🌟Special Edition - Maersk - Q2/2023

Greetings, Maritime Enthusiasts! 🌊

Welcome to a special edition of maritime exploration with Maritime Analytica, in this edition, we're delving into Maersk's Q2/2023 performance, offering you concise insights into an easily digestible format, ensuring you're well-informed about the maritime landscape. 🚢

Get ready to embark on a journey through the captivating world of maritime insights! ⚓

Today’s Quote from Vincent Clerc, CEO of Maersk, on Q2 Results

“We will need to adapt to the new market situation over the next 18 months.”

Vincent Clerc, CEO of Maersk, discusses the shipping company's second-quarter results and how demand is changing globally.

5 Takeaways from Industry Expert Lars Jensen on Q2 Performance of Maersk

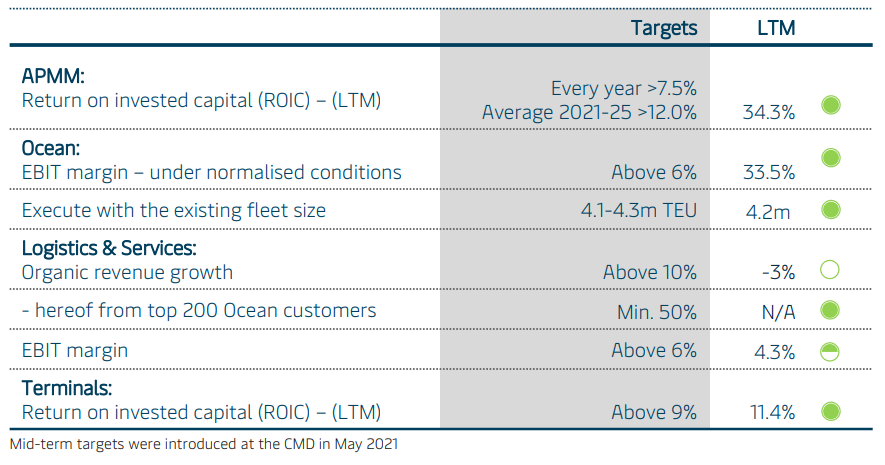

Maersk's Q2 2023 results show strong profitability with EBIT and EBITDA margins in line with CMA CGM and ahead of ONE.

Lower bunker prices and consumption saved nearly $750 million, but unit costs (excluding bunkers) only fell by -1%.

Freight rates declined over 50%, aligned with market trends.

Maersk's lifted volume dropped by -6.1%, indicating a consistent market share loss trend.

Despite volume changes, Maersk's pursuit of a logistics strategy remains prominent, focusing on end-to-end services.

Reuters: Maersk warns of slower demand for container shipping.

Delving Deeper: A Comprehensive Analysis 👇

(*Based on Maersk’s Official Reports of Q2-2023)

MARKET INSIGHTS

Global Economic Outlook: Global economic growth projected around 2% in 2023, but Q2 revealed concerns with cracks in economic outlook emerging. China's recovery slowed, US and Europe stressed by rising interest rates, raising concerns about financial institutions.

Europe and US Concerns: Survey indicators hint at flat growth or possible recession in H2 2023 and early 2024. Manufacturing sector struggles with demand weakening due to increased interest rates, impacting investment spending.

Consumer Spending Patterns: European consumers adjust goods spending, Euro area retail trade down 1.7%, UK goods consumption dropped 2.3%. US sees slower goods consumption growth.

Inventory Correction Impact: Inventory correction continues, affecting logistics activities. Container trade demand drops 4.0% to 6.5% YoY in Q2 due to weak imports in certain regions, while capacity increases with vessel deliveries.

Freight and Logistics Challenges: Freight rates decline, container shipping and air freight volumes decrease. Road freight demand weakens in the US, warehousing demand pulls back with rising vacancy rates, and the challenging environment for container trade and logistics services persists.

