🔥Q2 Surprise: Is Maersk Quietly Winning the Logistics War?

🚨10 Sharp Questions That Reveal the Real Maersk Q2 Story!

🎖️Subscribe /✨Sponsorship /📊Exclusive Report /🙏Rate us /🎁Send Gift

🔥 Greetings, Maritime Mavericks!

Maersk’s Q2 results have just been released.

Volumes are up. Terminals are booming. Logistics is improving.

But profits? Slipping.

Margins? Under pressure.

And Ocean—the core—is feeling the squeeze.

1️⃣ Did Maersk grow in Q2 2025?

2️⃣ What happened to profitability?

3️⃣ Is the Ocean division still the crown jewel?

4️⃣ How did Logistics & Services perform?

5️⃣ Are Terminals Maersk’s new power play?

6️⃣ What’s new with Gemini Cooperation?

7️⃣ How’s Maersk doing on sustainability?

8️⃣ What about investor returns?

9️⃣ What’s the market outlook?

🔟 Is this still a Maersk-led market?

Plus

🏅Maritime Analytica Insight – Big Picture

Let’s break it down in 10 critical questions that reveal the true state of Maersk in Q2 2025👇

1️⃣ Did Maersk grow in Q2 2025?

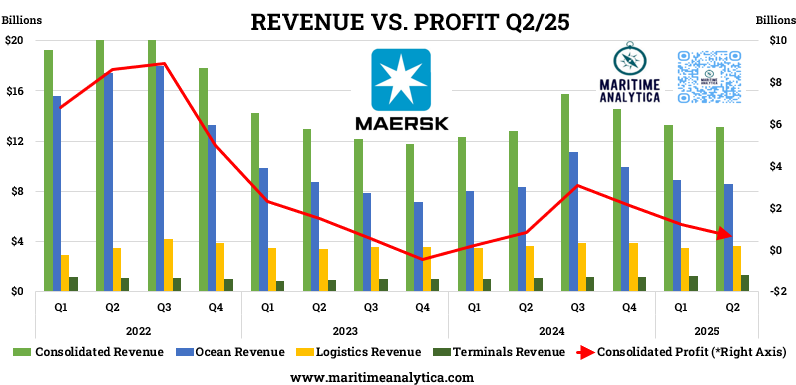

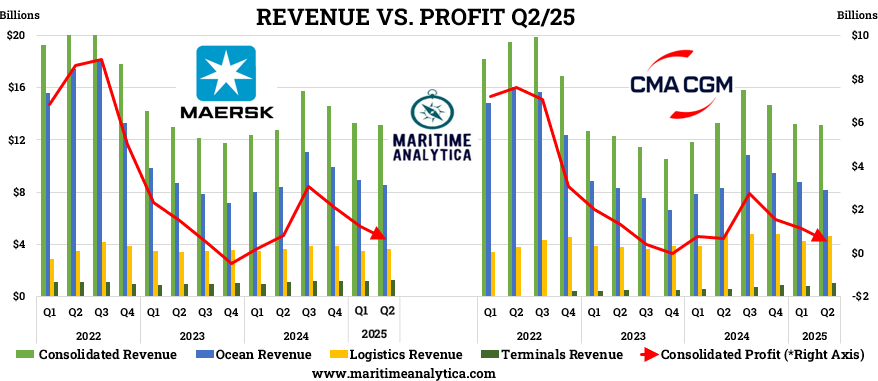

3.1B (up from $12.8B last year)

EBITDA: $2.3B (up from $2.1B)

Underlying EBIT: $818M (up from $756M)

💡 But free cash flow went negative: –$373M, due to rising capex and lease costs.

2️⃣ What happened to profitability?

📉 Headline EBIT fell to $845M (–$118M YoY) Why?

Ocean EBIT plunged 51% to $229M

Logistics & Services grew EBIT to $175M (+39%)

Terminals surged to $461M (+31%)

🏗️ Heavy investments in fleet + no asset sales this quarter = margin pressure.

3️⃣ Is the Ocean division still the crown jewel?

🚢 Not this time.

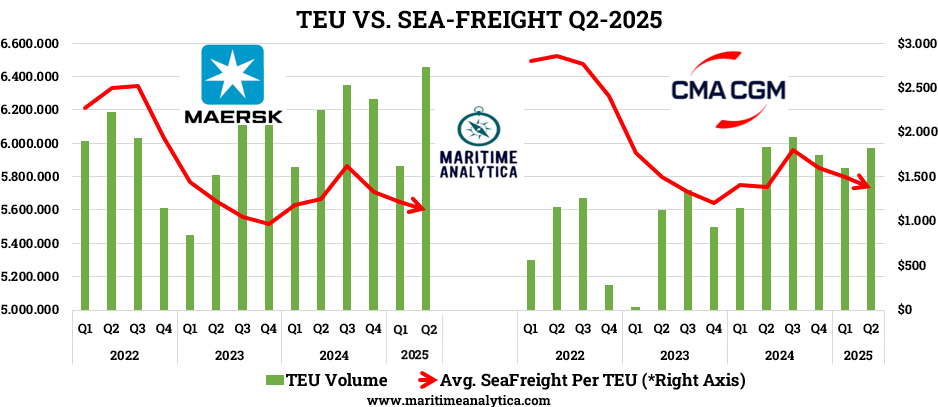

Volumes rose 4.2%, but…

Freight rates fell 9.6% YoY

Unit costs (ex-bunker) rose 1.8%

EBIT margin dropped to 2.7% (from 5.6%)

💥 Profit was squeezed despite 10% higher volume QoQ. Ocean is now working harder for smaller returns.