Executive Visuals

Clear, decision-ready visuals designed for senior leaders in container shipping.

Each chart distills complex market data into a single strategic insight — focused on scale, profitability, and structural shifts shaping the industry.

No noise.

No commentary.

Just what matters.

Why this matters?

Scale no longer guarantees superior profitability.

Operational efficiency is driving margin differentiation.

Strategic execution now outweighs fleet size.

Why this matters?

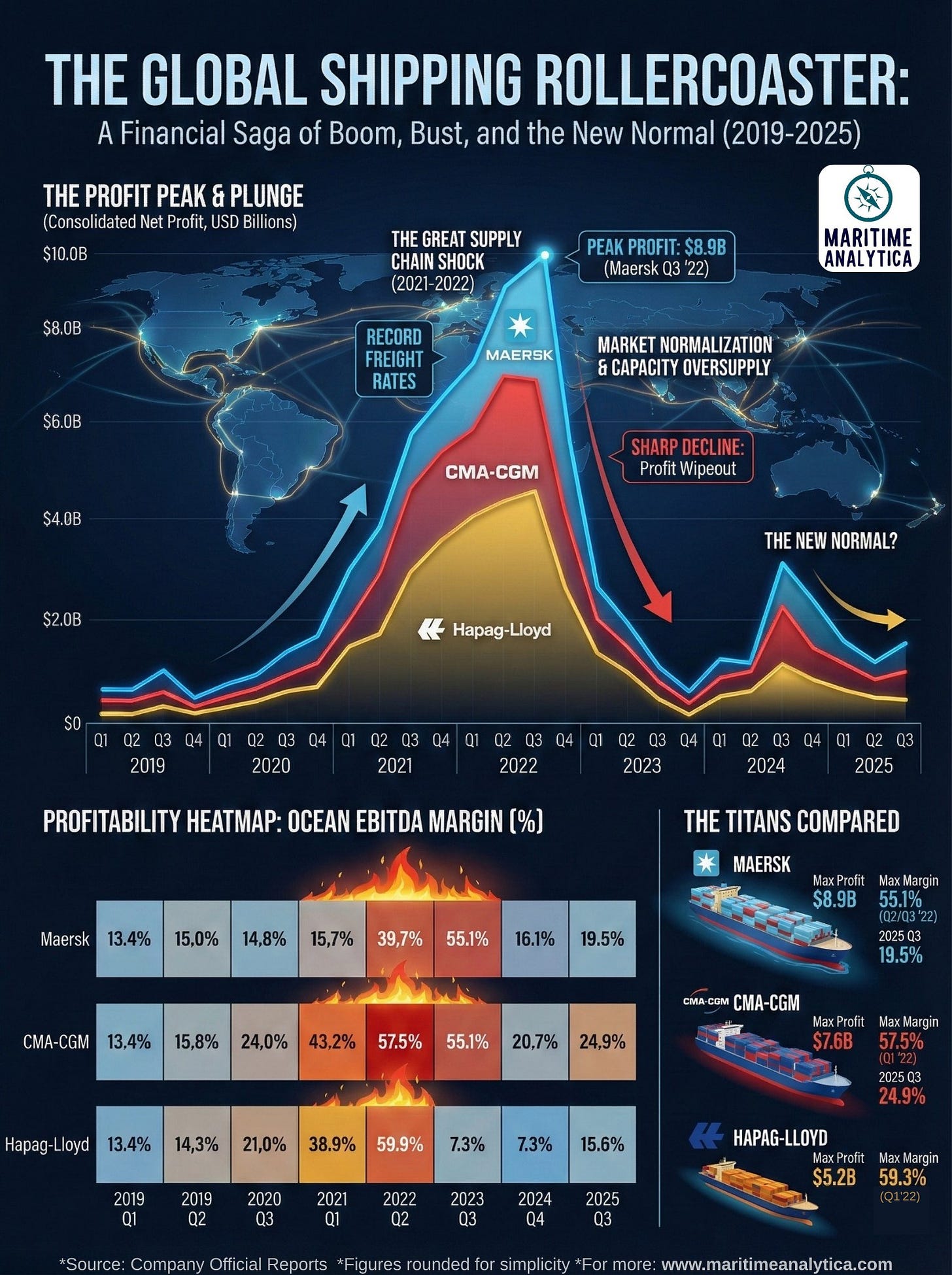

Pandemic profits peaked, then normalized sharply.

