🔥The World's Top 10 Economies Revealed! Maritime Analytica Insight - 124!

🌎 The World’s Most Influential Container Shipping Platform — Trusted by 200,000+ Leaders Worldwide!

🎖️Subscribe /✨Sponsorship /📊Exclusive Report /🙏Rate us /🎁Send Gift

🔥Greetings, Maritime Mavericks!

Welcome to Maritime Analytica! 🌊🚀 Your gateway to the latest shipping intelligence. Stay ahead with expert insights, market trends, and breaking maritime news.

🌍Maersk Vs. CMA CGM Vs. Hapag-Lloyd AG in Q1-25

🔥Top U.S Trade Partners in MENA

📉 U.S. Shipping Exports Plunge 78% in April

📦 Top Economies by Import Intensity in 2024

🛑 Southeast Asia Feels the Tariff Squeeze

🌎 California Now Outranks Japan in GDP

🌐Global GDP Recovery since Covid’19

🛳️East Asia Commands Global Shipbuilding

🌊🚀Together, we can navigate a sea of knowledge and discovery. Share the wisdom, share the journey!

⭐️Today's Wisdom from the Waves:

"The cure for anything is salt water: sweat, tears, or the sea." – Isak Dinesen

🚢 Maritime Trivia: Shipping Quiz Time!

Previous Answer: All of the above

💡 Elevate Your Brand in Shipping World!

Looking to elevate your brand in maritime? Partner with us to reach 200,000+ industry decision-makers through high-impact sponsorships and strategic content across LinkedIn and our newsletter. 👉 info@maritimeanalytica.com

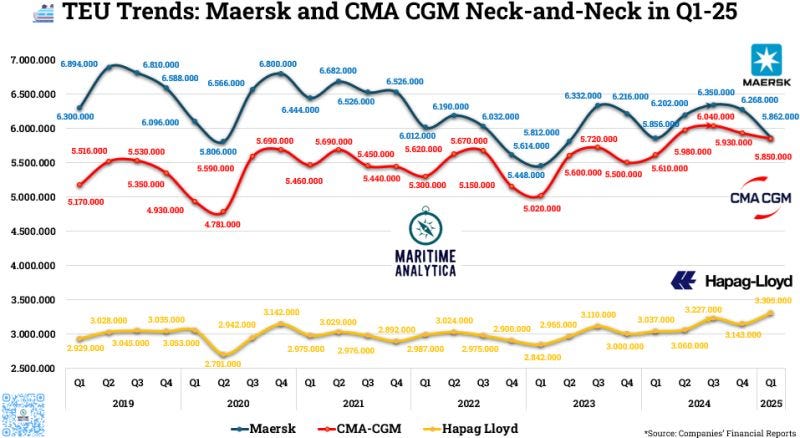

🌍Maersk Vs. CMA CGM Vs. Hapag-Lloyd AG in Q1-25🔥

A.P. Moller - Maersk leads with 5.86M TEU in Q1 2025, up from Q4 but still below 2023 peaks.

CMA CGM saw a moderate drop to 5.85M TEU, maintaining a close second.

Hapag-Lloyd AG hit a new high of 3.31M TEU, continuing steady volume growth since mid-2023.

For more insights, our June 2025 Exclusive Report is ready for you!

🔥Top U.S Trade Partners in MENA

$142B arms deal signed with Saudi Arabia

Qatar to buy $96B in Boeing aircraft

U.S. lifts sanctions on war-torn Syria

🏅Maritime Analytica Insight: “Trump’s pivot boosts U.S.–Gulf economic ties while sidelining traditional allies. Expect intensified MENA trade flows, aerospace growth, and strategic realignment—reshaping defense, aviation, and logistics sectors globally.”

📉 U.S. Shipping Exports Plunge 78% in April

April exports fell to 57K TEUs after new tariffs

China-bound exports dropped 77% in one month

Ports like L.A. and New Orleans hit hardest

Firms front-loaded March exports pre-tariff impact

🏅 Maritime Analytica: “The April nosedive reveals how reactive trade ecosystems are to policy shocks. Strategic forecasting, diversified routing, and nearshoring will be vital for U.S. exporters to stabilize flows amid recurring tariff volatility.”