⚓ The Maritime News Edition - 33

Exclusive Insights on Container Shipping, Market Trends, and Strategic Guidance

Hello, Maritime Mavericks! 🚢🌊

Embark on an exhilarating journey with the Maritime Analytica newsletter!

Get ready to submerge yourself in a sea of groundbreaking insights on container shipping, sprinkled with expert tactics and the most up-to-date industry buzz.

🚢 Maersk Methanol Debut

🛳️ Ocean Alliance Stability

🌊 Crisis Sparks CO2 Surge

🚗 Woes Hit Car Chains

🌍 Attacks Impact Supply

🚢 Houthi Shifts Shipping

🌍 Attacks Outweigh Pandemic

🚢 Shipping Recovers Amid Strikes

🌍 Container Ships Embrace New Route

🌍 Crisis: 2nd Largest Capacity Drop

🚨 UNCTAD Warns of Trade Crisis

🛳️ Sea-Freight, Bunker, Charter, Stocks Indices

Let's plunge into it with enthusiasm! 🌊🔍

Today's Wisdom from the Waves🌊:

“One cannot discover new oceans unless they have the courage to lose sight of the shore.” - André Gide"

🚢 Maritime Trivia: Container Shipping Quiz Time! 🚢

*Last Week’s Answer: Freight Insurance

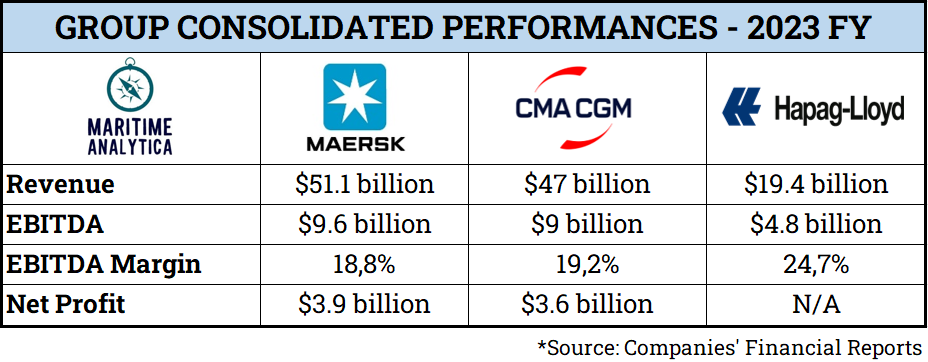

🔥Hot Topic🔥- Carriers’ 2023 Figures Revealed!

1- Maersk Launches First Methanol Mega-Ship

Ane Maersk, a 16,200 TEU container ship, is the first of 18 methanol-powered vessels.

Named after Ane Mærsk McKinney Uggla, it's christened at HD Hyundai Heavy Industries.

Deployed on Maersk’s AE7 service from Asia to Europe starting February.

Maiden voyage fueled with green methanol; Maersk actively seeking green fuels for 2024-2025.

Maersk classifies green fuels based on 65-95% life cycle GHG reductions compared to fossil fuels.

2- Ocean Alliance Stands Strong: Liner Switch Unlikely via Linerlytica

Hapag-Lloyd's move prompts alliance speculation.

Ocean Alliance's fixed 10-year agreement limits swift changes.

Maersk's new Gemini Cooperation set to launch in 2025.

Legal constraints make Ocean Alliance members unlikely to switch soon.

THE Alliance seeks replacement after Hapag-Lloyd's departure.

3- Red Sea Crisis Sparks CO2 Surge via Sea-Intelligence

Extended Routes: Conflict forces longer paths, elevating emissions by 31%-66%.

Speeding Impact: Each knot faster raises CO2 emissions by 14%.

Downsizing Dilemma: Shift to smaller vessels yields a 141% CO2 increase on Asia-Europe routes.

Triple Threat Impact: Combined factors may result in a 260%-354% CO2 surge to North Europe and Mediterranean.

Uncharted Challenges: Mitigating increased emissions poses a realistic challenge amid the Red Sea crisis.

4- Red Sea Woes Hit Car Supply Chains

Car carriers reroute via Cape of Good Hope due to Red Sea threats, causing delays.

Japanese giants NYK Line and K Line join diversion, worsening global car carrier capacity issues.

Already sold-out global fleet hampers vehicle movements, compounded by diversions.

Cape route cuts fleets' effective capacity by 5-6%, affecting carmakers' shipments.

Carriers hesitant to return, citing inadequate naval protection against ongoing Red Sea threats.

