⚓ The Maritime News Edition - 26

Exclusive Insights on Container Shipping, Market Trends, and Strategic Guidance

Salutations, Maritime Adventurers! ⚓

Embark on a journey with the Nautical Dispatch, your weekly passage into the captivating realm of container shipping.

Navigate through the currents of Maritime Insight Pro's unparalleled industry acumen, guiding you through the waves of the freshest news and updates! 🚢

Today's Wisdom from the Waves; 🌊

“🌊The voice of the sea speaks to the soul. The touch of the sea is sensuous, enfolding the body in its soft, close embrace." - Kate Chopin

🚢 Navigating Knowledge: Container Shipping Quiz Time! 🚢

*Last Week’s Answer: All of the Above

1- Big shipping firms stop Red Sea routes, how bad is it for global supply chain?

Attacks prompt temporary halt in Red Sea entries for Maersk & Hapag-Lloyd.

Maersk's near incident & Hapag-Lloyd's vessel hit by an unknown object.

Houthis attacks raise shipping costs, prompting some companies to reroute.

ICS calls for action as Red Sea handles 12% of global trade.

U.S. urges a global naval force; concerns over Houthi aggression persist.

2- Red Sea Shipping Crisis: Container Ships Reroute Amid Rebel Threats via Financial Times

Security Concerns: Maersk diverts vessels due to heightened security concerns in the Red Sea.

Houthi Rebel Attacks: Iranian-backed rebels prompt global shipping companies to reroute for safety.

Naval Response: US-led coalition expands naval task force to protect commercial shipping in the region.

Supply Chain Disruption: Vessel diversions pose a risk to global supply chains, affecting container traffic and crude oil shipments.

Economic Impact: Brent crude prices rise, retailers anticipate delays, and shipping companies expect longer voyages around Africa.

3- Global Shipping Faces Disruption Due to Canal Woes and Conflict via VesselBot

Panama Canal Shift: Low water levels prompt rerouting to the US East Coast, impacting global trade patterns.

Middle East Turmoil: Houthi attacks force vessels to circumvent Africa's Cape of Good Hope, avoiding Red Sea risks.

East Coast Surge Reversal: Recent months see a shift in favor of West Coast ports due to Panama Canal delays.

Transit Challenges: Plans to increase Panama Canal transits aim to ease congestion, but a dry season threat loom.

Environmental Concerns: Rerouting via Suez raises fuel consumption, emissions, and costs, posing sustainability challenges.

🚢 Cast Your Vote: Container Shipping Insights Poll! 🚢

Last Week’s Insight: 47% of our followers believe that Twin Canal (Panama & Suez) Crises will cause severe disruptions to global trade in long term.

4- Inactive Vessel Capacity Plummets Amid Global Challenges via Linerlytica

Inactive vessel capacity sees a sharp decline.

Idled fleet and drydock capacity both decrease throughout the week.

Current idle capacity stands at a mere 74 ships, amounting to 128,000 TEU.

Challenges such as attacks south of Suez and congestion at Panama are absorbing some capacity.

Idled containerships are swiftly being redeployed in response to the evolving maritime landscape.

5- Houthi Attacks Pose Threat to Red Sea Shipping Safety

Houthis target commercial ships in the Red Sea, raising indiscriminate attack concerns.

Total attacks reach 10, with MSC and Hapag-Lloyd vessels hit.

Maersk and Hapag-Lloyd halt Red Sea voyages due to safety concerns.

Analysts suggest Houthis may target any ship, regardless of Israel links.

AIS data shows vessels navigating discreetly amid rising security risks.

6- Red Sea Shipping Crisis Sparks Economic Concerns

Tonnage Drop: 70% reduction due to Houthi attacks prompts rerouting.

Economic Fallout: Longer routes raise costs, impact supply chains, and risk inflation.

US Response: Urgent action needed to address the crisis and stabilize global trade.

7-Red Sea Crisis Alters Shipping Routes via Sea-Intelligence

Houthi attacks halt Red Sea transit, impacting Suez routing.

Shift to round-Africa affects Far East to North America trade.

Sailing times increase significantly for Africa routing.

1.4-1.7 million TEUs needed for sustained round-Africa services.

It is emphasized potential absorption, but highlights need for faster speeds.

8- Houthi Threats Impact Shipping in Red Sea

80+ container ships, including top carriers, still use Red Sea/Suez despite Houthi warnings.

Houthi demand tied to Israel-Gaza situation, pending UN ceasefire vote.

CMA CGM, Maersk reroute for safety, Maersk notes US Government freight distinction.

