🔥 IMF’s Trade Cut Hits Shipping—Who Wins, Who Loses? 🚢 Your Exclusive Maritime Analytica Insight 108!

🚢 Maritime Analytica 2.0: Smarter, Sharper, Essential – Trusted by +15,000 Maritime Leaders Worldwide!

🌟Follow us: Website / YouTube / LinkedIn / Make Us Better in Just 10 Seconds!

🔥Greetings Maritime Mavericks!

🚀 Welcome to the New Maritime Analytica! We’ve leveled up—more insights, sharper analysis, and real impact. Let’s dive in!

1️⃣ 📊 The Shipping Charts of the Week

2️⃣ 📰 The Maritime News of the Week

🌏 IMF Cuts Trade Outlook

🔥 US-China Shipping War

🛳️ MSC’s $1.76B Megaships

⚓ Mid-Tier Carriers Surge

🌎 Trump’s Tariff Shock

3️⃣ ⚓ Port Watch: Delays & Congestion

4️⃣ 🌱 Maritime Sustainability: Did You Know?

5️⃣ 🚀 Maritime Tech: Next Big Thing

6️⃣ 📜 Maritime History: Defining Moments

7️⃣ 🏆 The Maritime CEO Power Move of the Week

8️⃣ ⚠️ Maritime Lies That Everyone Believes

9️⃣ 🧠 Shipping Trivia: Can You Guess the Right Answer?

🔟 🤖 Maritime GPT Prompt of the Week

🌊🚀Together, we can navigate a sea of knowledge and discovery. Share the wisdom, share the journey!

🚢 This premium edition is FREE—for now! 🌟 Don't miss next week’s insights. Upgrade to Premium Today! 👉

Got thoughts? We'd love to hear them! 🚀 Feel free to reply with your feedback—we’re always looking to improve!

🚢 We’ve Upgraded! What Do You Think?

1️⃣ 📊 The Shipping Charts of the Week

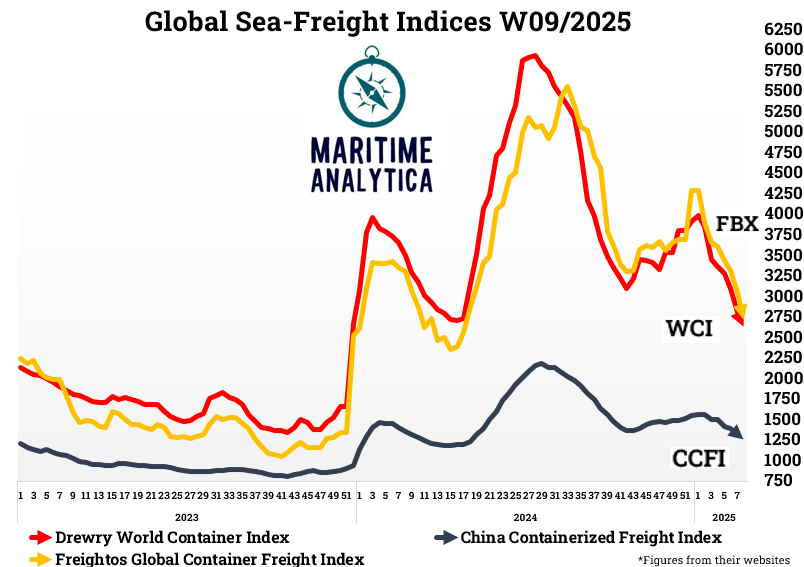

📉 Sea Freight

Container freight rates continue to fall as capacity increases, with the WCI down 6% and SCFI down 5% last week. Major carriers have not yet resumed Red Sea transits, keeping supply in check. A resolution to the crisis could flood the market with capacity, pushing rates down further.

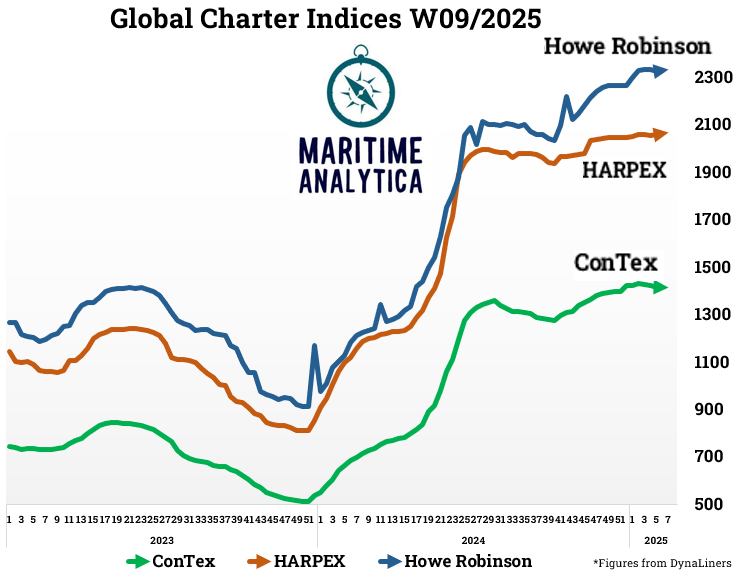

📈 Charter Market

Containership charter rates remain stable despite falling freight rates, driven by strong demand and limited vessel availability. The 1,700 TEU segment sees the most activity, with operators securing long-term charters. Panamax and feeder vessels also remain in high demand, keeping competition strong.

2️⃣ 📰 The Maritime News of the Week

🌏IMF Cuts 2025-26 Trade Growth Outlook

Global trade growth revised down for 2025-26.

