🔥 Q2 Surprise: Is SITC Quietly Expanding Its Containership Empire?

🚨 10 Sharp Questions That Reveal the Real SITC Q2 Story!

🎖️Subscribe /✨Sponsorship /📊Exclusive Report /🙏Rate us /🎁Send Gift

🔥 Greetings, Maritime Mavericks!

World’s 14th largest container carrier SITC’s Q2 2025 results are out — and the numbers are explosive.

Revenue is up 28%. Net profit soared 79.5%. Freight rates are climbing.

But behind the headline growth, the big story is fleet expansion.

SITC is doubling down on intra-Asia dominance, betting big on small, high-frequency container trades while reshaping its containership portfolio for the next cycle.

1️⃣ Did SITC grow in Q2 2025?

2️⃣ What happened to profitability?

3️⃣ Is SITC buying more ships?

4️⃣ How is SITC’s fleet evolving?

5️⃣ Are higher freight rates sustainable?

6️⃣ What about SITC’s financial strength?

7️⃣ How is SITC investing beyond ships?

8️⃣ What about sustainability?

9️⃣ What’s the market outlook?

🔟 Is SITC quietly becoming Asia’s containership powerhouse?

Let’s break it down into 10 sharp questions that expose what’s really driving SITC’s Q2 story👇

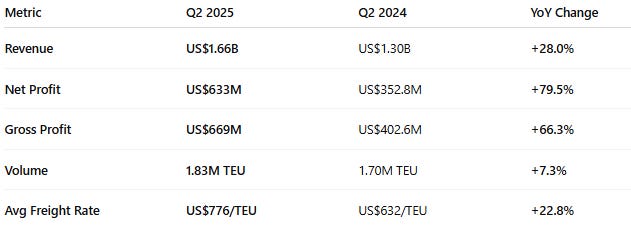

1️⃣ Did SITC grow in Q2 2025?

Revenue: US$1.66B (+28% YoY)

Net profit: US$633M (+79.5% YoY)

Volume: 1.83M TEU (+7.3% YoY)

Freight rates: US$776/TEU (+22.8% YoY)

💡 Strong intra-Asia demand + better pricing drove double-digit topline growth.

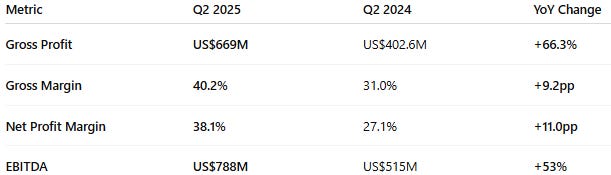

2️⃣ What happened to profitability?

Gross profit: US$669M (+66.3%)

Gross margin: 40.2% (vs. 31.0% LY)

Operating leverage kicked in thanks to higher utilization and better yields.

🏅 Maritime Analytica Insight: SITC’s margin expansion outpaces most global carriers. Unlike ocean majors struggling with overcapacity, SITC thrives on regional specialization.

3️⃣ Is SITC buying more ships?

Absolutely.

Recently ordered four 2,700-TEU containership for US$152M

Two more vessels under construction, deliveries by mid-2028

Prioritized small and mid-sized vessels (<3,000 TEU) — 95 of 119 vessels already in this range.

💡 Strategy: Serve high-frequency intra-Asia loops where mega-ships don’t fit.