Earnings stabilized above pre-2019 levels.

Profit volatility is now structurally lower.

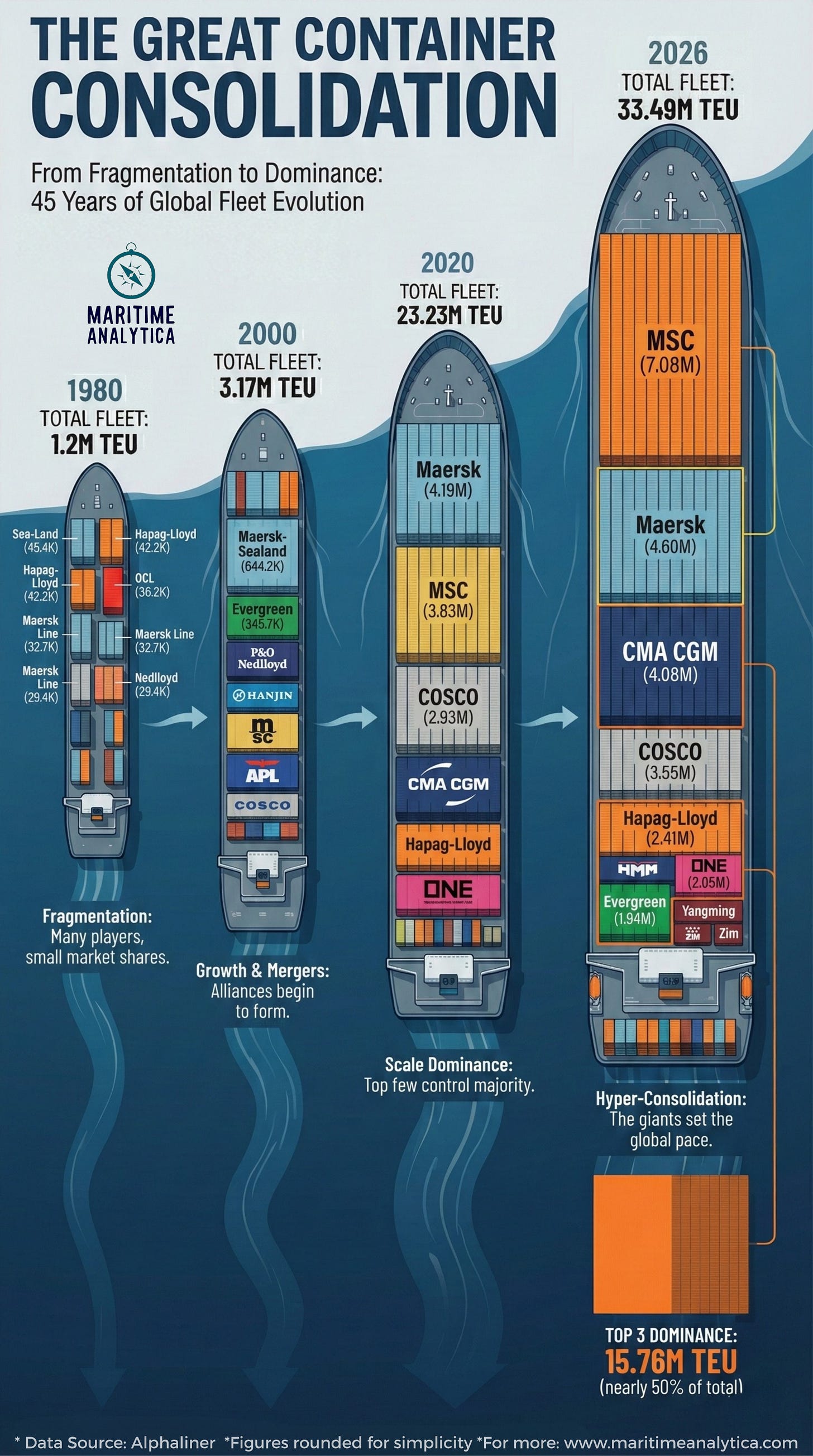

Why this matters?

Market power has concentrated into a few global giants.

Scale now shapes pricing, networks, and resilience.

Smaller carriers face shrinking strategic room.

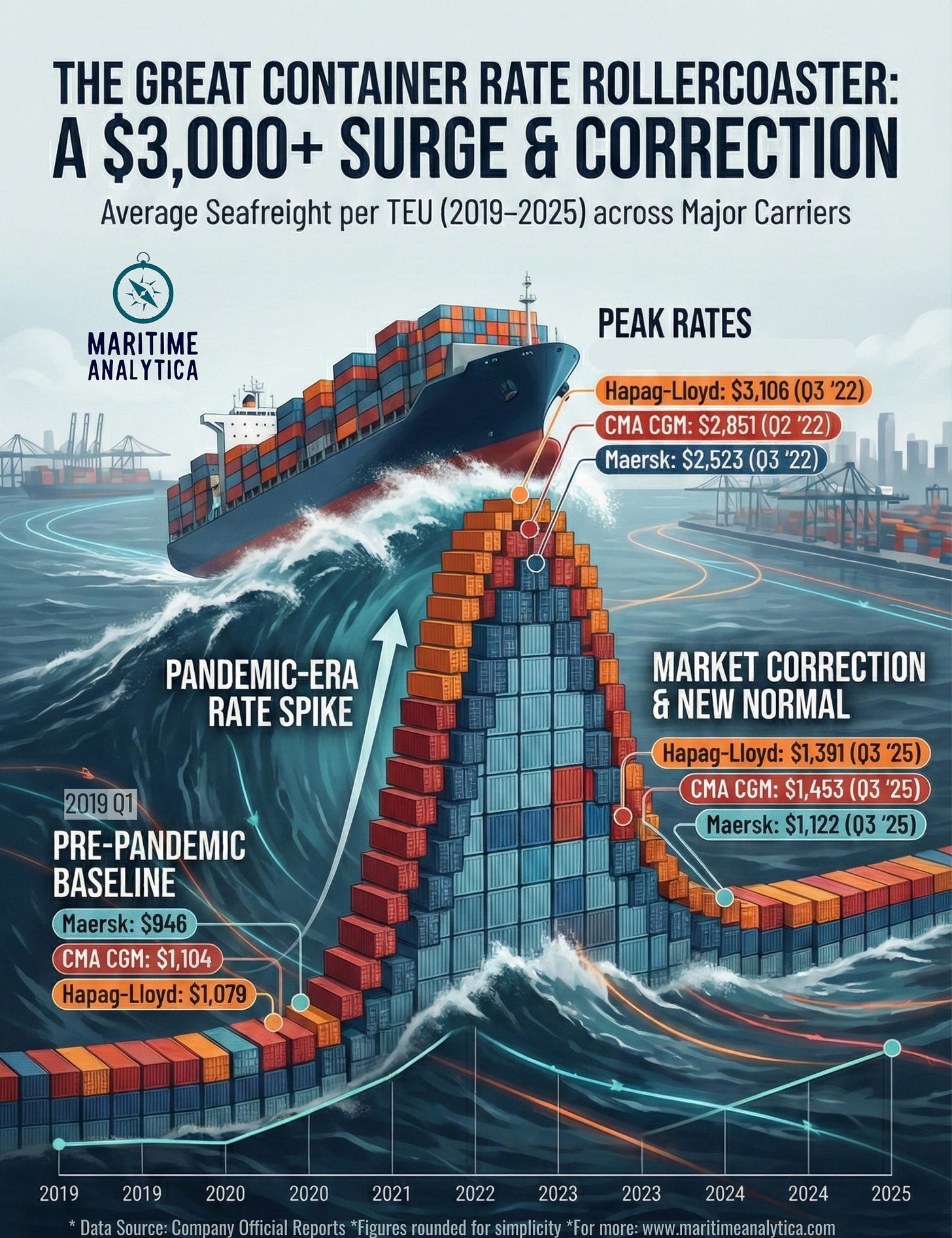

Why this matters?

Rate volatility reshaped carrier profitability cycles.

Pandemic spikes did not create a permanent pricing floor.

The market has settled into a lower, more competitive normal.

Why this matters?

Pandemic profits created a temporary margin bubble.

Record rates drove historically unsustainable returns.

The industry has normalized at lower profit levels.

Why this matters?

Higher margins do not always follow larger volumes.

Pricing power varies significantly across major carriers.

Margin discipline increasingly defines competitive advantage.

Why this matters?

Capacity growth remains concentrated among the largest carriers.

Scale expansion continues despite softer market conditions.

Competitive pressure will intensify across main trade lanes.

Why this matters:

Capacity growth is increasingly dominated by MSC.

