⚓ The Maritime News Edition - 29

Exclusive Insights on Container Shipping, Market Trends, and Strategic Guidance

Ahoy, Maritime Mavericks! 🚢 🌊

Dive into the latest Maritime Analytica newsletter for a thrilling journey through:

⚓🔀 Maersk's Red Sea diversion

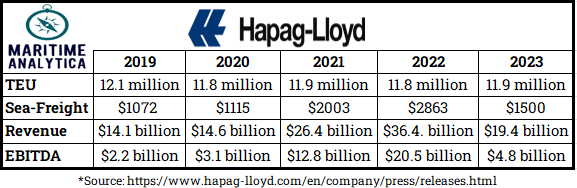

🌐💹 Hapag LLoyd 2023 Figures

📈 🚢Houthi attacks boosting shares

🚢 📉 Oversupply of containerships

🚢🏆 Top Container Carriers of 2024

🌍🔄 Red Sea chokepoints

📈 🚢US container imports surge

🌍⚠️China-Taiwan tensions

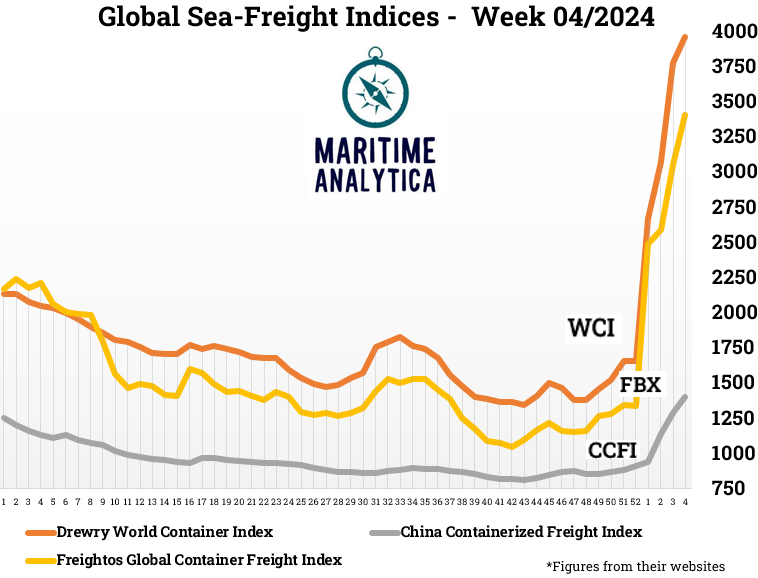

📉 🛢️Latest Stocks, Bunker, Sea-Freight, Charter rates

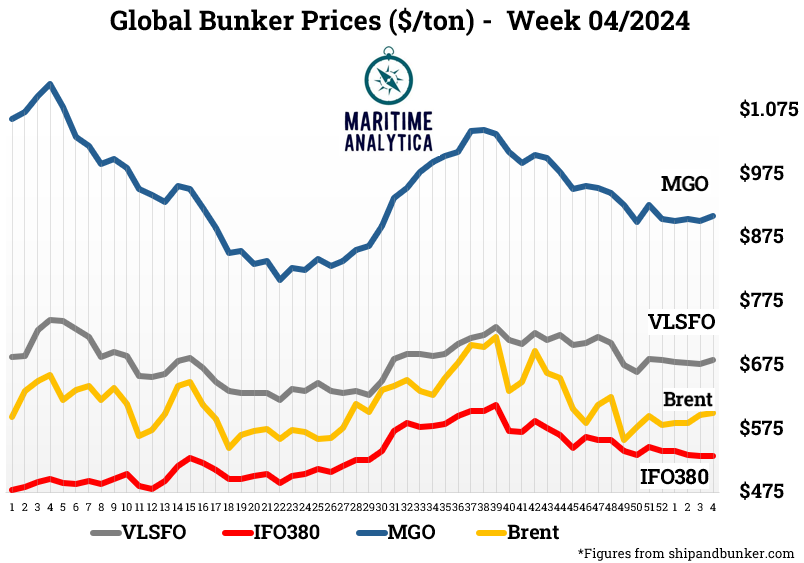

Immerse yourself in groundbreaking insights, riding the waves of industry buzz.

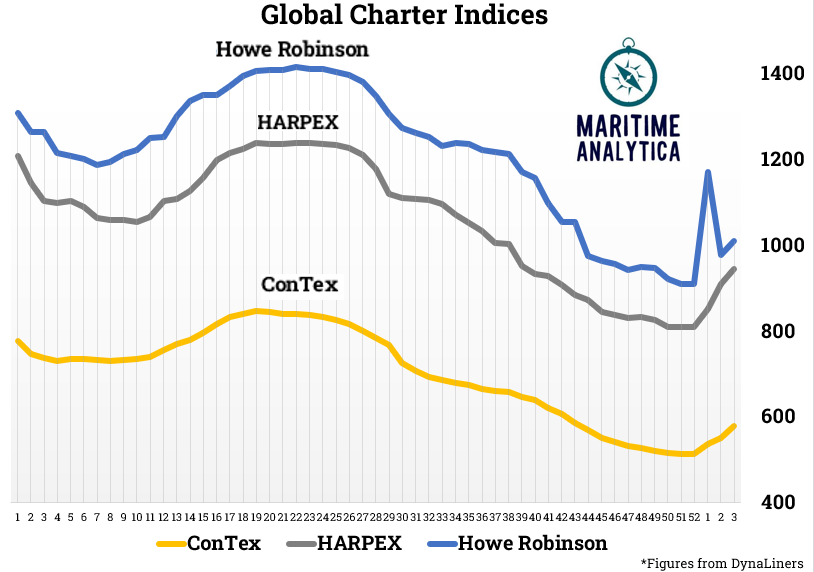

Let's dive in with enthusiasm! 🌊🚀

Today's Wisdom from the Waves:

"If you want to build a ship, don't drum up people to collect wood and don't assign them tasks and work, but rather teach them to long for the endless immensity of the sea." - Antoine de Saint-Exupéry 🌊

🚢 Maritime Trivia: Container Shipping Quiz Time! 🚢

*Last Week’s Answer: Reduced Carbon Emissions

1- Maersk Diverts Ships from Red Sea Amid Rising Threats; US Shipping Rates Soar 70%

2- Hapag-Lloyd AG - 2023 Figures Revealed

3- Red Sea Disruption Temporarily Eases Container Ship Glut

Houthi attacks lead to longer journeys, lifting freight rates temporarily.

Extended routes around South Africa alleviate worries of surplus.

Maersk & Hapag-Lloyd shares rise, despite net losses and scrappage hurdles.

🚢 Cast Your Vote: Container Shipping Insights Poll! 🚢

Last Week’s Insight: Considering the global push for carbon neutrality, only 33% of our followers are optimistic about container shipping companies achieving ambitious emission reduction targets.

4- Top Container Carriers as of 2024 via Statista

5-Red Sea Shipping Risks: Maersk Holds Decision, Iran Sends Warship via S&P Global

Maersk delays Red Sea shipping decision post Houthi attack: tension rises.

Iran dispatches warship after US Navy action; lines reroute for security.

Oil prices surge 2% due to escalating tensions; Suez Canal trade impacted.

Shipping companies cautious; more than 50% tonnage drop in Bab al-Mandab Strait.

6- China's Growing Worries: Red Sea Shipping Attacks Raise Concerns

7- Red Sea Disruption Sparks Shipping Lines’ Share Surge

Houthi attacks lead to longer journeys, temporarily elevating freight rates.

Carriers see a share price boost, overcoming challenges like net losses and potential scrappage issues.

8-Red Sea Attacks: Shipping Costs Surge, Delays Loom

Businesses like Boxer Gifts hit by steep shipping rate increases due to Red Sea disruptions.