US-led Operation Prosperity Guardian protects shipping; Greece, Denmark join multinational force.

9- Shipping Aims for 5-10% Low Carbon Fuel, Availability Uncertain via Clarksons

Currently, only 1% of ships ready for green and blue fuels.

IMO targets 5-10% zero-emission fuels by 2030; 29% of order book ships geared for change.

Container sector leads with 55% of future ships prepared for alternative fuels.

LNG, methanol, & ammonia gain popularity; COP-28's raises hope.

Concerns linger on whether enough green fuels will be available by 2030.

10-Attacks on ships in the Red Sea could lead to supply chain disruptions

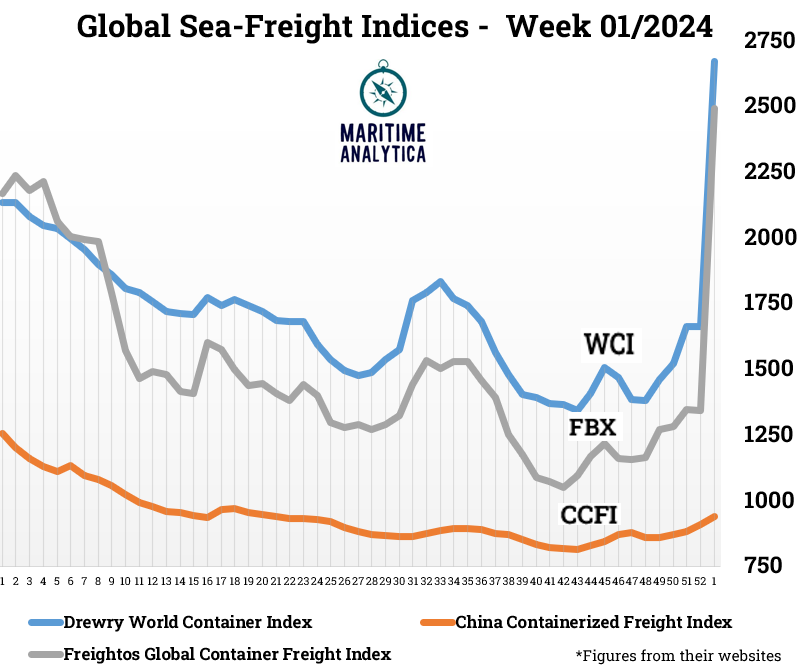

11- Global Sea-Freight Indices🚀

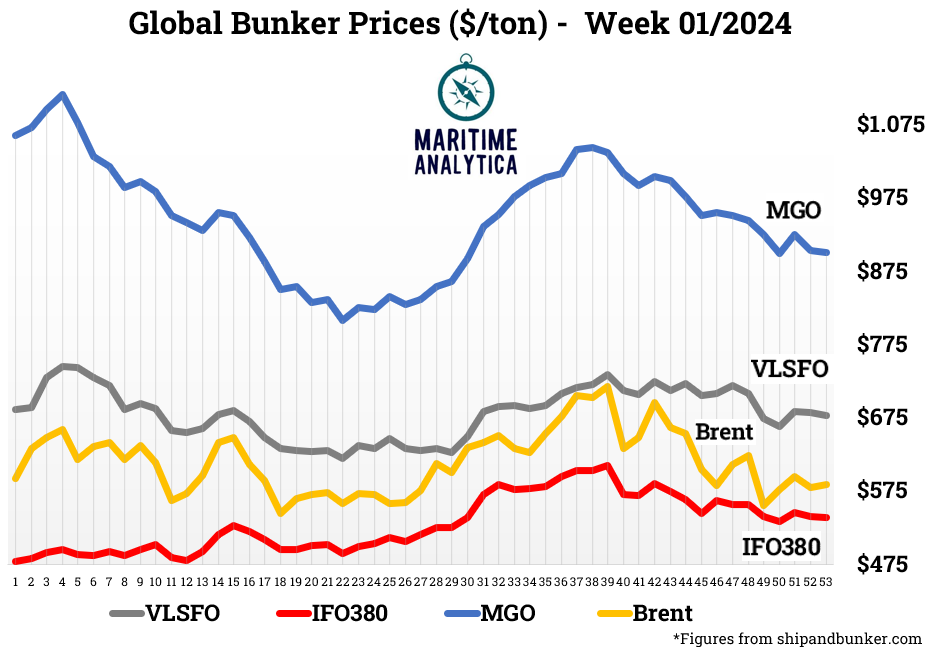

12- Global Bunker Prices

13- Suez Canal oil demand destruction "much less at risk"