Scale leadership is reshaping competitive balance among top carriers.

Fleet expansion is no longer evenly distributed across the industry.

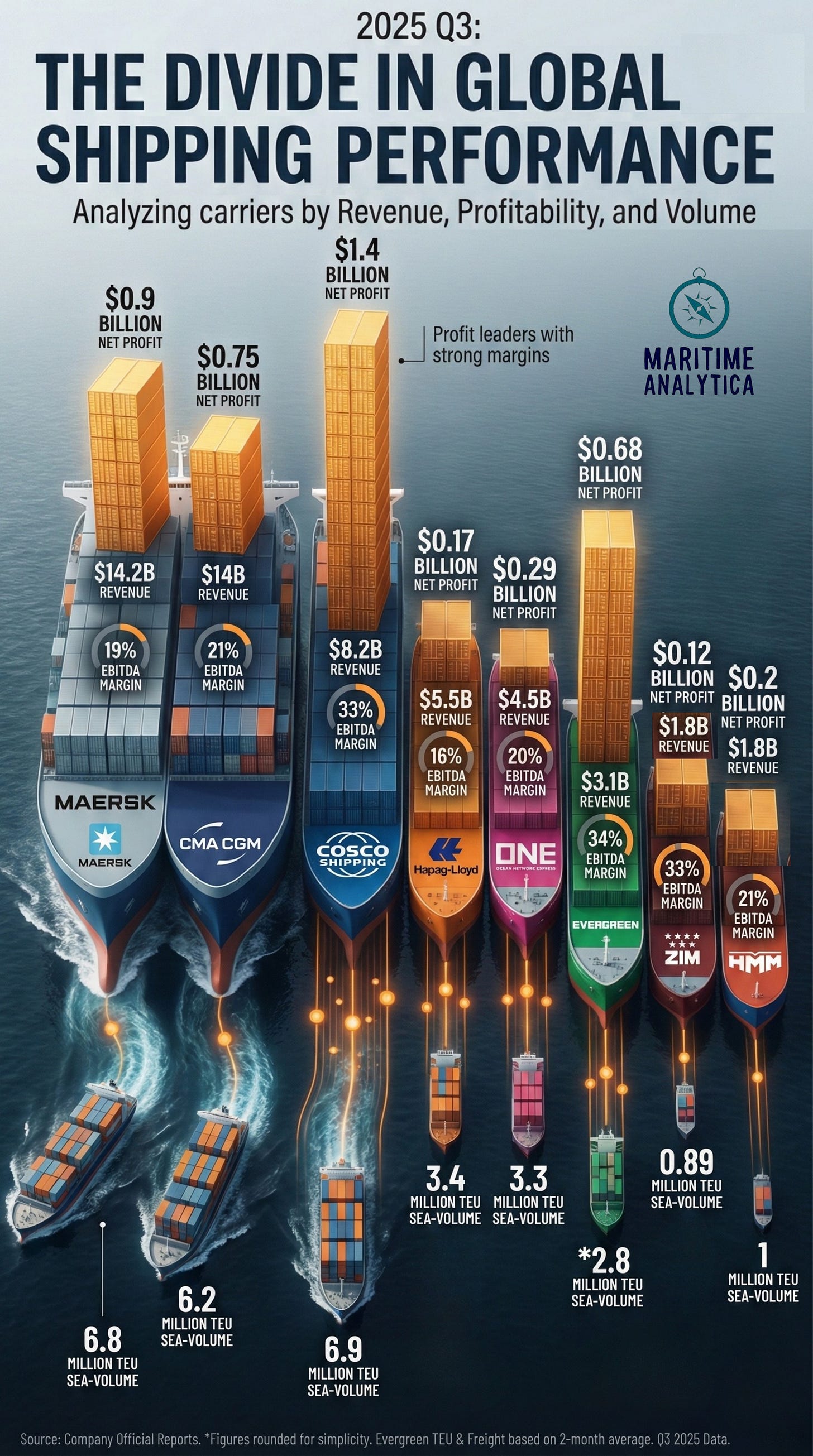

Why this matters?

Scale alone does not determine net profit outcomes.

Margin quality differentiates leaders from volume-heavy players.

Strategic positioning now matters more than absolute size.

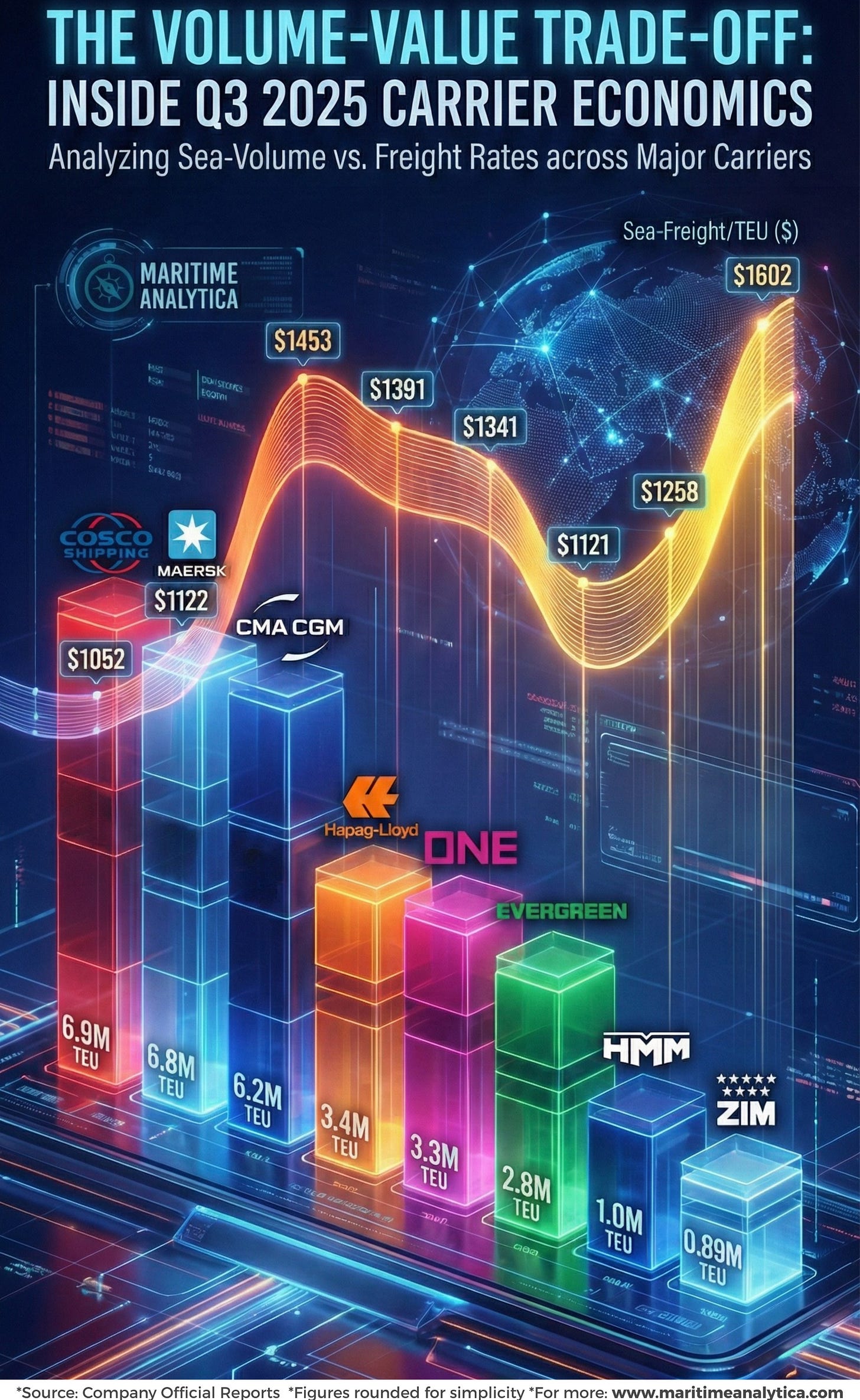

Why this matters?

Higher volumes do not automatically deliver higher unit value.

Pricing strategy differs sharply across major carriers.

Revenue quality is increasingly as important as scale.

Why this matters?

Scale leadership and profit leadership are diverging.

Efficiency now drives margins more than volume.

Strategic execution defines competitive power.

Why this matters:

Capacity leadership has decisively shifted toward MSC.

Scale competition among top carriers has intensified structurally.

Fleet expansion now directly reshapes market power.

Why this matters?

Shipping profits proved highly cyclical, not structurally permanent.

Extreme margins collapsed once capacity and demand normalized.

The industry has entered a lower, more disciplined profit era.