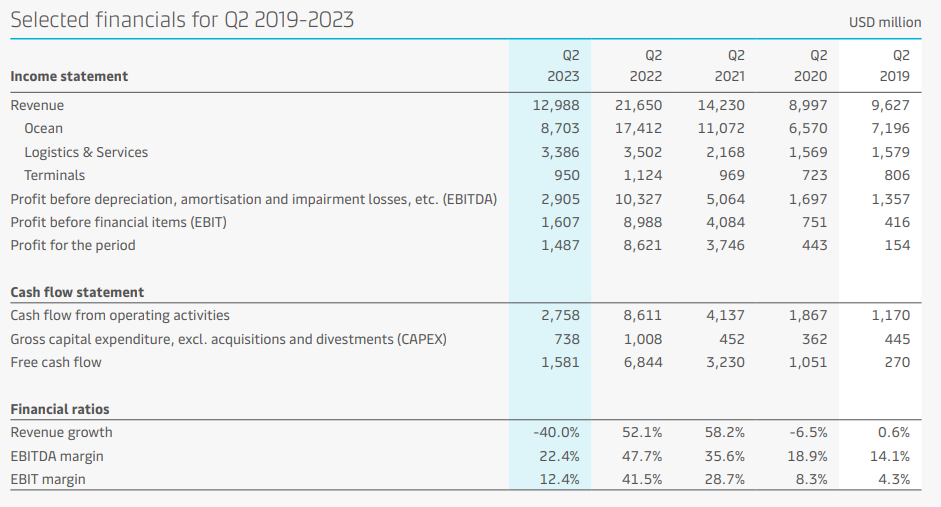

OVERALL REVIEW - Q2 2023

Strong Financial Results: A.P. Moller - Maersk reports robust Q2 financial performance, with anticipated volume and rate trends. Revenue decline slowed due to decreasing rates from 2022 peak and continued destocking in North America and Europe.

Global Economic Outlook: Despite challenges, muted macro-economic growth is projected due to persistent pressure from higher interest rates and potential recession risks in Europe and the US.

Revised Volume Projection: Lower container volume growth forecasted at -4% to -1%, compared to prior -2.5% to +0.5%. Full-year financial guidance raised due to strong H1 performance.

Effective Cost Measures: Cost initiatives supported Q2 profitability despite lower activity expectations in H2, reinforcing all segments.

Operational Highlights:

Ocean faced lower volumes and rates due to post-2022 normalization and inventory correction.

Logistics & Services impacted by ongoing destocking and reduced consumer demand.

Terminals influenced by normalized storage revenue and lower volume, while strong cost control maintained financial performance.

Divestment of Maersk Supply Service concluded.

Sustainable efforts continued with orders for green vessels and e-trucks, in alignment with IMO's net zero agreement by 2050.

