🔥ONE Line on Q2 2025: Growth Without Profitability!

🌍Volumes rise, but falling freight rates and cost pressures squeeze margins.

🎖️Subscribe /✨Sponsorship /📊Exclusive Reports /🙏Rate us /🎁Send Gift

🔥Greetings, Maritime Mavericks!

Global container shipping is facing falling spot rates, tariff-driven volatility, and rising cost pressures.

From tariff shocks to freight collapses and Cape re-routings, Q2 has been one of the most turbulent periods for container shipping in recent years.

ONE Line’s results reveal an industry under pressure — yet adapting fast through strategic fleet deployment, flexible cost controls, and operational resilience.

We review ONE Line’s Q2 Performance in 10 different perspectives:

ONE’s Modest Profit Amid Margin Squeezes

Revenue Gap Widens vs. Leaders

Tariff Volatility Disrupts Transpacific Trades

Freight Rates Collapse on Asia-Europe Lanes

Liftings Up, Utilization Down

Cape Rerouting Escalates Operational Costs

ONE’s Fuel Advantage Partially Neutralized

Port Congestion & Labor Shortages Hit Reliability

Fleet Expansion Amid Weakening Rates

FY2025 Outlook Slashed

and

🌍 Big Picture

Let’s dive in…

1. ONE’s Modest Profit Amid Margin Squeezes

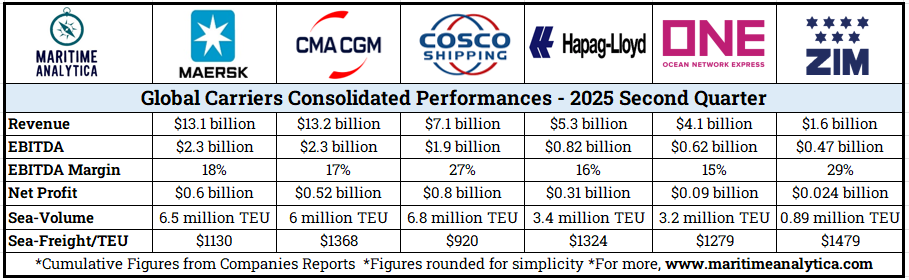

💡ONE posted a $90M net profit with an EBITDA margin of 15%, far behind COSCO (27%) and ZIM (29%).

🏅 Maritime Analytica Insight: “ONE’s thinner margins show weaker pricing power and higher cost exposure compared to peers — highlighting a need for better yield management.”

2. Revenue Gap Widens vs. Leaders

💡ONE generated $4.1B revenue, far below Maersk ($13.1B) and CMA CGM ($13.2B), despite higher global liftings (3.2M TEU).

🏅 Maritime Analytica Insight: “The mismatch between ONE’s volume and revenue signals structural underpricing — ONE moves boxes but struggles to monetize capacity.”

3. Tariff Volatility Disrupts Transpacific Trades

💡The U.S.–China 90-day tariff pause temporarily boosted ONE’s Transpacific liftings, but freight rates remained under pressure at $1,279/TEU, well below ZIM’s $1,479/TEU.

🏅 Maritime Analytica Insight: “ONE benefits from volume spikes but fails to capitalize on premium freight; stronger contractual pricing strategies are needed to compete with ZIM.”