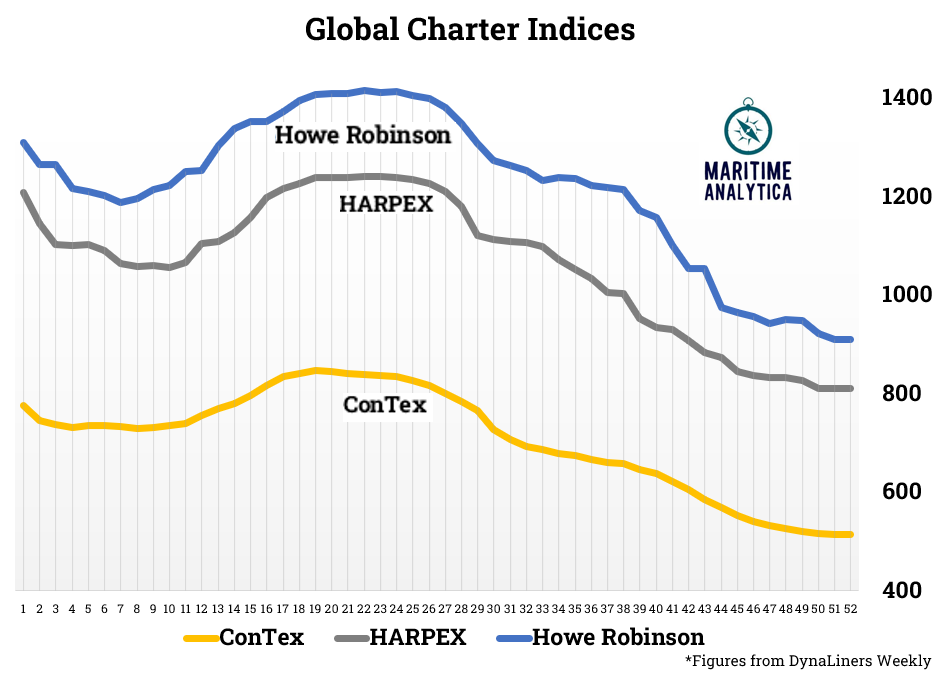

14- Global Charter Indices

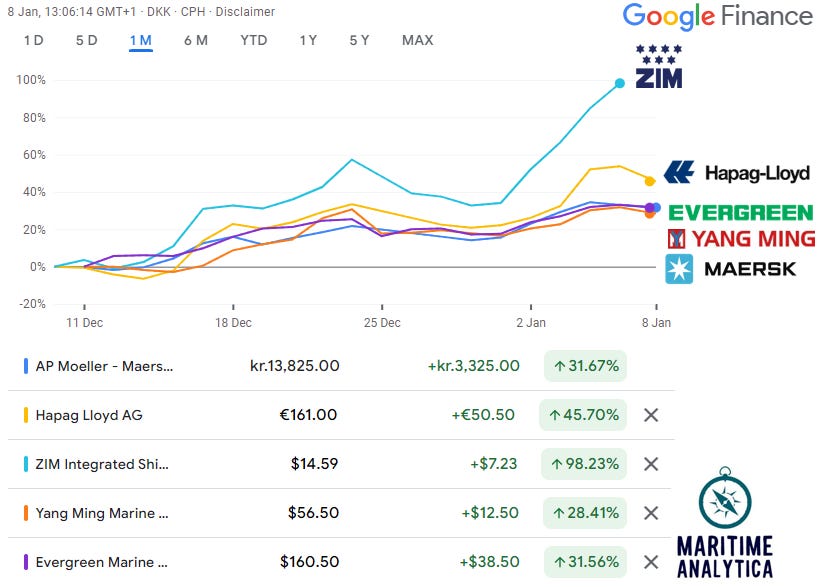

15- Carriers - Stock Performances

We read your emails, comments, and poll replies daily. Hit reply and let us know what you want more of! - Email: maritime-analytica@outlook.com

Have you missed any past newsletter? Check them out here:

For more daily news, follow up via Linkedin here:

For our exclusive market reports, online customized courses, advertisement services, and more, please complete the form:

Invite your friends to read Maritime Analytica⚓

Invite friends to read Maritime Analytica. Share the referral link for them to subscribe and earn benefits:

Share the link via text, email, or social media.

Get Free Exclusive Market Report for 5 referrals.

Receive a 60min Zoom Sectoral Chat for 10 referrals.

Obtain Exclusive Consultancy Service for 20 referrals.

Visit the leaderboard and check Substack’s FAQ for more details. Thanks for supporting Maritime Analytica!

To learn more, check out Substack’s FAQ.