⚓ The Maritime News Edition - 32

Exclusive Insights on Container Shipping, Market Trends, and Strategic Guidance

Hello, Maritime Mavericks! 🚢🌊

Embark on an exhilarating journey with the Maritime Analytica newsletter!

🚢 DHL Warning

🌍 Exclusive Routes

📈 Asia-EU Rates

🌏 Bahri Logistics Alternative Route in Red Sea

🚢 Capacity Drop

🌍 Export Evolution

🚢 Houthi Attacks

🚢 Vietnam's Connectivity

🌏 Trade Shifts

📈 Shipping Rates Surge

🌍 Longer Routes, Emissions

🛳️ Sea-Freight, Bunker, Charter, Stocks Indices

Get ready to submerge yourself in a sea of groundbreaking insights on container shipping, sprinkled with expert tactics and the most up-to-date industry buzz.

Let's plunge into it with enthusiasm! 🌊🔍

Today's Wisdom from the Waves; 🌊

"The heart of man is very much like the sea, it has its storms, it has its tides, and in its depths, it has its pearls too." - Vincent van Gogh

🚢 Maritime Trivia: Container Shipping Quiz Time! 🚢

*Last Week’s Answer: 2010

1- DHL Warns: 20-Day Shipping Delay Amid Red Sea Tensions

Casper Ellerbaek, DHL's Global Head of Ocean Freight, highlights a 20-day shipping delay due to Red Sea tensions.

Discusses the impact on companies and the global supply chain.

2-Exclusive Data Unveils Red Sea Diverted Routes

Genco Picardy, a US-listed bulk carrier, targeted by Houthis in Gulf of Aden.

No LNG carriers in Red Sea; major shipping companies suspend navigation.

US retaliates, putting financial sanctions on Yemen's Houthis.

All shipping segments withdraw from Suez, causing significant disruptions.

3- Red Sea Crisis Sparks Surge in Asia-EU Shipping Rates

90% shift to Cape of Good Hope spikes Asia-Europe rates fourfold.

Drewry Index jumps 85% in 2 weeks, signaling ongoing supply chain disruptions.

South African Ports face delays: major carriers suspend Red Sea transit.

Rising rates prompt worries about market adjustments and potential economic shocks.

Stakeholders urged to plan ahead amid geopolitical volatility & energy supply risks.

4-Impact of Red Sea Attack on Global Shipping🌏

30% of global trade passes through the Suez Canal in the Red Sea.

Houthi attacks in the Red Sea significantly affect global supply chains, especially trade between Asia and Europe.

Trade volume via the Suez Canal has dropped by 40% since December 15th.

Ships are rerouting via the Cape of Good Hope, adding 10 days and 7000 km to voyages, doubling costs.

Bahri Logistics has created a sea-land corridor between the Gulf and Red Sea, allowing smooth cargo movement with an average transit time of 4 days.

The Cape of Good Hope route increases voyage time by 19 days and operational costs by over USD 2 million.

This corridor helps shipping lines avoid conflict zones, saving time, money, and reducing carbon footprint.

The corridor is expected to increase traffic through the Suez Canal by 5-10%.

For more information: info@bahrilogistics.sa

5- Red Sea Crisis: Second Only to Ever Given in Capacity Drop via Sea Intelligence

Month-long Red Sea crisis disrupts service networks, creating uncertainty in Asia-Europe routes.

Danish analysts use Trade Capacity Outlook to compare changes, emphasizing disruptions and volatility.

Sea-Intelligence notes normal market behavior with red circles indicating capacity declines during Chinese New Year/Golden Week.

Sea Intelligence CEO Alan Murphy highlights 'Ever Given' as the largest impact, but Red Sea crisis surpasses early pandemic impacts.

Visual depiction shows severity with red circles for holiday-related declines and green arrows for pandemic phases.

6- 150 Years of Global Exports: Key Shifts Among Economic Giants

Graphic highlights 150 years of global export changes.

19th-century UK led with Germany; post-WWII, the U.S. emerged as a leader.

Japan's rapid growth preceded China's current dominance.