Shipping firms divert vessels, causing delays and impacting supply chains.

Ongoing disruptions raise financial concerns and potential price hikes, risking customer satisfaction.

9- Carriers Gain $18 Billion Amid Red Sea Chaos

Suez Canal closure and rising freight rates propel Maersk and Hapag-Lloyd to an $18 billion market value surge.

Shippers reroute via Cape of Good Hope, doubling travel time and further boosting freight rates.

Surge in prices may be temporary, influenced by factors like factory schedules, global demand, and efforts to reopen the canal.

10- U.S. Container Imports Rise 9.2% in December, Exceeding Pre-Pandemic Levels

December 2023 witnesses a 9.2% YoY surge in U.S. container imports, totaling 2.1 million TEUs.

East and Gulf Coast ports flourish, while West Coast ports, including Long Beach and Los Angeles, see decreases.

Despite Panama Canal drought, East and Gulf Coast ports recover in December, with Red Sea disruptions' impact anticipated in January.

11- Tensions Escalate in China-Taiwan Conflict

China reacts strongly to US Speaker Pelosi's Taiwan visit, conducting military exercises.

Despite tensions, Taiwan Strait's key shipping route experiences minimal disruption.

China imposes limited sanctions on Taiwan, with minor impact on its economy.

China expected to intensify military drills and sanctions, keeping pressure on Taiwan.

Commercial vessels around Taiwan face minimal impact amid heightened political tensions.

12- Global Sea-Freight Indices📈

13- Global Bunker Prices📉

14- Global Charter Indices📉

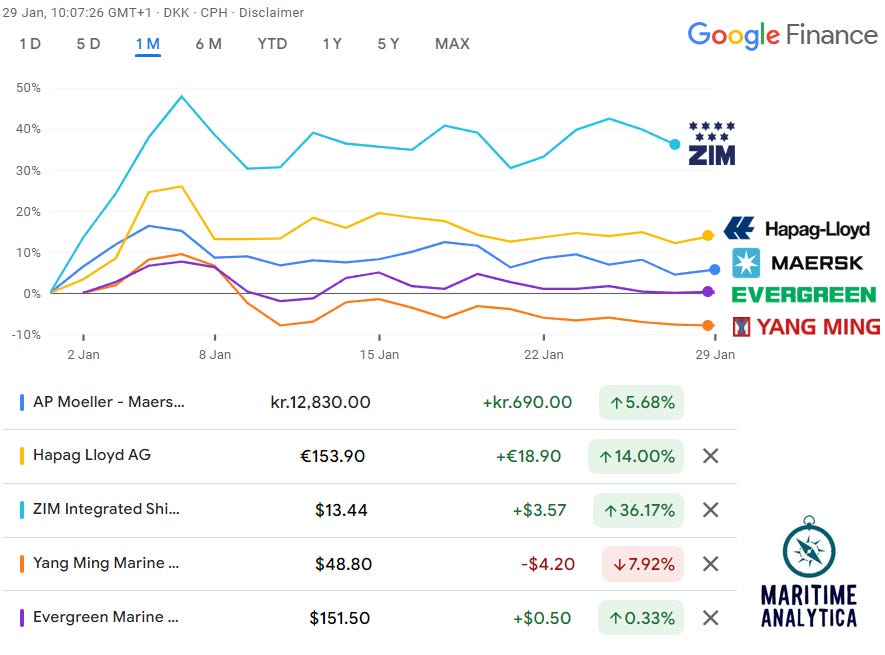

15- Carriers - Stock Performances 🆙

We read your emails, comments, and poll replies daily. Hit reply and let us know what you want more of! - Email: maritime-analytica@outlook.com

Have you missed any past newsletter? Check them out here:

For more daily news, follow up via Linkedin here:

For Exclusive Container Shipping Market Report and more, please fill into the form here: