⚓ The Maritime News Edition - 30

Exclusive Insights on Container Shipping, Market Trends, and Strategic Guidance

Hello, Maritime Mavericks! 🚢🌊

⛵🌎Embark on an exhilarating journey with the Maritime Analytica newsletter!

🚢 China's Mega Ship Launch

📦💥Box-ship Boom Despite Challenges

🔴👁️ U.S. & U.K. Eye Red Sea

⬆️💰Red Sea Attacks Drive Costs

🌍📊 2024 Global Risks Analysis

🌊🔄Short-Term Struggles After Red Sea Crisis

💥🛳️Houthi Rebels' Major Red Sea Assault

🕒💼Time for Shipping Stocks?

🌊💼Q4 Turmoil for Container Shipping

📈⛴️Sea-Freight Trends & Stock Updates

🌊🔍Get ready to submerge yourself in a sea of groundbreaking insights on container shipping, sprinkled with expert tactics and the most up-to-date industry buzz.

🌊Let's plunge into it with enthusiasm!

Today's Wisdom from the Waves🌊:

"I believe that shipping containers are the backbone of global commerce, connecting nations and fostering economic growth on a scale never before imagined." - Bill Gates

🚢 Maritime Trivia: Container Shipping Quiz Time! 🚢

*Last Week’s Answer: Intelligent Routing

1- China Launches World's Largest Container Ship

The OOCL Valencia, the world's largest container ship (24,188 TEU), begins its trial voyage from Nantong, Jiangsu Province.

This marks China's first completion of such a vessel in 2024, following the delivery of OOCL SPAIN in March 2023.

2- Record Box-ship Deliveries Amid Market Challenges

2024 sees a robust start for liner shipping, driven by Red Sea diversions and surging spot rates.

Record-breaking 478 container ships (3.1m TEU) to be delivered, expanding fleet capacity by 10%.

Despite growth, ship capacity demand forecasted to rise by 3-4%, signaling potential market imbalance.

Red Sea disruptions prompt vessel diversions, impacting spot rates and introducing uncertainty in freight rates and schedules.

3- Possible U.S. and U.K. Intervention in Red Sea

Iran-backed Houthis launch their largest attack with 21 missiles and drones from Yemen.

U.S. and U.K. jets and destroyers intercept and shoot down the projectiles.

Growing concerns of potential intervention in the Red Sea to address heightened security risks.

Situation remains fluid; further developments expected in response to Houthi attacks.

4- Red Sea Attacks Spike Shipping Costs

Container shipping costs from China to Europe surge 248% ($1,148 to $4,000)

Major companies redirect routes, causing delays and increased fuel costs.

Panic in China, surcharges, and higher insurance costs contribute to the rise.

Prolonged Red Sea disruption add 0.7% to global CPI inflation by end-2024.

It is expected the crisis to be short-lived but may affect inflation dynamics.

🚢 Cast Your Vote: Container Shipping Insights Poll! 🚢

💡Last Week’s Insight: Apart from reducing emissions, only 29% of our followers are willing to support container shipping companies that invest in alternative fuels such as biofuels or hydrogen.

5- Global Risks in 2024 via Visual Capitalist

Global leaders prioritize extreme weather as the top risk, posing threats to food systems and infrastructure.

AI-driven misinformation surges to second place, jeopardizing trust and global election integrity.

Post-pandemic, deepening societal divides escalate the risk of polarization in political and economic realms.

Escalating conflicts, exemplified by the Lebanon attack, rank as the eighth-highest risk, hinting at broader regional conflict.

6- Red Sea Crisis Impact: Short-Term Challenges via Sea-Intelligence

Red Sea carriers' networks become unpredictable, leading to extended transit times.

Longer routes from Asia to North Europe and the Mediterranean contribute to the challenge.

Imminent shortage warns of a capacity crunch for Asian exports in the coming weeks.

Visible impact with delays on the Asia-North Europe route and a rapid shortfall observed in mid-January.

Contextual perspective: Crisis noted but considered less severe than pandemic disruptions.

7- Houthi Rebels Launch Largest Red Sea Attack

Houthi militias execute their most extensive attack on merchant vessels in the Red Sea.

Heightened concerns about maritime security and potential implications for regional stability.

8- Is It Time to Consider Shipping Stocks?

Growing Red Sea tensions reshape global shipping routes, creating opportunities for investors.

Alternative routes drive container freight rates to nearly double, impacting exporters worldwide.

Stocks of major shipping firms, including ZIM Integrated Shipping, Hapag-Lloyd, AP Moller-Maersk, and Cosco Shipping, see significant surges.

Shifting logistics create investment opportunities in global shipping stocks amidst ongoing developments.

9- Container Shipping Hits Rough Waters in Q4 Amid Red Sea Upheaval

Container stocks face challenges as Red Sea disruptions shake up the market.

Cosco sees a sharp 62% drop in Q4 profits, reflecting post-COVID struggles.

OOCL reports an 8.2% decline in average container revenue, indicating a tough quarter.

Zim expected to post significant losses in Q4 despite sector optimism and market changes.

Evergreen and Yang Ming, Taiwanese carriers, experience Q4 revenue declines.

10- Global Sea-Freight Indices📈

11- Global Bunker Prices📉

12- Oil prices jump after U.S. strikes against Iran-backed Houthi rebels

13- Red Sea Strikes Propel Oil Surge: What You Need to Know

Airstrikes Boost Oil Prices: US-led attacks trigger a 4% spike in WTI and push Brent above $78.

Shipping Chaos Unfolds: Global vessels advised to avoid Red Sea amid rising geopolitical tensions.

Houthi Attacks Disrupt Trade: Ongoing strikes impact major shipping companies, including Maersk and Hapag-Lloyd.

Global Supply Concerns: Fears rise over broader conflict impacting oil supply and prices.

Markets on Edge: Geopolitical risks shake oil market, signaling potential price volatility ahead.

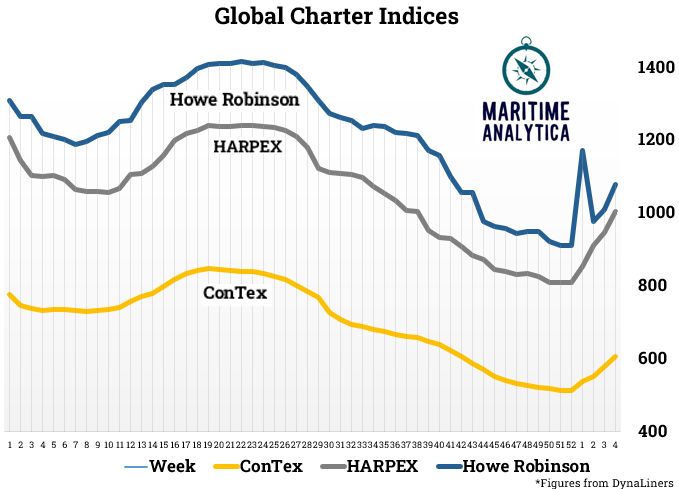

14- Global Charter Indices📉

15- Carriers - Stock Performances 🆙

We read your emails, comments, and poll replies daily. Hit reply and let us know what you want more of! - Email: maritime-analytica@outlook.com

Have you missed any past newsletter? Check them out here:

For more daily news, follow up via Linkedin here:

For more info, please fill into the form here: