⚓ The Maritime News Edition - 34

Exclusive Insights on Container Shipping, Market Trends, and Strategic Guidance

Ahoy, Maritime Trailblazers! 🌊⚓

Join the Maritime Analytica newsletter for an exciting voyage!

🚢 Red Sea Crisis

🌍 Global Trade Dynamics

🌊 Red Sea Shipping Woes

🌐 MSC Rival Emerges

🚢 Suez Canal Traffic Plummets

🔄 Suez Canal Shift

🚢 Sea-Freight Surge

🏆 MSC's Vintage Fleet

⚠️ Houthi Attacks Threaten

📈 Maritime Reliability Peaks

🛳️ Sea-Freight, Bunker, Charter, Stocks Indices

Dive deep into a sea of cutting-edge insights on container shipping, seasoned with expert strategies and the latest industry chatter. Let's dive in with zest! 🔍

For Full Access to News, Art, Sustainability and Art Editions, Become Paid Member via:

Today's Wisdom from the Waves; 🌊

"The ocean stirs the heart, inspires the imagination, and brings eternal joy to the soul." - Robert Wyland 🌅⚓

🚢 Maritime Trivia: Container Shipping Quiz Time! 🚢

*Last Week’s Answer: Galvanizing

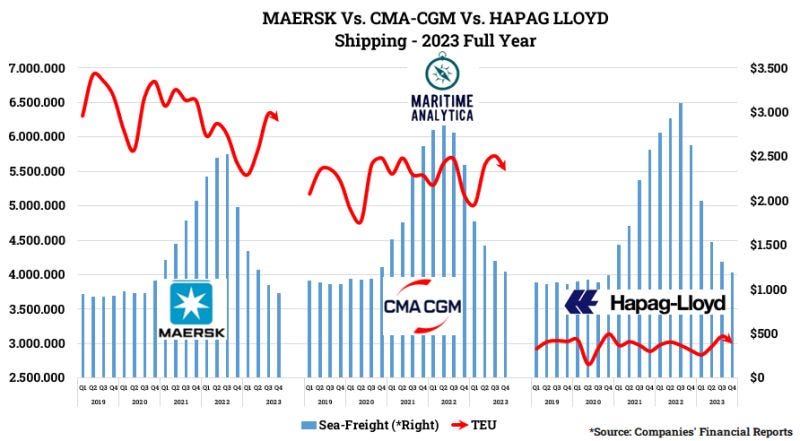

🔥Hot Topic🔥- Carriers’ 2023 Figures Revealed!

1- Shipping industry crisis: Attacks in red sea force vessels to reroute

2- 150 Years of Global Trade Dynamics Unveiled

British Industrial Peak: 19th-century Britain led as the world's industrial giant.

Data-Driven Exploration: Peterson Institute and WTO data reveal global export shifts.

Economic Superpowers: Explore the rise and fall of leading economies in international trade.

3- Red Sea Shipping Woes: Surging Costs, Delays, and Trade Challenges

Rerouted vessels cause delays and surcharge complexities.

Shipping costs rise, impacting global consumer goods.

Global trade persists with potential inefficiencies.

Red Sea shipping crisis triples container rates.

4- Gemini Cooperation Emerges as MSC Rival, Ocean Alliance Shrinks via MDS

Gemini Cooperation forecasted to slightly surpass MSC's combined capacity.

Predicted dominance on transatlantic and Asia-Middle East routes with a potential 40% market share.

Ocean Alliance, now without Hapag-Lloyd, becomes the smallest major alliance despite significant capacity.

🚢 Cast Your Vote: Container Shipping Insights Poll! 🚢

Last Week’s Insight: Real-Time Visibility: 58% of our readers believe that real-time visibility in container tracking and monitoring is very critical for the efficient management of the supply chain.

5- Suez Canal Traffic Plummets: Top 10 Shipping Lines Witness 64% Capacity Drop via MDS

Fleet capacity (TEU) of Top 10 shipping lines through Suez Canal drops by 64% YoY.

HMM and ZIM experience the largest percentage reduction, rerouting all capacity via Cape of Good Hope.

Maersk, among others, maintains some capacity through Suez Canal despite heightened risks.