Advanced economies to grow 2.1% in 2025, 2.5% in 2026.

Emerging economies show stronger growth, despite slight revisions.

China's slowdown adds pressure, with 4.5% GDP by 2026.

🏅Maritime Analytica: “Weaker trade growth may impact container demand, freight rates, and supply chain strategies—watch for market volatility ahead.”

🔥 US-China Trade War Targets Shipping Industry

Trump’s administration proposes high port fees on Chinese-built ships.

Fees range from $1M to $1.5M per port call for operators.

32% of the global top 10 fleets are Chinese built.

COSCO is most exposed, with 60% of its fleet built in China.

🏅 Maritime Analytica: “US tariffs could disrupt global trade flows, increasing costs for shippers.”

🛳️MSC Orders $1.76B in Ultra-Large Containerships

MSC secures up to eight 22,000-TEU LNG dual-fuel vessels.

Ships to be built at Zhoushan Changhong in China.

Each vessel costs around $220M, delivery set for 2028.

MSC’s total newbuild investments at this yard reach $6.5B.

🏅 Maritime Analytica: “LNG dual-fuel expansion aligns with decarbonization goals despite regulatory uncertainties.”

⚓ Second-Tier Carriers Grow Faster Than Market

18 medium-sized carriers now control 6.5% of global fleet.

Fleet capacity grew 12.4%, outpacing the 10.2% global average.

SeaLead Shipping leads growth, expanding 64,863 TEU.

Tangshan Port Hede Shipping enters top 30 with a 75.6% jump.

🏅 Maritime Analytica: “Mid-tier carriers are gaining ground, disrupting the dominance of shipping giants.”

🌎Trump’s Tariffs Target Asia’s Trade Gap

U.S. aims to match tariffs with Asian partners.

South Korea faces the biggest tariff discrepancy.

Vietnam runs a $124B trade surplus with the U.S.

Higher tariffs may raise costs and reduce demand.

🏅Maritime Analytica: “Expect supply chain shifts, pricing volatility, and trade retaliation—companies must prepare for new sourcing strategies in 2025.”

3️⃣ ⚓ Port Watch: Current Delays & Congestion

4️⃣ 🌱 Maritime Sustainability: Did You Know?

⚙️ Fuel-EU Maritime 2025: The Rule That Changes Everything

🚢 Emission Cuts: Ships over 5,000 GT must reduce emissions—2% by 2025, 14.5% by 2030, and 80% by 2050. Non-compliance means fines and port bans.

💡 Fuel Challenge: Biofuels are scarce, LNG is temporary, and synthetic fuels are expensive—future winners remain uncertain.

💰 Rising Costs: Green fuel surcharges (€100–€300 per TEU), retrofitting downtime, and charter rejections will impact shipping.

🏆 Winners & Losers: Big carriers investing in methanol & biofuels win; smaller fleets face high compliance costs.

📢 Future Trends: E-fuels, AI routing, and carbon capture could reshape shipping by 2035. Are you prepared?

🌊 Practical Guidance: Need help navigating compliance? Check the official Fuel EU Maritime Regulation Guide.

5️⃣ 🚀 Maritime Tech: Next Big Thing

⚙️ AI-Powered E-B/L: The End of Paperwork Chaos?

📜 E-B/Ls are revolutionizing container shipping, cutting costs and delays. Major carriers aim for full adoption by 2030.

⚡ Why It Matters:

✅ Instant processing vs. 5–10 days for paper B/Ls.

✅ Blockchain-backed security prevents fraud.

✅ Saves $6B/year by eliminating paper & courier costs.

🔍 Next Step: AI-driven smart contracts to automate approvals, customs, and payments.

🏆 Leaders: Maersk, MSC, CMA CGM, and ports like Singapore & Rotterdam push for global adoption.

🌊 Practical Guidance: Need further insight? Check the official Electronic Bill of Lading standard | DCSA

📜 Maritime History: Defining Moments

🛳️ SS Ideal X – The First Container Ship (1956)

🚢 Size: 173m long, carried 58 containers.

⚡ Efficiency: Cut loading time from days to hours.

🌍 Impact: Reduced costs by 90%, revolutionizing global trade.

🏗️ Legacy: Today’s giants carry 24,000+ TEUs, reshaping supply chains.

7️⃣ 🏆 Maritime CEO Power Move of the Week

🌏MSC Eyes India: Maritime Growth in Motion

MSC explores strategic investments in India’s booming maritime sector.

Key focus: logistics, shipbuilding, cruise tourism, and port upgrades.

Sagarmala Project fuels India’s rise as a global trade hub.

MSC’s expansion aims to boost efficiency, jobs, and infrastructure.

🏅 Maritime Analytica: India’s port traffic surged 8% in 2023 (India Shipping News). MSC’s entry could accelerate trade dominance.

8️⃣ ⚠️ Maritime Lies That Everyone Believes

❌ Shipping Myth: "Fuel Costs Make Shipping Too Expensive!"

✅ Truth: Modern container ships move 1 ton of cargo nearly 160 km on just 1 ton of fuel—outperforming trucks & planes! 🚀

9️⃣ 🧠 Shipping Trivia: Can You Guess the Right Answer?

📢 Answer drops next week! Stay tuned. 🚢🔥 (Previous Answer: Drone Ships)

🔟 🤖 Maritime GPT Prompt of the Week

🚢 "Summarize today’s top 3 global shipping disruptions and suggest quick mitigation strategies for my shipping/logistics team."

🌟For more👉 info@maritimeanalytica.com / www.maritimeanalytica.com