Global merchandise exports surged from $59B in 1948 to $24.3T in 2022.

🚢 Cast Your Vote: Container Shipping Insights Poll! 🚢

Last Week’s Insight: %36 of our followers believes that Autonomous Vehicle for Last-Mile hold the most promise for container shipping companies as last-mile delivery solution.

7- Houthi Terrorists Strike Again: Third Attack on Red Sea Ship in 3 Days

Houthi terrorists launch two missiles at M/V Chem Ranger in the Red Sea.

No injuries reported; 3rd attack on commercial shipping in 3 days.

The ship continues its course.

8-Vietnam’s Liner Shipping Connectivity Soars Amid Manufacturing Boom via Sea-Intelligence

Vietnam's liner shipping connectivity jumps 13.7% YoY, ranking 9th globally.

Steady rise in Vietnam's connectivity, particularly in recent quarters.

Exports to N. America see a remarkable 44% surge, fueling export growth.

Hanoi targets a 6% export increase in 2024, positioning Vietnam amidst global economic shifts.

9- Global Trade Shifts Amid Conflict via Dr. Rodrigue

Routing Change: Asia-Europe traffic shifts from Suez to Cape of Good Hope due to regional conflicts, impacting supply chains.

Options: Shanghai-Rotterdam alternatives include Suez (27 days), Cape (35 days), and Eurasian Landbridge (14 days, limited).

Economic Impact: Deviation brings added costs, disrupts supply chains, affecting Mediterranean transshipment hubs.

Eastern Seaboard: Shanghai-New York routes see marginal impact, with transpacific and Panama Canal options remaining viable.

10-Red Sea Crisis Escalates: Container Shipping Rates Soar, Routes Extended

Ongoing Red Sea Crisis prompts shipping route shift from Suez Canal to the longer Cape of Good Hope.

Container rates triple, with additional charges of $500 for 20-foot and $1000 for 40-foot containers.

Delays impact Australian red meat exports to the Middle East, EU, and UK, with potential shortages emerging.

Agricultural sector faces challenges in trade logistics, affecting canola exports and increasing costs for certain imports.

Global trade disruptions raise concerns about inflationary bottlenecks and potential spikes in energy prices.

11- Red Sea Crisis Spurs Longer Shipping Routes, Higher Emissions

Red Sea disruptions lead to rerouting, forcing longer journeys around Africa.

Container vessels face increased costs and emissions due to extended routes.

Average emissions rise by roughly 14,000 tons of CO2 per vessel on the southern Africa route.

Cumulative emissions likely to surge with continued route diversions and faster sailing speeds.

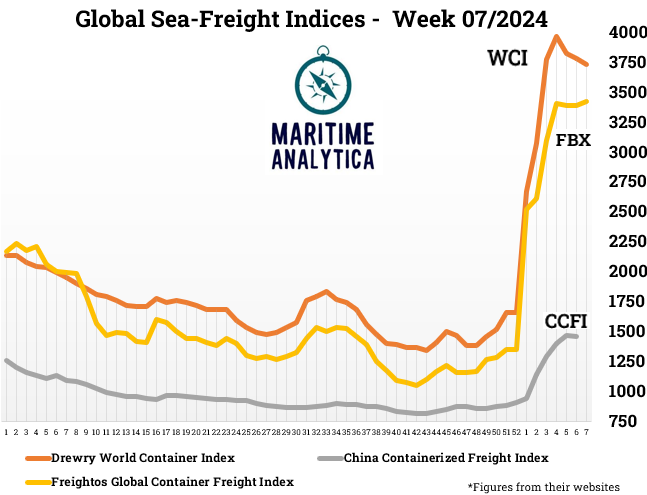

12- Global Sea-Freight Indices📈

13- Global Bunker Prices📉

14- Global Charter Indices📉

15- Carriers - Stock Performances 🆙

We read your emails, comments, and poll replies daily. Hit reply and let us know what you want more of! - Email: maritime-analytica@outlook.com

Have you missed any past newsletter? Check them out here:

For more daily news, follow up via Linkedin here:

For more, please fill into the form here: