🔥MSC Widens Lead in Global TEU Race! Maritime Analytica Insight - 129

🌎 The World’s Most Influential Container Shipping Platform — Trusted by 200,000+ Leaders Worldwide!

🎖️Subscribe /✨Sponsorship /📊Exclusive Report /🙏Rate us /🎁Send Gift

🔥Greetings, Maritime Mavericks!

Welcome to Maritime Analytica! 🌊🚀 Your gateway to the latest shipping intelligence. Stay ahead with expert insights, market trends, and breaking maritime news.

🌍Container Shipping’s Billion-Dollar Reset

🌊China’s Export Hierarchy in 2024

💶 EU’s 2024 Import Landscape: China Still Leads

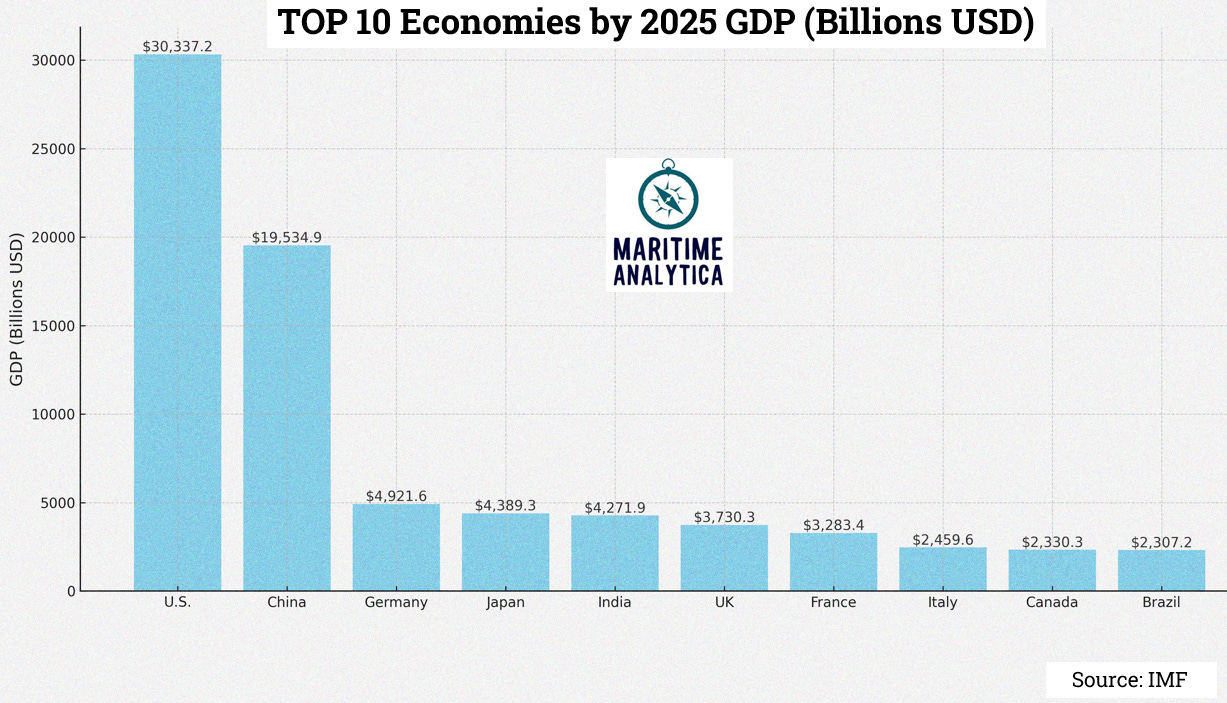

🌐 2025’s Economic Power Rankings Revealed

🟢First Mid-Sea CO₂ Handoff Redefines Shipping

🚀 India Leads Emerging Growth Pack

🔥Countries with Inflation Projections in 2025

📦Cape Route Reroutes Boost Container Losses

🚢 MSC Widens Lead in Global TEU Race

🌊🚀Together, we can navigate a sea of knowledge and discovery. Share the wisdom, share the journey!

⭐️Today's Wisdom from the Waves:

🌊 "The sea, once it casts its spell, holds one in its net of wonder forever." – Jacques-Yves Cousteau

💡 Elevate Your Brand in Shipping World!

Looking to elevate your brand in maritime? Partner with us to reach 200,000+ industry decision-makers through high-impact sponsorships and strategic content across LinkedIn and our newsletter. 👉 info@maritimeanalytica.com

🌍Container Shipping’s Billion-Dollar Reset

Hapag-Lloyd market cap down 70% since 2022

Maersk, Cosco stabilize amid persistent weak demand

Evergreen, ZIM struggle as rates stay under pressure

🏅Maritime Analytica: “Industry valuations show normalization post-COVID, with profitability squeezed by overcapacity and geopolitics — carriers must prioritize leaner, tech-driven, customer-focused models to stay competitive.”

🌊China’s Export Hierarchy in 2024

US tops China's export markets at $500B, narrowly edging the EU at $495B.

Hong Kong ranks third with $300B, still a critical re-export hub.

Vietnam ($180B) and 🇯🇵 Japan ($160B) highlight China’s strong regional ties.

🏅Maritime Analytica: “Despite tariffs and political tension, the U.S. retained its top spot as China's largest export destination in 2024. But the near-equal EU trade and rising Southeast Asian demand hint at Beijing's diversifying strategy.”

🌍 EU’s 2024 Import Landscape: China Still Leads

China dominates EU imports with 21.3% share, far ahead of others.

US follows with 13.7%, showing deep transatlantic interdependence.

UK (6.7%) and 🇨🇭 Switzerland (5.5%) maintain strong regional flows.

Türkiye and 🇳🇴 Norway both at 4%, reflecting close trade ties.

🏅Maritime Analytica: “Despite political tensions, China remains the EU’s top supplier by a wide margin. But watch the US–EU trade axis—growing in value, particularly in high-tech and energy sectors.”

🌍 2025’s Economic Power Rankings Revealed

U.S. leads with $30.3T projected GDP

China trails with $19.5T, widening the gap

Germany, Japan, India dominate mid-tier positions

Brazil reclaims 10th spot, edging out Russia

🏅Maritime Analytica: “The U.S.–China gap signals a reshaped global power balance. Supply chains, investments, and shipping flows will increasingly pivot around these economic poles—smart operators must recalibrate strategies now.”