⚓Ready to Discover 27,500 TEU Containership? Dive into Maritime Analytica Insight - 71

🌍Exclusive Insights on Container Shipping, Market Trends, and Strategic Guidance

🌟Follow us: Substack / YouTube / LinkedIn / Instagram / X-Twitter

Greetings, Maritime Mavericks! ⚓

Set sail on an exhilarating journey with Maritime Mastery Express and explore the fascinating realm of container shipping 🚢.

🌎 Maritime Indices - Week 38

🌐 Top Export Destinations

🌍 Asia-North Europe Instability

💹 China’s Maritime Dominance

❄️ Arctic Record Boxship

💹 Asia's Maritime Power

🌍 Record 27,500 TEU Ship

🌍 U.S. Export Destinations

🚢 Michelangelo’s Ocean Art

🕰️ Timeless Bill of Lading from 1745

🌊🚀Together, we can navigate a sea of knowledge and discovery. Share the wisdom, share the journey!

🚀 Have you tried our FREE container tracking service yet? 🚀

🥇Our e-mail service include:

Container Journey Notification (from empty dispatch to return)

ETA Adjustments (Notifications on delays or early arrivals)

Unreleased Container Notification (to minimize demurrage fees)

🌟Stay ahead with real-time updates on your shipments—tracking has never been easier! Just send us your container number, and we’ll handle the rest.

👉 info@maritimeanalytica.com

Today's Wisdom from the Waves; 🌊

”The sea knows no limits, makes no concessions. It has given us everything and it can take everything away from us." - John Lindqvist

*Acropolis, Athens, Greece

🚢 Maritime Trivia: Container Shipping Quiz Time!

Previous Answer: Carbon Reinforced Polymer

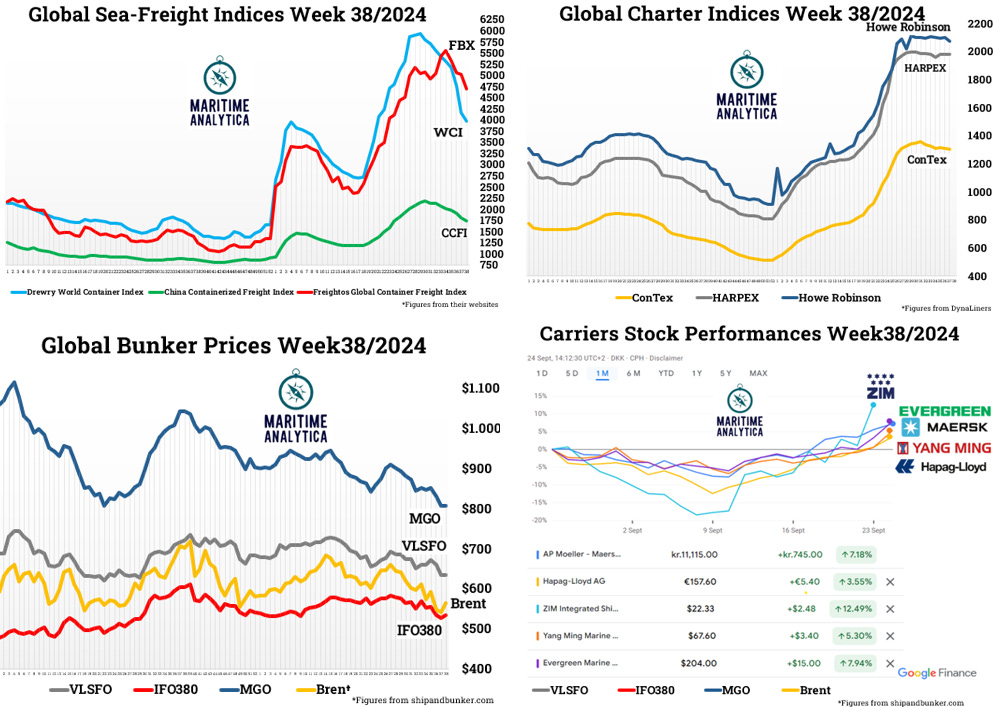

🌍Maritime Indices - Week 38🔥

🌐G20’s Top Export Destinations: U.S. & China

U.S. and China were the top export markets for 7 G20 countries each.

Asian countries heavily exported to China, as N. America leaned on the U.S.

Germany was the key export market for France, Italy, and Türkiye.

Mexico sent 77% of exports to the U.S., compared to 13% from the UK.

Strong regional trade patterns emerged, especially in Europe.

🌍Surging Instability in Asia-North Europe Shipping Capacity

Weekly container vessel capacity fluctuates drastically, especially during peak seasons.

Asia-North Europe trade has seen volatility triple since pre-pandemic times.

Transpacific trades show more stability in weekly capacity.

Asia-North Europe faces nearly 90,000 TEU weekly fluctuations, compared to 50,000 TEU on Transpacific routes.

Increased volatility highlights the need for better contingency planning.