5- How Red Sea attacks impact global supply chain

6- Houthi Attacks Force Global Shipping Shifts

Economic Ramifications: Shipping companies triple container prices, contributing to inflation concerns globally.

Oil and Gas Impact: Red Sea disruptions affect oil and LNG trade; about 12% of global oil and LNG pass through the Red Sea.

China's Role Uncertain: China's response to the crisis remains uncertain, impacting its exports and raising questions about its stance.

🚢 Cast Your Vote: Container Shipping Insights Poll! 🚢

Last Week’s Insight: 44% of our followers are somewhat comfortable with the idea of container shipping companies sharing data with partners in the supply chain for collaborative efficiency.

7- Red Sea Attacks Outweigh Pandemic Impact on Global Shipping

Red Sea attacks create more disruption than the early pandemic, impacting vessel capacity.

Only the 2021 Suez Canal blockage had a larger impact.

Longer transits affect container pickups; unused vessel capacity offers potential relief.

Second-largest in recent years, affecting container movements at ports.

Adding vessels post-Chinese New Year crucial for a balanced schedule; industry seeks a Suez solution.

8- Red Sea Shipping Recovers Amid Ongoing US Strikes

Red Sea shipping, including tankers, shows a fragile recovery as the US targets Houthi sites.

Bab al-Mandab Straits' transits rise to 40 on Jan. 22, highest since the US-led counterattacks on Jan. 11.

US and UK forces target eight Houthi sites, contributing to changes in shipping patterns.

Crude oil on the water increases to 29 million barrels on Jan. 21, with Russian cargoes less affected.

9- Container Ships Embrace Cape of Good Hope via Linerlytica

80% opt for longer route since Dec 15, 2023.

Exceptions: CMA CGM and select smaller operators.

Driven by Suez Canal congestion and global supply chain issues.

Cape route adds time and costs but offers strategic benefits.

Industry adapts, exploring diverse routes for smoother operations.

10-Red Sea Crisis: 2nd Largest Capacity Drop via Sea-Intelligence

Ongoing for a month, Red Sea crisis disrupts Asia-Europe routes.

Trade Capacity Outlook report shows unprecedented volatility.

Marked events, including pandemic phases and "Ever Given" incident, provide context.

Red Sea crisis emerges as the largest single event, exceeding early pandemic impact.

Press release underscores crisis gravity and global trade network impact.

11- UNCTAD Warns of Global Trade Crisis Amid Maritime Challenges

UNCTAD raises alarm over disruptions in global trade.

Red Sea assaults, Black Sea tensions, and Panama Canal drought contribute to the crisis.

Record shipping cost increases and environmental concerns escalate.

Urgent call for international collaboration to address threats to supply chains.