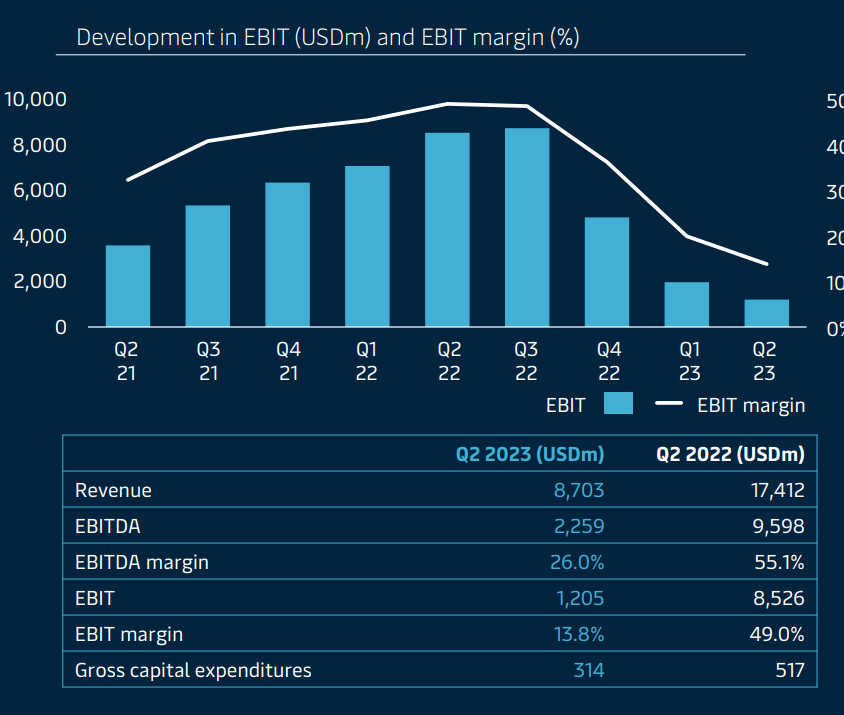

OCEAN

Ocean Performance Overview:

Q2: Lower rates and volumes due to normalization and destocking.

Volumes dropped 6.1%, mainly in USA, Intra Asia, and India/Middle East.

Freight rates decreased 51% YoY and 15% QoQ.

Unit costs improved slightly, driven by lower network & handling costs.

Utilization up to 91% due to less congestion & better schedule reliability.

Financial and Operational Performance:

Revenue dropped USD 8.7bn to USD 8.7bn YoY.

EBITDA and EBIT decreased USD 7.3bn due to lower revenue.

Loaded volumes fell 6.1%, average freight rates declined 51%.

Operating costs decreased 17%, especially bunker and handling costs.

Bunker costs down 34%, improving efficiency by 2.9%.

Operated Capacity and Developments:

Capacity down 3.4% to 4,136k TEU YoY.

Focus on carbon-neutral vessels and partnerships.

Network initiatives enhance service and asset utilization.

H1 2023 Financial Overview:

Revenue down 44% to USD 18.6bn.

EBITDA and EBIT margins decreased.

Operating costs down 14%, driven by various factors.

Summary:

OCEAN's Q2 faced challenges from normalization and destocking, leading to lower rates and volumes. Efforts towards efficiency, service enhancement, and sustainable growth remain priorities.

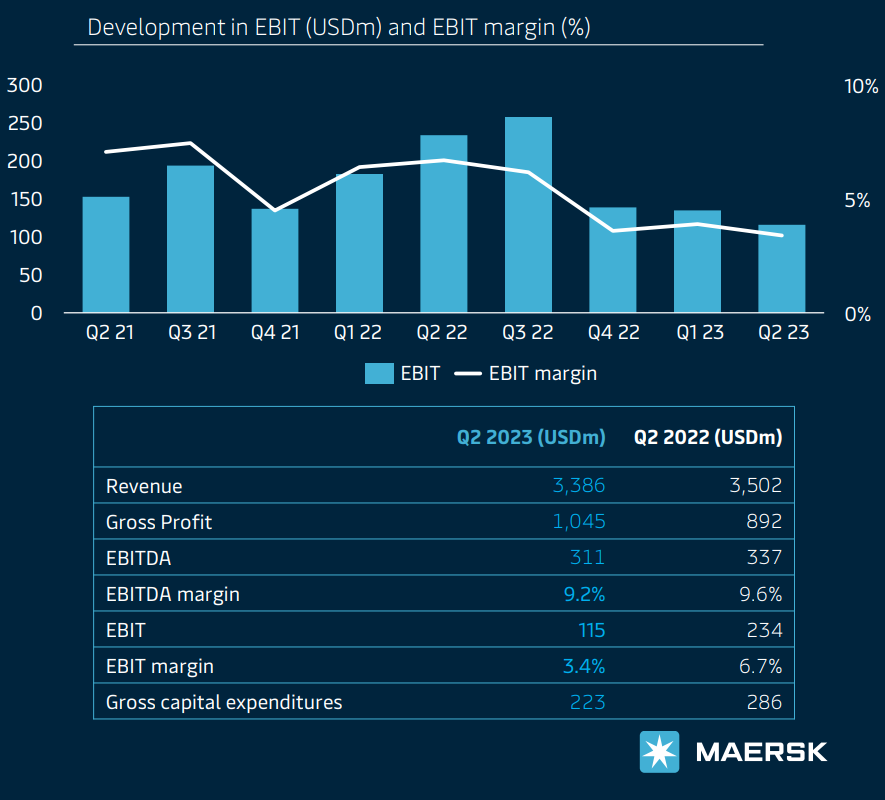

LOGISTICS

Logistics & Services Performance Overview:

Lower volumes due to ongoing destocking & reduced consumer demand.

Challenging logistics sector with limited prospects of volume rebound.

Technology rollout up, balanced with increased cost management.

Financial and Operational Landscape:

Revenue down by 3.3% to USD 3.4bn, mainly due to lower volumes & rates.

Organic revenue fell by 19%, impacted by volume & air rate declines.

Acquisitions in 2022 and 2023 contributed USD 560m in Q2 2023.

EBITA and Gross Profit Insights:

EBITA was USD 158m, affected by volatile freight markets.

Gross profit increased to USD 1.0bn, driven by Fulfilled by Maersk.

EBITDA at USD 311m, EBIT at USD 115m, reflecting lower demand, rates.

Key Developments in 2023:

Fulfilled by Maersk added 782k sqm capacity, integrating LF Logistics.

Transported by Maersk strengthened LCL offering.

Over 50 new LCL lanes added, expanding LCL network to over 500 lanes.

H1 2023 Financial Overview:

H1 revenue at USD 6.9bn, bolstered by Fulfilled by Maersk integration.

Managed by Maersk revenue down 4% to USD 1.1bn due to lower volumes.

Transported by Maersk revenue at USD 3.1bn, due to lower air rates.

EBIT down to USD 250m, due to acquisitions & technology investments.

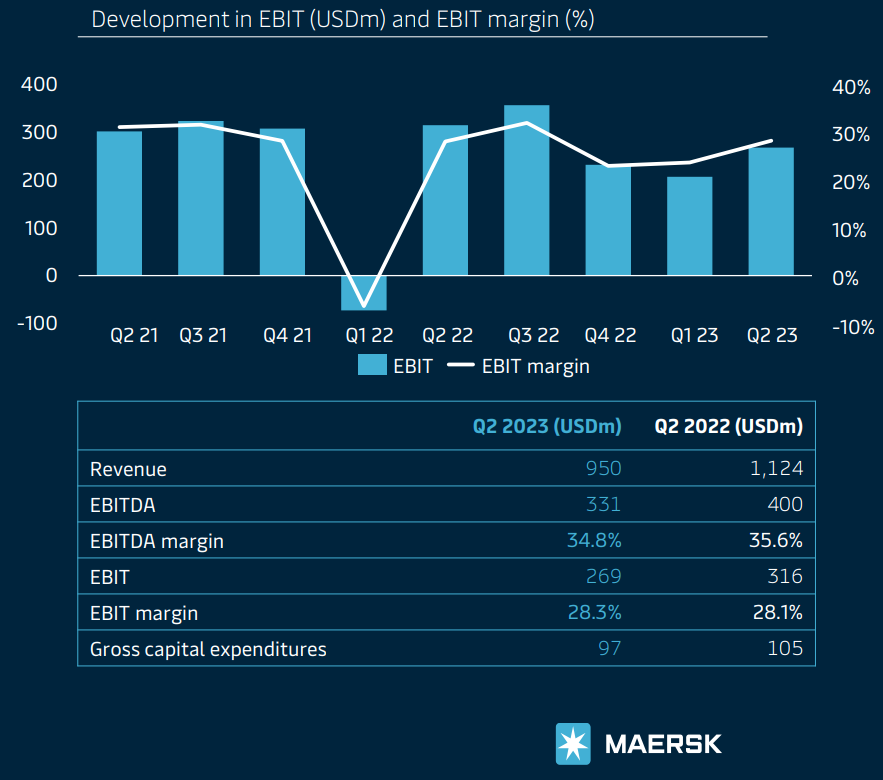

TERMINALS

Terminals Volume and Utilization:

Volumes significantly below 2022 levels, notably in North America.

