🚨Q2 Reality Check: Is Hapag-Lloyd Playing Defense or Quietly Expanding Its Power?

🎯10 Hard Questions That Reveal the Real Hapag Q2 Story!

🎖️Subscribe /✨Sponsorship /📊Exclusive Report /🙏Rate us /🎁Send Gift

🔥 Greetings, Maritime Mavericks!

Hapag-Lloyd has revealed its Q2 2025 results.

Volumes are climbing. 📦

Revenue is rising. 💰

But profits? Sliding fast. 📉

Is this the start of a margin war—or the foundation of long-term power?

1️⃣ Did Hapag grow in Q2 2025?

2️⃣ What happened to profitability?

3️⃣ Is the Ocean (Liner Shipping) still strong?

4️⃣ What about costs?

5️⃣ Did Gemini Cooperation deliver?

6️⃣ How’s the Terminal & Infrastructure business?

7️⃣ What about fleet renewal & green strategy?

8️⃣ How are investors rewarded?

9️⃣ What’s the market outlook?

🔟 Is this still a Hapag-led market?

Plus

🏅Maritime Analytica Insight – Big Picture

Ocean = Margin Compression Zone

Terminals = Stability Engine

Fleet & Sustainability = Future Hedge

Investor Trade-off

Verdict

Let’s break it down in 10 critical questions that reveal the true state of Hapag LLoyd in Q2 2025👇

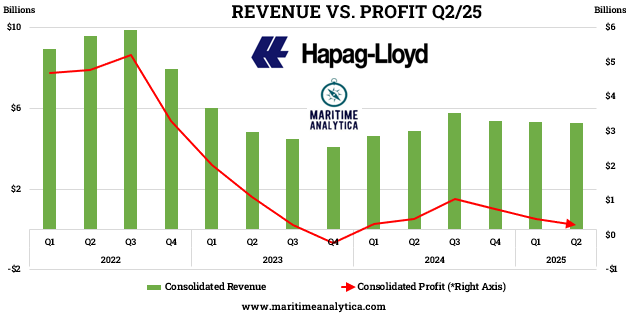

1️⃣ Did Hapag grow in Q2 2025?

Revenue: $5.27B (Q2-2024: $4.89B).

Volumes: 3.44M TEU (Q2 2024: 3.06M TEU).

💡 Growth driven by strong demand but not margin expansion.

2️⃣ What happened to profitability?

EBITDA: $820M (Q2 2024: $1,028M).

EBIT: $189M (Q2 2024: $485M).

Net profit: $306M (Q2 2024: $467M).

💡 Rising costs turned volume growth into thinner returns.

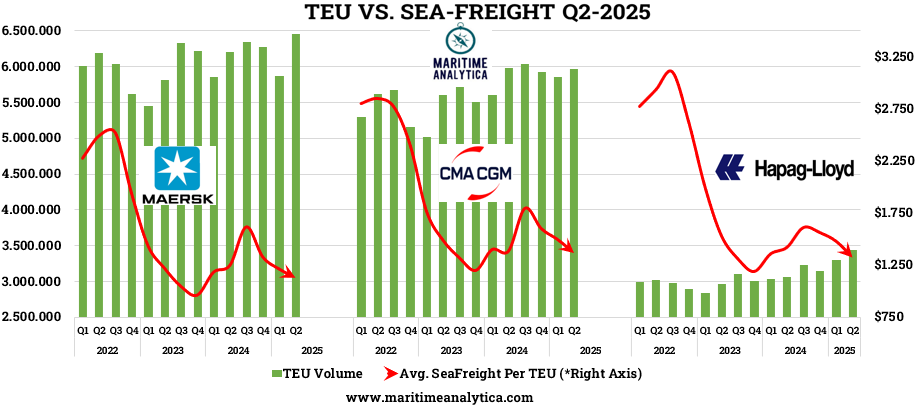

3️⃣ Is the Ocean (Liner Shipping) still strong?

Revenue: $5.17B (Q2 2024: $4.79B).

EBITDA: $777M (Q2 2024: $991M).

EBIT: $167M (Q2 2024: $468M).

Freight rate: $1,324/TEU (Q2 2024: $1,422).

💡 Volumes up, but Ocean now working harder for less profit.