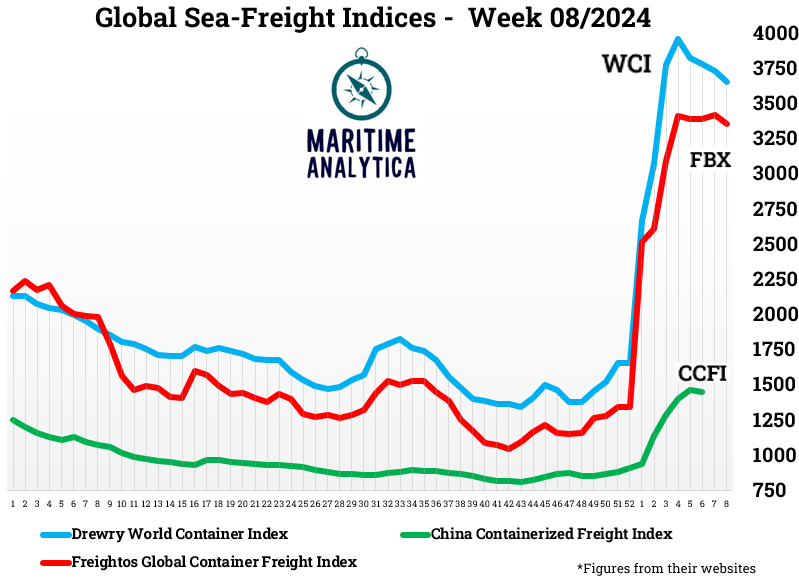

12- Global Sea-Freight Indices📉

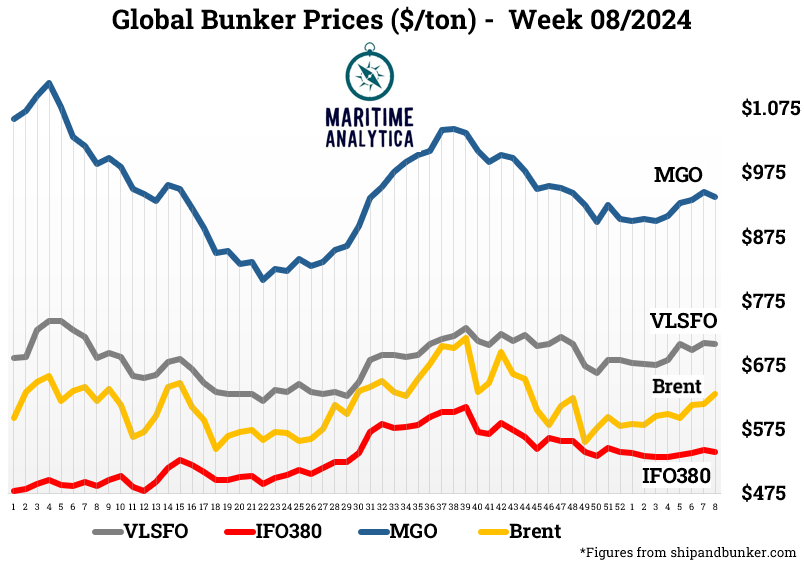

13- Global Bunker Prices📉

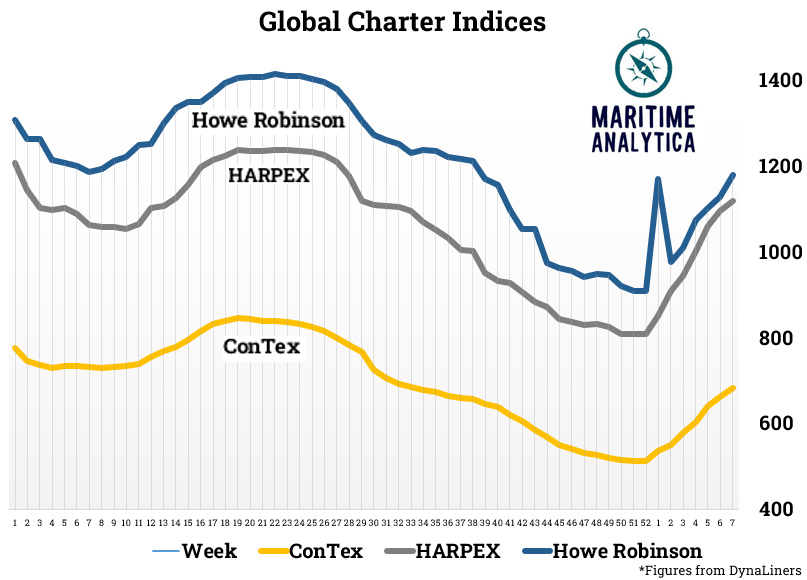

14- Global Charter Indices🆙

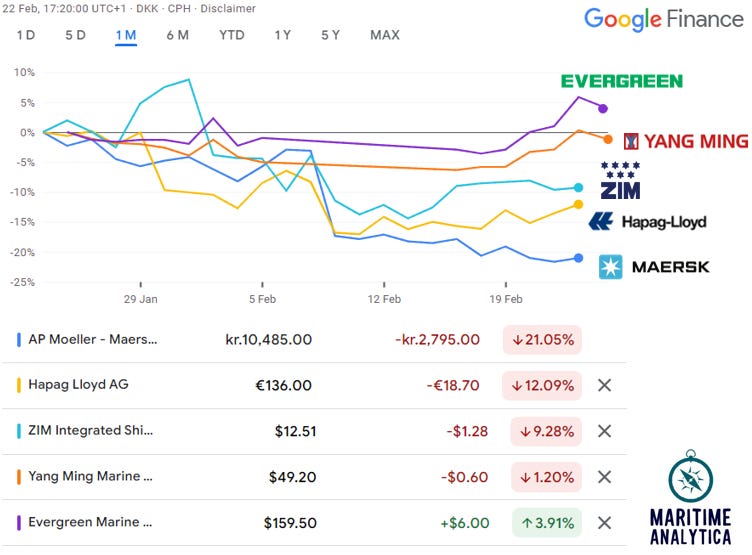

15- Carriers - Stock Performances 📉

We read your emails, comments, and poll replies daily. Hit reply and let us know what you want more of! - Email: maritime-analytica@outlook.com

Have you missed any past newsletter? Check them out here:

For more daily news, follow up via LinkedIn here:

For more, please fill into the form here: