🔥Hapag-Lloyd CEO Jansen: “The US Role in Global Shipping Is Shrinking — And It Could Last for Years”

🚨10 Must-Know Insights on Hapag-Lloyd’s Strategy, Global Trade Shifts, and the Future of Container Shipping!

🎖️Subscribe /✨Sponsorship /📊Exclusive Reports /🙏Rate us /🎁Send Gift

🔥Greetings, Maritime Mavericks!

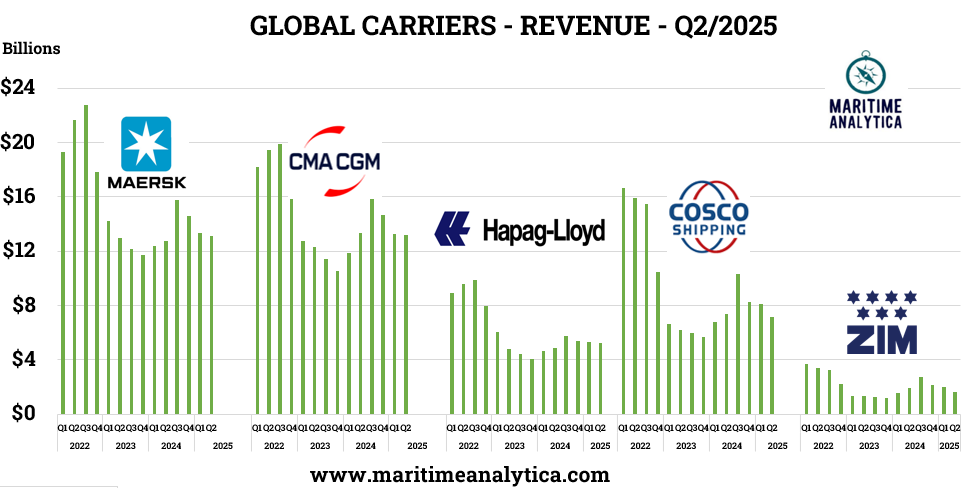

Global shipping is entering a decisive phase.

Demand flows are shifting, supply chains are being redesigned, and U.S. tariffs are rewriting trade maps.

Hapag-Lloyd stands at the center of this transformation — balancing growth, cost pressures, and new opportunities.

With flexible fleet deployment, supply chain diversification, and the Gemini network, it has positioned itself for resilience.

But uncertainty remains high: freight rates are volatile, U.S. demand is slowing, and consumer sentiment is fragile.

The next 18 months will separate winners from survivors — and Hapag-Lloyd wants to lead.

🚨10 Must-Know Insights from Hapag LLoyd CEO on Hapag-Lloyd’s Strategy, Global Trade Shifts, and the Future of Container Shipping!

🚨10 Must-Know Insights from Hapag LLoyd CEO:

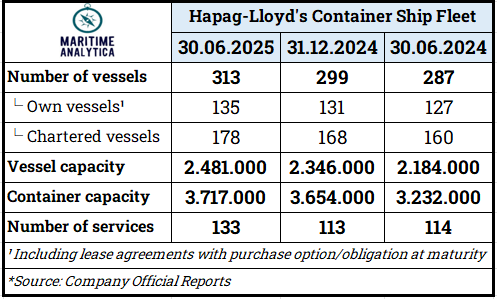

1. Flexible Fleet Deployment

➡️ “We’re lucky because we can move our ships around freely. We can deploy more ships in Asia, India, Africa, or wherever the demand is. That’s a big plus compared to those tied to fixed assets.”

💡Maritime Analytica Insight: Hapag-Lloyd operates 313 vessels (2.48M TEU), with 59% owned fleet, giving strong flexibility in redeploying ships to growth markets.

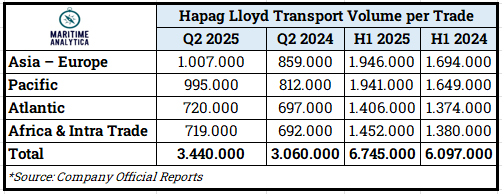

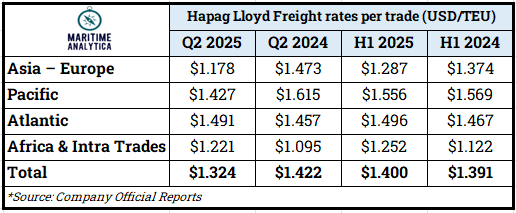

2. Supply Chain Diversification

➡️ “I believe that many shippers and many buyers will, over time, diversify their supply chains, because you need to manage risk in a very different way in today’s world compared to how it was in the past.”

💡Maritime Analytica Insight: Far East exports rose +7.2% YoY in H1 2025, driving 11% volume growth for Hapag-Lloyd across diversified lanes.

3. Diversification Offsets Cargo Weakness

➡️ “That’s good for liner operators, because supply chain diversification increases vessel demand, offsetting some of the negative effects from weaker overall cargo volumes.”

💡Maritime Analytica Insight: Transport volumes climbed to 6.75M TEU (+10.6% YoY) while freight rates stayed stable at $1,400/TEU, softening cargo pressure.