🔥 Wondering Which Three Countries Dominate Shipbuilding Industry? Dive Into Maritime Analytica Insight - 80

🌎Unlock Exclusive Insights into Container Shipping—Trusted By 13,046 Industry Leaders from 147 Countries!

🌟Follow us: Substack / YouTube / LinkedIn / Instagram

🔥Greetings, Maritime Mavericks!

🌊Step aboard the Maritime Mastery Express and embark on your journey into the fascinating world of container shipping.

🔥Maersk Q3/2024 Results Revealed! 🔥

🛳️Autonomous Ships Approved

🌐 US East Coast Port Strike Ends

💦 Suez Canal Traffic Plummets

💹China’s Rise in Latin America

💶 The EU’s Major Trade Partners

🌎 Future Shipping Fuels: Uncertain Outlook

💹 China Leads Global Shipbuilding

🌟 Starry Voyages: Vincent van Gogh

🕰️ Timeless Bill of Lading: A Historic Gem

🌊🚀Together, we can navigate a sea of knowledge and discovery. Share the wisdom, share the journey!

🚀 Have you tried our FREE container tracking service yet?

🥇Our e-mail service include:

Container Journey Notification (from empty dispatch to return)

ETA Adjustments (Notifications on delays or early arrivals)

Unreleased Container Notification (to minimize demurrage fees)

🌟Stay ahead with real-time updates on your shipments—tracking has never been easier! Just send us your container number, and we’ll handle the rest.

👉 info@maritimeanalytica.com

🔮Help shape us! Take our 2-question survey in under 10 seconds! via Survey 🙏

⭐️Today's Wisdom from the Waves:

“One cannot discover new oceans unless they have the courage to lose sight of the shore.” - André Gide"

*Containership at Cinque Terra, Italy

🚢 Maritime Trivia: Container Shipping Quiz Time!

Previous Answer: Improving Fuel Efficiency

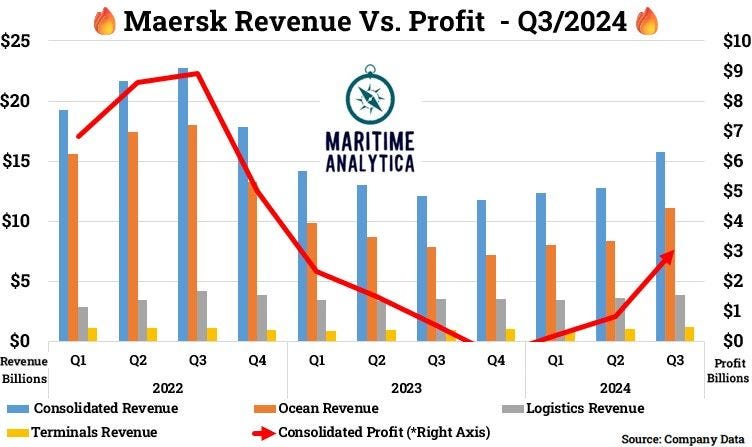

🔥Maersk Q3/2024 Results Revealed! 🔥

🌐 A.P. Moller - Maersk CEO Vincent Clerc: “We reaffirmed our commitment to profitable growth and operational progress, driving results across all business areas through continued rigorous focus on cost discipline, productivity gains, and efficient asset utilization.”

📈 Revenue Growth: Up 30% y-o-y to $15.8bn, driven by higher freight & volumes.

🚢 Ocean Profit Surge: EBIT margin hit 25.5% as freight rates rose by 54%.

📦 Logistics Strength: Revenue grew 11%, with EBIT margin reaching 5.1%.

🏗️ Terminal Gains: Record volumes in N. America boosted profit and revenue.

📊 Guidance Raised: FY 2024 EBITDA outlook now $11.0-11.5bn

🪙For more comprehensive insights, 🚀 Unlock Lifetime Access Today. For just $999, enjoy unlimited premium content forever—no renewal fees! Get exclusive container shipping insights at your fingertips!

🛳️BIMCO Approves AUTOSHIPMAN Agreement for Autonomous Ships

BIMCO has adopted the AUTOSHIPMAN agreement for autonomous and remotely controlled ships.

This standardizes services for third-party ship managers and is based on the SHIPMAN agreement.

It allows operational mode switches during voyages for legal compliance.

The autonomous shipping sector is expanding with new remote management services.

🌐US East Coast Port Strike Ends, Capacity Crunch Ahead

A 3-day strike at US E. Coast ports ended on October 4, causing vessel queues.

Capacity may drop by -17% for Asia to USEC and -14% for N. Europe to USEC.

Delays could extend impacts, with losses reaching to -40% for some routes.

Exporters should prepare for a temporary capacity crunch.

Limited mitigation expected from shipping lines as market rates decline.

💦Suez Canal Traffic Drops 70% as Ships Divert to Cape Route

Suez Canal volume down 70% y/y in Q3 2024, unchanged from the Q2.

Cape of Good Hope traffic surged over 50% as ships avoid the Red Sea.

Panama Canal volume stabilized at 88% of last year’s level in Q3 2024.