: Group revenue rose +11% YoY in H1 2025 to $10.6B while volumes jumped +10.6% to 6.7M TEU. Despite geopolitical risks, resilient demand and Gemini efficiencies helped buffer market volatility.

2️⃣ “The network had gotten off to a very successful start, having delivered on its promise of more than 90% schedule reliability.”

🏅 Maritime Analytica Insight: Gemini achieved 92–95% on-time performance across key Asia-Europe and Transpacific lanes. Around 60% of bookings now run on Gemini routes, making Hapag the industry leader in reliability.

3️⃣“But making the switch had cost Hapag-Lloyd a three-digit million-dollar figure.”

🏅 Maritime Analytica Insight: Gemini transition costs exceeded $250M+ in H1, a key driver of the -61% EBIT plunge in Q2 to $189M. Startup expenses and vessel diversions around the Cape of Good Hope are weighing heavily on margins.