🔥ZIM CEO Eli Glickman’s Bold Call: Can ZIM Outrun the Risks Ahead?

🚨ZIM CEO Eli Glickman: "Few Are Willing to Take the ZIM Risk"

🎖️Subscribe /✨Sponsorship /📊Exclusive Reports /🙏Rate us /🎁Send Gift

🔥Greetings, Maritime Mavericks!

ZIM Integrated Shipping is back in the spotlight—but not for the usual reasons.

Once a pandemic-era superstar, ZIM now faces plunging profits, strategic uncertainty, and shifting investor sentiment.

CEO Eli Glickman just sent a bold message to the market: “ZIM is a tough prize.”

Translation? Buying ZIM might be the opportunity of the decade—or a financial nightmare.

But why is ZIM suddenly so hard to value?

That’s where our 10 critical questions come in — the ones shaping ZIM’s future and investor sentiment worldwide:

1️⃣ Why is ZIM called a “tough prize”?

2️⃣ How did ZIM go from pandemic hero to today’s uncertainty?

3️⃣ What’s behind ZIM’s financial pressure?

4️⃣ Does ZIM’s share price reflect the risks?

5️⃣ What’s Glickman’s strategy to stabilize ZIM?

6️⃣ Could ZIM become an acquisition target?

7️⃣ How does ZIM compare to Maersk, CMA CGM, and COSCO?

8️⃣ Why are buyers hesitating despite ZIM’s assets?

9️⃣ What’s next for ZIM in 2025?

🔟 The Big Picture

Let’s reveal them all…

1️⃣ Why is ZIM called a “tough prize”?

Because any buyer would inherit high volatility, fluctuating earnings, and risky trade exposure. Glickman warns: “Not many people are going to take the risk.”

2️⃣ How did ZIM go from pandemic hero to today’s uncertainty?

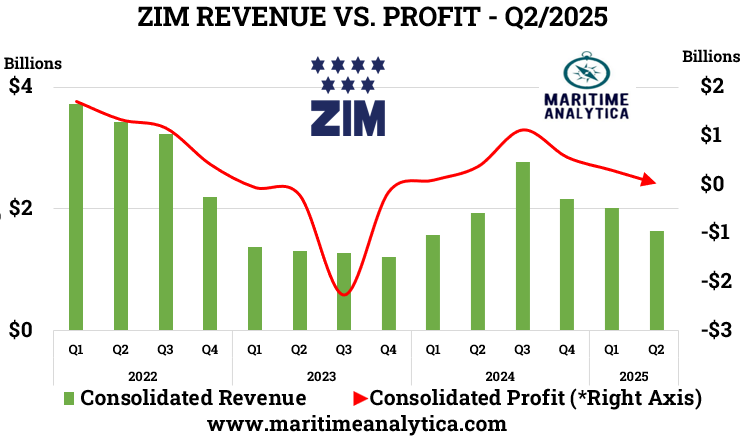

In 2021, ZIM’s profits exploded, riding record-high freight rates. But fast-forward to 2025:

Margins are compressed

Debt levels remain elevated

Market demand is shifting unpredictably

3️⃣ What’s behind ZIM’s financial pressure?

Two big headwinds:

Falling spot rates amid overcapacity 📉

Rising operating costs from fuel, charters, and debt repayments

Together, they’ve squeezed earnings and spooked short-term investors.