🔥What If Every Sea-Freight Spike Became Inflation? Top 10 Must-Knows from the OECD Report!

⁉️How Sea Freight Shapes Global Inflation — and Why It Matters to You?

🎖️Subscribe /✨Sponsorship /📊Exclusive Report /🙏Rate us /🎁Send Gift

🔥 Greetings, Maritime Mavericks!

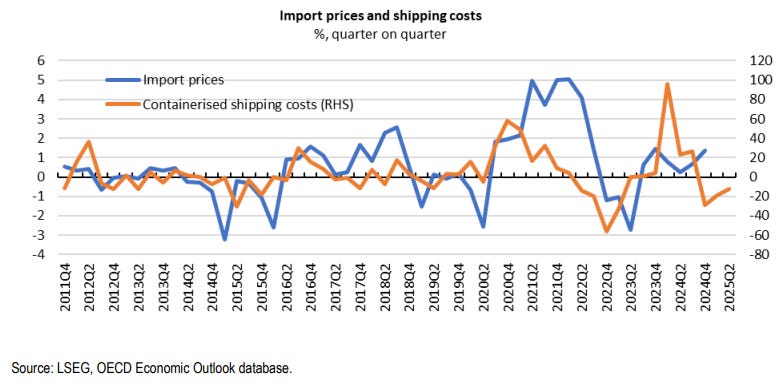

In 2024, container shipping costs surged +140% — even though oil prices dropped and new vessels entered the market.

So, what triggered the spike?

→ Red Sea attacks,

→ Tariff fears,

→ Front-loaded seasonal trade.

But here's the real shock:

🚨 A 10% rise in freight costs leads to 0.2% import inflation, triggering consumer price hikes across the world.

The OECD's new report now confirms what many in the industry have long suspected:

Sea freight quietly fuels global inflation.

For policymakers, it’s a macro warning. For shipping professionals, it’s a strategic call to action.

👉 Read the original OECD report

Here’s what we’ve distilled — and what it means for you:

📌 Top 10 Key Findings — Every Maritime Leader Must Know

🔮 What Lies Ahead: A New Era of Fragile Flows

🔍 Action Plan for Maritime Executives

🏁 Conclusion: From Silent Mover to Inflation Maker

Let’s dive in…

💡 Position Your Brand at the Core of Global Shipping?

Want to reach real decision-makers in the container shipping world?

Maritime Analytica connects your brand with 200,000+ shipping executives, logistics leaders, and trade influencers through powerful sponsorships and targeted storytelling from 158 countries.

📈 Drive visibility.

🚢 Build authority.

🤝 Earn trust — where it matters most.

Let’s shape the future of shipping, together. 👉 info@maritimeanalytica.com

📌 Top 10 Key Findings — Every Maritime Leader Must Know

📦 A 10% rise in container shipping costs → 0.2% import inflation

➡️In G20 countries, container freight directly increases import prices for manufactured goods.

💸 Import inflation leads to 0.18% core inflation after 1 year

➡️The shock doesn't stay at the port — it reaches consumer prices worldwide.

🛑 Headline inflation impact is smaller (0.08–0.12%)

➡️Food and fuel dominate CPI, but container costs still make their mark.

🔎 Excluding commodities reveals a clearer story

➡️When energy and food are removed, the direct inflationary role of container costs becomes more visible — and more reliable.

🌍 High seaborne dependency = higher inflation risk

➡️If 80% of your trade is seaborne, a 10% shipping cost rise means up to 0.8% higher import inflation in G20 countries.