🚨10 Must Know from Maersk CFO Jany on Global Shipping!

If Vincent Clerc explained the strategy, Patrick Jany revealed the financial reality behind it.

🏛️About Us /✨Media Kit / 📊2026 Outlook / 👑Gold (*Last 18 Seats)

🔥Greetings Maritime Mavericks,

As you may remember from our last week’s posts, Maersk CEO Vincent Clerc explained how the next cycle will be shaped by capacity discipline, Suez normalization, and operational flexibility.

But strategy alone does not reset shipping cycles.

Financial pressure does.

Maersk CFO Patrick Jany also revealed the financial forces that will truly reset the market: falling freight rates, excess capacity, and the inevitable exit of weaker tonnage.

His message was direct.

The downturn is not a possibility.

It is already underway.

And its duration will depend entirely on how fast capacity leaves the system.

Ready? Let’s dive in…

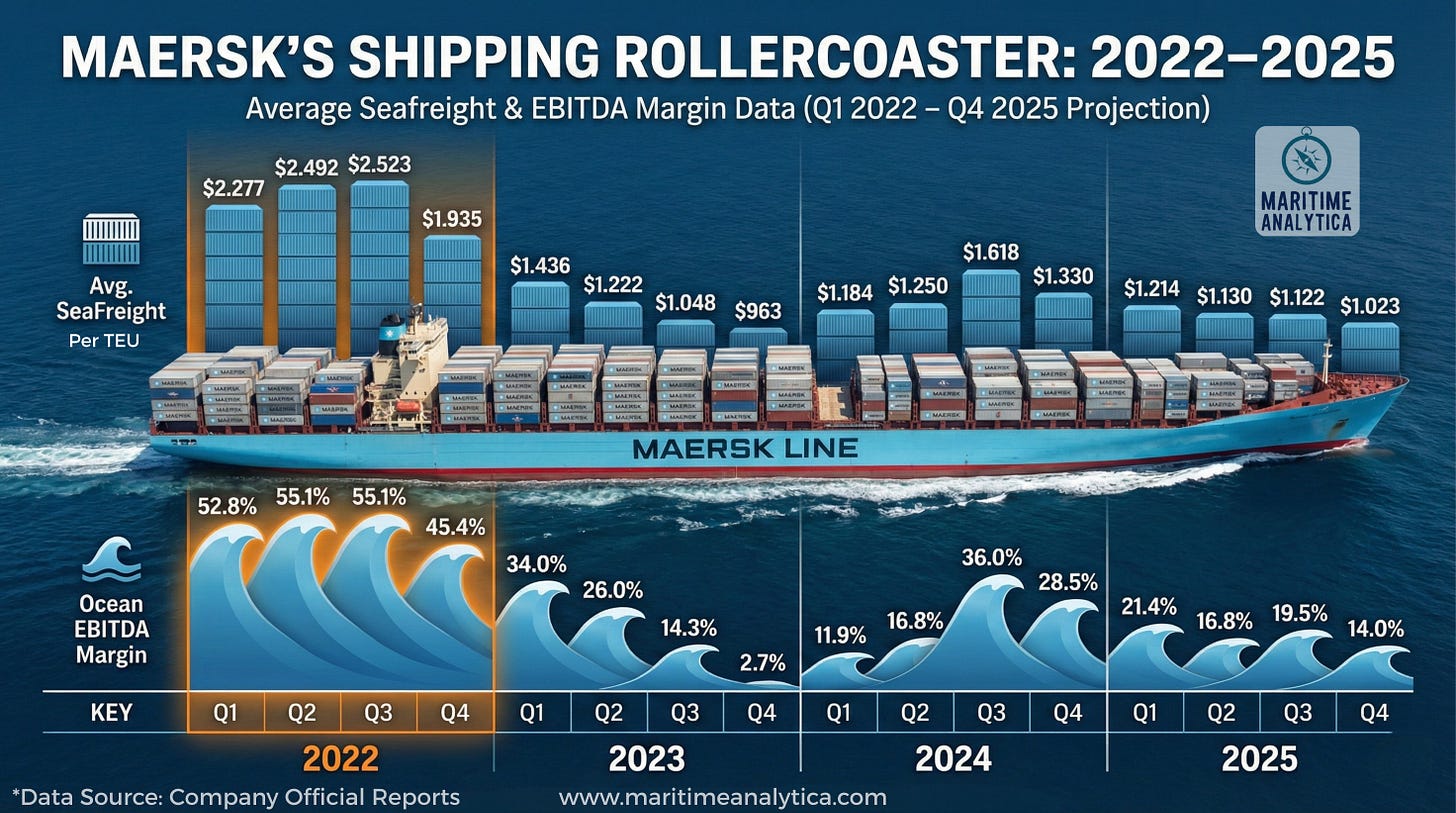

1️⃣ “Our yearly guidance implies that ocean will have results lower than in 2025 and even the last quarter of 2025.”

💡Ocean earnings are expected to weaken as freight rates normalize across global trades.

2️⃣ “We expect freight rates to continue to come down.”

💡Freight rate normalization is now the primary driver of industry earnings pressure.