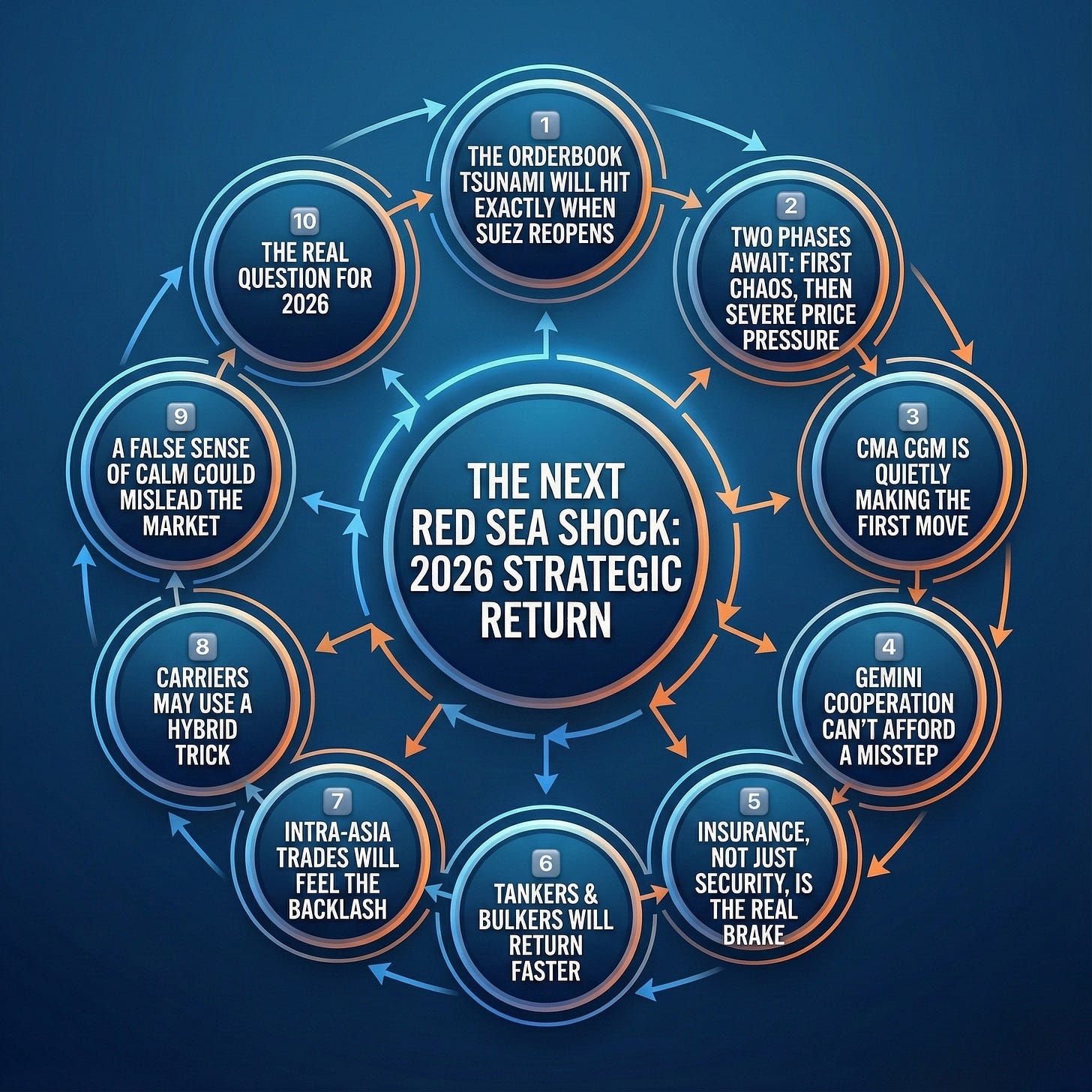

🚨The Next Suez Shock: Why 2026 Won’t Look Like 2024 in Red Sea?

🔥The return to Suez won’t be smooth — it will be strategic.

🎖️Join Us / ✨Media Kit / 📊2026 Outlook / 🎥YouTube / 🏛️About Us

🔥 Greetings, Maritime Mavericks!

Everyone thinks a Red Sea comeback simply means shorter routes and lower emissions.

But that’s the surface-level story.

The real 2026 narrative is far more complex:

Carriers are not just deciding when to return —They are deciding how, how fast, and how much risk they are willing to absorb in a market already drowning in capacity and new tonnage.

Here are the 10 real consequences the industry should expect:

1️⃣ The Orderbook Tsunami Will Hit Exactly When Suez Reopens

Liners avoided the Red Sea for almost two years — an avoidance nobody expected to last this long.

During that time, the global orderbook ballooned to 30% of fleet capacity.

➡️ When Suez reopens, the detour ends.

➡️ SEVERAL % of global capacity is instantly freed.

➡️ And new ships keep being delivered through 2026.

💡Outcome: Overcapacity goes from “bad” to “systemic.”

2️⃣ Two Phases Await: First Chaos, Then Severe Price Pressure

A return to Suez will save ~5500km and ~10 days on Asia–Europe.

Phase 1: Chaos

Earlier arrivals

Terminal clogging

Irregular bunching

Empty container imbalances

Phase 2: The Hammer Comes Down

Once schedules stabilize, massive downward pressure on rates follows.

💡Why? More ships + low demand = brutal price war conditions.