🔥Maersk vs. COSCO vs. Hapag-Lloyd vs. ZIM — Who Shapes the Future of Global Shipping in Q2 2025?

🔎Exclusive SWOT analysis reveals strategies shaping global shipping’s next decade!

🎖️Subscribe /✨Sponsorship /📊Exclusive Report /🙏Rate us /🎁Send Gift

🔥 Greetings, Maritime Mavericks!

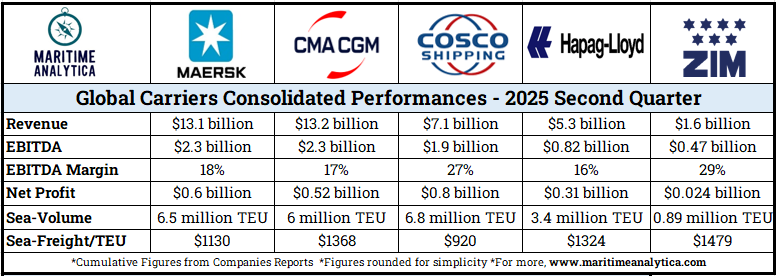

Q2 2025 wasn’t just another earnings season — it reshaped the balance of power in global container shipping.

Falling freight rates. Red Sea detours. Volatile bunker prices. U.S.–China tariff shocks.

This quarter tested the resilience of the world’s biggest carriers like never before.

But while the market softened, the Big Four took radically different paths:

Maersk bets on becoming a global logistics integrator.

COSCO doubles down on scale + methanol-powered mega-ships.

Hapag-Lloyd plays the reliability + premium cargo game.

ZIM focuses on fleet flexibility + LNG cost leadership.

The result? A new multi-polar shipping battlefield — and the fight for dominance heading into 2026 has only just begun.

To see who’s truly best positioned for the future, we built a deep-dive Q2 SWOT analysis powered by real data and strategic insights.

It uncovers hidden strengths, unseen vulnerabilities, untapped opportunities, and looming threats that will decide who leads the next decade of global trade.

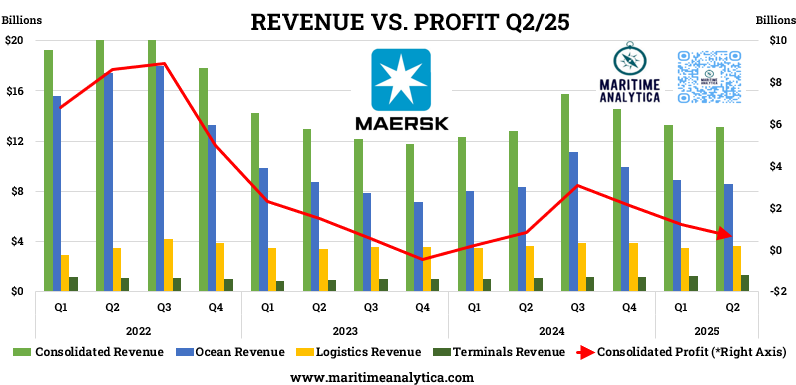

1️⃣ Maersk — The Logistics Integrator

2️⃣ COSCO — The Scale Warrior

3️⃣ Hapag-Lloyd — The Reliability Player

4️⃣ ZIM — The Agile Disruptor

🔥 Who Shapes the Future of Shipping?

🏅 Maritime Analytica Insight — The Big Picture

Ready? Let’s go…

🧩 SWOT Analysis — The Big Four

1️⃣ Maersk — The Logistics Integrator

Redefining shipping through vertical integration.

Strengths:

Expanding logistics + terminals ecosystem → cold chain & inland dominance

EBIT margin 8.3% despite soft spot rates

High-value long-term contracts stabilize earnings

Weaknesses:

Ocean growth underperforming peers

Rising capex → negative free cash flow

Opportunities:

Premium cross-selling via logistics bundling

Growth in reefer cargo, pharma lanes, and e-commerce

Threats:

Reliance on EU import demand

Higher geopolitical exposure in Red Sea & tariff-sensitive corridors

2️⃣ COSCO — The Scale Warrior

China’s national champion aiming for volume supremacy.