🚨Is COSCO Quietly Winning the Q2-2025 Shipping Game?

🔥COSCO’s Q2 2025 shows volume growth — but can it sustain momentum amid rising competition?

🎖️Subscribe /✨Sponsorship /📊Exclusive Report /🙏Rate us /🎁Send Gift

🔥 Greetings, Maritime Mavericks!

COSCO SHIPPING Holdings just released its Q2 2025 results — a quarter defined by record container volumes, falling spot rates, and an intensifying fight for market share against MSC, Maersk, and CMA CGM.

Behind the numbers lies a story of resilience, risk, and bold bets on the future of global trade. Let’s unpack it.

I. COSCO Consolidated Performance

II. Container Shipping Division

III. Terminal Division

IV. Strategy & Outlook

V. Conclusion — COSCO’s Crossroads

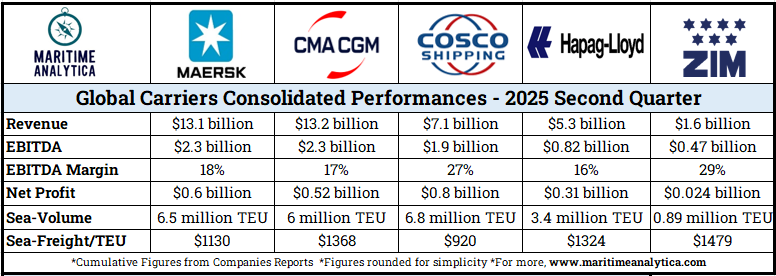

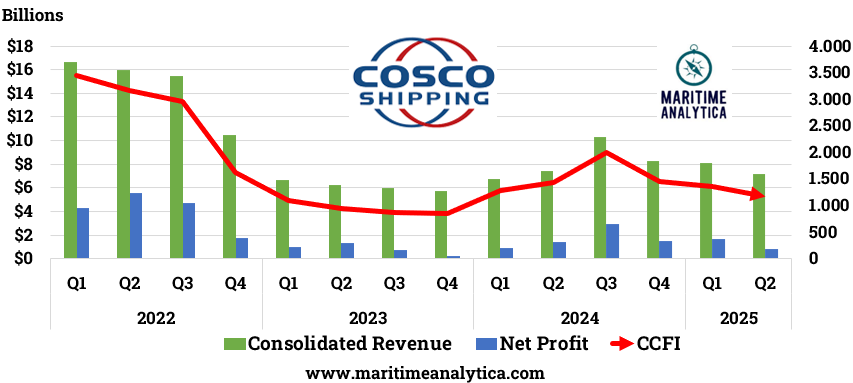

I. COSCO Consolidated Performance

Revenue: $15.2B in 1H 2025 (+7% YoY)

Net Profit: $2.4B — flat compared with last year

EBITDA: $4.9B (+2% YoY)

Cash Flow: $3.6B from operations (+12%)

Debt Ratio: 43.3% (slightly higher vs Dec 2024)

💡 Revenues are rising, but profits remain flat as falling freight rates and higher costs continue to squeeze margins.