⚓ The Maritime News Edition - 28

Exclusive Insights on Container Shipping, Market Trends, and Strategic Guidance

Set Sail, Sea Explorers! ⚓

Welcome aboard the Maritime Analytica's Journal, your weekly expedition into the fascinating realm of container shipping. Cruise confidently with Maritime Insights' exclusive industry highlights, riding the currents of the latest news and updates! 🌊

Dive into the ocean of maritime wisdom with us – where every revelation is a pearl waiting to be uncovered! 🌟

Today's Wisdom from the Waves:

"In every outthrust headland, in every curving beach, in every grain of sand, there is the story of the earth." - Rachel Carson 🌊

🚢 Navigating Knowledge: Container Shipping Quiz Time! 🚢

*Last Week’s Answer: Drone Ships

1- Tensions rising in the Red Sea

2-Panama Canal Crisis: Years, Billions Needed to Save Vital Trade Route

Canal faces severe drought, impacting $270 billion global trade.

Short-term fixes include vessel limits; long-term solution requires damming Indio River.

$2 billion project faces opposition, needs congressional approval.

Climate change, El Niño, and infrastructure gaps contribute to the crisis.

Global trade routes affected, jeopardizing canal's future.

3-Global Shipping's Chokepoints

22-30% of global trade flows through Red Sea's Bab-el-Mandeb & Suez Canal.

Disruptions in these chokepoints affect oil prices & disrupt food shipments.

80% of global goods (by weight) use China-centric sea routes.

70% of global goods trade relies on sea routes.

Extended closures due to attacks threaten global trade, causing price fluctuations and supply chain disruptions.

4- Suez Canal Crisis: A Ripple Effect on the Global Economy

🚢 Cast Your Vote: Container Shipping Insights Poll! 🚢

Last Week’s Insight: 67% of our followers are willing to support shipping companies that invest in alternative fuels such as biofuels or hydrogen.

5-Liner Fortunes Surge Amid Red Sea Shipping Crisis via Linerlytica

SCFI climbs 8%, reaching a high of 1896.65 points.

405 container vessels, totaling 5.56m TEU, affected by diversions due to Red Sea conflicts.

Liner disruptions lead to a tighter market balance, boosting stock upgrades for many liners.

Jefferies raises liner outlook, citing reduced near-term capacity and higher spot rates, expecting positive margins in 2024.

Drewry's global composite index rises over $1,000, with Shanghai to Rotterdam rates doubling, up 115%.

6- Global Sea-Freight Indices🚀

7-How conflict in the Red Sea is affecting global trade

8- Sea Attacks Force Tough Choices for Shippers

Red Sea attacks push shipping companies to decide between risking Houthi assaults or opting for longer, costlier routes around Africa.

Disruptions threaten higher consumer prices as major shipping firms alter routes to navigate security concerns.

Soaring insurance costs and extended routes lead to increased transportation expenses, affecting container shipments from China.

9- China-U.S. Freight Rates Drop Amid Manufacturing Slowdown and Red Sea Unrest

China to U.S. West Coast Ocean freight rates unexpectedly decrease.

Weak demand in Chinese manufacturing prompts cancellations by MSC, the world's largest shipper.

Rates are below expectations, with West Coast prices falling while East Coast rates stay higher.

Global freight complexities, including issues at the Panama Canal, contribute to a fluid market.

Ongoing Middle East tensions impact trade routes, leading to potential cancellations in the coming months.

10- Red Sea Disruption Boosts Shipping Rates Temporarily

Houthi attacks lead to longer routes, boosting freight rates for shipping operators.

Longer journeys around South Africa ease overcapacity concerns, reducing the expected surplus.

Maersk and Hapag-Lloyd see a share price boost, but challenges remain with net losses and potential scrappage deterrence.

Occurs as China rushes goods to Europe before Chinese New Year, keeping container rates elevated.

Temporary benefits could lead to overcapacity concerns if scrappage efforts are hindered.

11- Red Sea Threats Propel Container Shipping Rates Soaring

Asia to northern Europe spot rates surge 173% to over $4,000.

Mediterranean routes hit $5,175; some carriers announce prices above $6,000.

North America’s East Coast rates climb 55% to $3,900 for a 40-foot container.

Suez Canal traffic down 28%, fueling risks of congestion & prolonged high rates.

China to Europe container rates double since Dec. 21; Shanghai to Los Angeles rises 30%.

12- Global Bunker Price 🛢️

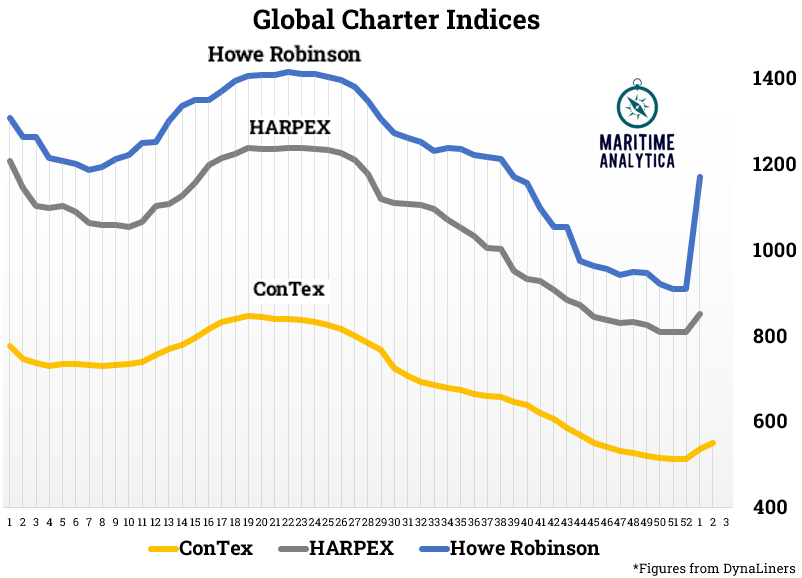

13- Global Charter Indices🚢

14- Carriers - Stock Performances

15- Container Costs & Freight Rates Soar

Red Sea attacks disrupt Indian trade, causing significant surges in container costs and freight rates.

Exporters and importers face competitiveness challenges and increased costs, sparking inflation concerns.

Rerouting to avoid the Red Sea adds delays, impacting delivery schedules.

Urgent government intervention sought to stabilize the industry amid rising freight costs and transit time challenges.

We read your emails, comments, and poll replies daily. Hit reply and let us know what you want more of! - Email: maritime-analytica@outlook.com

Have you missed any past newsletter? Check them out here:

For more daily news, follow up via Linkedin here:

For our exclusive market reports, online customized courses, advertisement services, and more, please complete the form:

Invite your friends to read Maritime Analytica⚓

Invite friends to read Maritime Analytica. Share the referral link for them to subscribe and earn benefits:

Share the link via text, email, or social media.

Get Free Exclusive Market Report for 5 referrals.

Receive a 60min Zoom Sectoral Chat for 10 referrals.

Obtain Exclusive Consultancy Service for 20 referrals.

Visit the leaderboard and check Substack’s FAQ for more details. Thanks for supporting Maritime Analytica!

To learn more, check out Substack’s FAQ.