Terminal volume decreased by 6.5% (3.4% adjusted) YoY in Q2 2023.

Utilization declined 7.2 percentage points to 72%.

Revenue and Cost Dynamics:

Q2 revenue down 15% due to lower demand and port congestion.

Cost control efforts led to a 3.1% decrease in costs per move.

EBITDA at USD 331m, margin protected at 35%.

Regional Performance and Modernization:

Europe volume up 4.7%, while Latin America increased 1.6%.

Asia, Middle East volumes down 11%, North America down 12%.

Modernization, including Port's reconstruction and investment in India.

Key Developments and Investments:

Focus on modernizing and expanding non-container capacity.

Investment in liquid berth at APM Terminals Pipavav, India.

USD 1.0bn investment planned in Brazilian Terminals by 2026.

H1 2023 Financial Overview:

H1 revenue at USD 1.8bn due to volume decrease & lower storage revenue.

Utilization 69%, revenue per move at USD 309, cost per move at USD 248.

EBIT at USD 476m, reflecting good results due to GPI impairment in 2022.

TOWAGE & MARITIME SERVICES

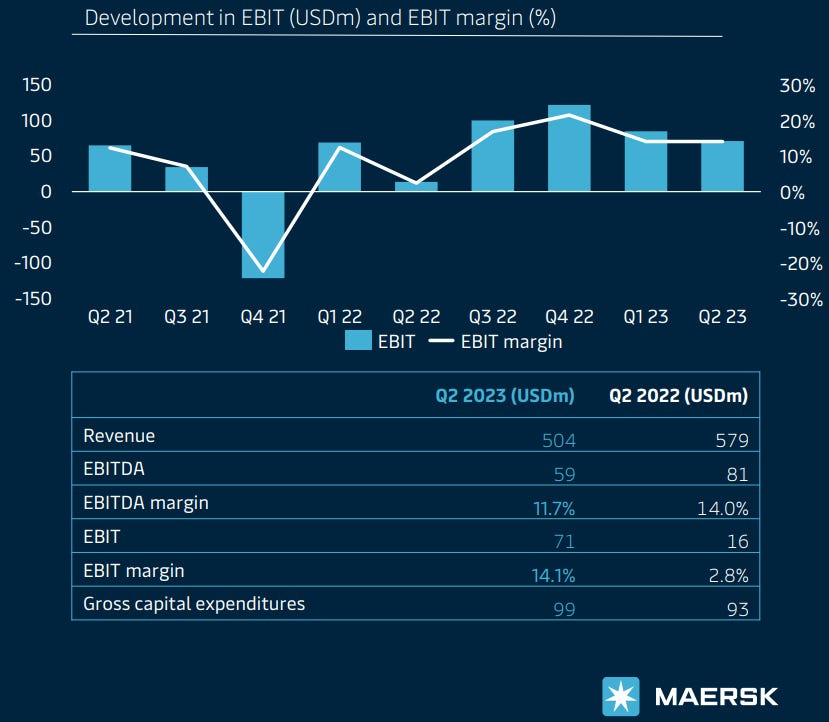

Overall Performance:

Towage & Maritime Services revenue at USD 504m (USD 579m).

EBITDA of USD 59m (USD 81m), EBIT increased to USD 71m (USD 16m).

Towage Segment:

Revenue up to USD 206m, with a 7% increase.

Harbour Towage revenue increased by USD 6m due to tariff hikes.

EBITDA rose to USD 61m, driven by higher revenue.

Maritime Services Division:

Completion of Maersk Supply Service divestment with a net gain of $15m.

Maersk Container Industry revenue down to $115m due to weak market.

EBITDA increased to USD 8m due to asset classification changes.

Höegh Autoliners AS:

Positive impact of $20m from Höegh Autoliners AS.

Improved performance in Höegh Autoliners AS contributing to results.

Financial Overview H1 2023:

Revenue steady at $1.1bn, EBITDA at $142m, and EBIT at $156m.

Performance improved due to enhanced results of Höegh Autoliners AS.