🚨Hapag-Lloyd CEO Rolf Habben Jansen: "2025 will offer the second year in a row with pretty decent growth."

🔟Must Know Insights from Hapag-Lloyd CEO Insights + Maritime Analytica!

🎖️Subscribe /✨Sponsorship /📊Exclusive Reports /🙏Rate us /🎁Send Gift

🔥 Greetings, Maritime Mavericks!

Global shipping is reshaping before our eyes.

Rising tariffs, volatile freight rates, and overcapacity are colliding.

Yet resilience defines this industry — demand grows, networks adapt, and technology evolves.

Hapag-Lloyd, now deep into its Gemini Cooperation with Maersk, stands at a turning point.

CEO Rolf Habben Jansen shares his unfiltered insights on trade, tariffs, demand, and the future on their recent webinar.

Ready?

🔟 Must-Know Hapag-Lloyd CEO Insights + Maritime Analytica

1️⃣ “Tariffs of around 15–20% are not great, but that doesn’t stop global trade even if of course it does not have a positive effect.”

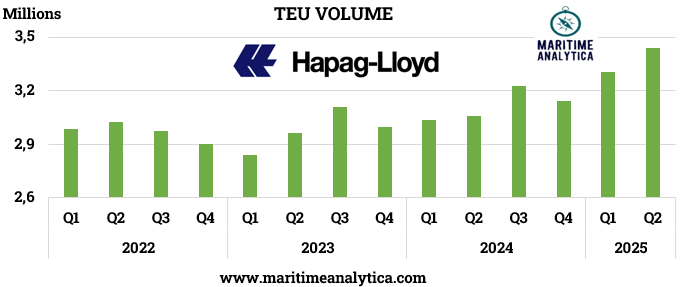

💡 Maritime Analytica Insight — Despite tariff pressures, Hapag-Lloyd’s Q2 transport volumes rose +11% YoY to 3.44M TEU, proving demand resilience despite cost friction.

2️⃣ “That’s probably more or less where most people had hoped or expected it to land.”

💡 Maritime Analytica Insight — The U.S. finalized tariffs at 15–20%, lower than initial proposals, creating short-term stability. Yet uncertainty lingers, affecting transpacific booking patterns.

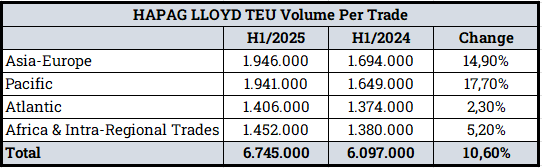

3️⃣ “The Far East Europe trades are still somewhat stronger than transpacific, the Atlantic is relatively weak, and the Latin American trades are relatively strong.”

💡 Maritime Analytica Insight — H1 2025 volumes confirm this: Asia-Europe up +15%, LatAm +10%, but transpacific softened amid shifting tariff policies.