⚓ The Maritime News Edition - 31

Exclusive Insights on Container Shipping, Market Trends, and Strategic Guidance

Salutations, Maritime Adventurers! ⚓

Dive into the latest Maritime Analytica newsletter for a thrilling journey through:

🚢The Most Dangerous Shipping Route

🌐 Gemini shaking the Alliances

🌍 Extreme Weather as Global Risk

🚢 Red Sea-Suez Rates Surge

⚠️ US Ships Hit by Houthi Attacks

🌊 Red Sea Turmoil

📉 China ASEAN Pivot

⚠️ Shipping Chokepoints Threaten

🚢 Red Sea Crisis

🚢 Suez Transits Drop

🌊 Sea-Freight, Bunker, Charter, Stock Indices

Navigate through the currents of Maritime Insight Pro's unparalleled industry acumen, guiding you through the waves of the freshest news and updates! 🚢

Today's Wisdom from the Waves; 🌊

"The sea, the great unifier, is man's only hope. Now, as never before, the old phrase has a literal meaning: we are all in the same boat." - Jacques Yves Cousteau

🚢 Navigating Knowledge: Container Shipping Quiz Time!

*Last Week’s Answer: Dynamic Scheduling

1-Why This Shipping Route Is One of the World’s Most Dangerous?

2- Hapag-Lloyd Joins Maersk, Shaking Global Shipping Alliances

Hapag-Lloyd and Maersk disrupt partnerships, impacting THE Alliance.

The Cooperation aims for 90% schedule reliability with a fleet of 290 vessels.

Departure of Hapag-Lloyd leaves a significant gap in THE Alliance offerings.

3- Extreme Weather Takes Center Stage: Global Risks Unveiled for 2024 🌍

World Economic Forum's 2024 Global Risks Report highlights extreme weather as the top global risk.

Misinformation ranks second, posing threats to trust, political divides, and global elections.

Societal polarization, driven by post-pandemic challenges, emerges as a concerning risk.

Escalating tensions in M. East rank as the 8th-highest global risk in 2024.

🚢 Cast Your Vote: Container Shipping Insights Poll!

Last Week’s Insight: 71% of our followers believe that real-time visibility in container tracking and monitoring is really crucial for the efficient management of the supply chain.

4- Red Sea-Suez Crisis Spurs Container Rates Surge: Asia-Europe & Med Rates Quadruple

Approximately 90% of containerized fleet avoiding Suez Canal, choosing Cape of Good Hope route.

Asia-Mediterranean rates surpass $5,000, Asia-Europe rates cross $4,500, quadrupling due to crisis.

Drewry ECI rises by 85% in two weeks, reaching $3,072, deflecting fall seen in 2023.

Anticipation of continued disruptions; Chinese New Year in February crucial for recalibration.

South African ports experience double-digit waiting times; major carriers like CMA CGM and MSC suspend Red Sea transit.

5- U.S. container ship hit by Houthi ballistic missile in Red Sea attacks

6- Red Sea Crisis Sparks Shipping Turmoil via Sea-Intelligence

Shippers face extended transit times due to round-Africa routing.

Red Sea disruptions lead to volatile and rapidly changing carrier networks.

Uncertain capacity outlook indicates a looming crunch for Asian exports.

Asia-North Europe sees visible impact with delays, expecting a capacity drop by January 22nd.

Crisis, while serious, pales in comparison to pandemic disruptions.

7- China's Trade Pivot: ASEAN Overtakes US in 2023

China's exports to Southeast Asia exceeded those to the US in 2023, marking a significant trade realignment.

ASEAN nations bought $524 billions of Chinese goods, outpacing both the US and the European Union.

The data reveals a gradual decoupling between China and the US, with increased exports to Mexico potentially to avoid US tariffs.

Sustained deflation in China lowered export prices, making Chinese goods more affordable globally.

Noteworthy surge in trade with Russia, showcasing China's strategic moves amid geopolitical changes.

8- Global Shipping Chokepoints Threaten Supply Chains

Duke University's Professor Lincoln Pratson identifies 13 critical maritime chokepoints impacting global trade.

OpenStreetMap GPS data and Statista insights enhance understanding of these vulnerabilities.

Pratson's analysis assesses potential disruptions, highlighting risks in closing these chokepoints.

Note: Percentages may not sum to 100 as ships often navigate multiple chokepoints, compounding risks.

9-Red Sea Shipping Crisis: Key Points

Container vessels avoid Red Sea amid Houthi attacks, opting for longer Cape of Good Hope routes.

Suez Canal impacted as 12% of global shipping uses Red Sea access.

Shell suspends Red Sea shipments indefinitely, fearing escalation; Chevron maintains routes.

Sovcomflot explores alternative routes; EU considers naval mission by Feb. 19.

10- Maritime Piracy Surge: IMB Highlights Concerns

IMB reports 120 piracy incidents in 2023, up from 115 in 2022.

Hostages spike from 41 to 73, with a significant increase in 2022 and 2023.

First successful Somali-based hijacking since 2017 raises concerns about ongoing piracy threat.

Gulf of Guinea remains dangerous, accounting for 75% of crew hostages despite fewer incidents.

11- Suez Canal Transits at 3-Year Low Since Ever Given Incident

Daily transits drop to 49 from a 2023 peak of 83, marking the lowest in three years.

Red Sea attacks reroute global trade, causing longer and costlier routes.

Traffic levels now mirror post-Ever Given blockage in April 2021.

Cape of Good Hope route gains popularity as ships seek alternatives.

Ever Given, after widespread diversions since mid-December, is now in the Indian Ocean, heading east.

12- Global Sea-Freight Indices 📉

13- Global Bunker Prices📉

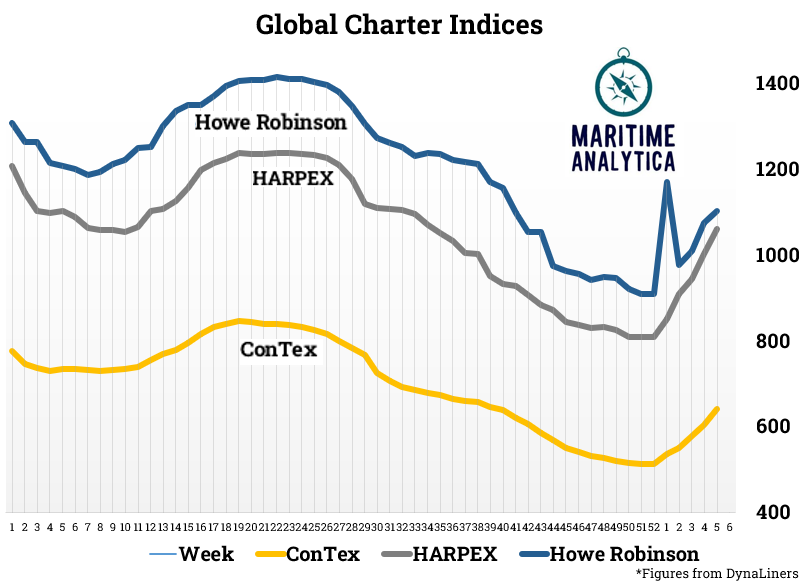

14- Global Charter Indices🆙

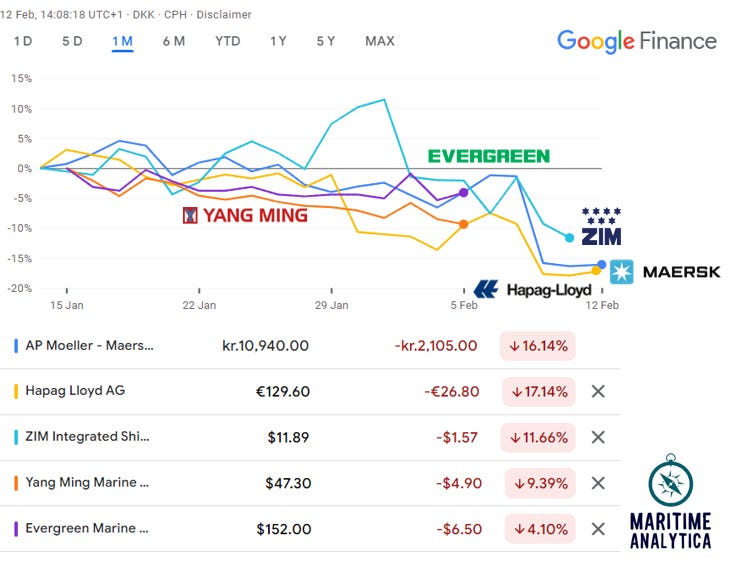

15- Carriers - Stock Performances 🆙

We read your emails, comments, and poll replies daily. Hit reply and let us know what you want more of! - Email: maritime-analytica@outlook.com

Have you missed any past newsletter? Check them out here:

For more daily news, follow up via Linkedin here:

For more, please fill into the form here: