Greetings, Enthusiasts of the High Seas! 🚢🌊

Prepare to embark on an exciting voyage with the latest edition of Maritime Analytica's enthralling newsletter!

Brace yourself to immerse into a world of cutting-edge revelations in container shipping, seasoned with expert strategies, and the very latest currents that are molding the industry.

With anticipation, let's plunge straight in!

Today's Wisdom from the Waves; 🌊

"Navigating the sea is not just a journey; it's an endless connection to the soul of the world." - Isabella Allende

🚢 Navigating Knowledge: Container Shipping Quiz Time! 🚢

*Last Week’s Answer: Wind turbine power generation

1- Panama Canal Traffic Jam: Not a Crisis Yet

Rolf Habben Jansen, CEO of Hapag-Lloyd AG-Lloyd: "It has an effect because it means you can load less on the ships. The effect is not immaterial, but it’s also not huge."

Judah Levine, Head of Research at Freightos:"Container ship traffic — most of which moves via scheduled transits booked well ahead of time and given priority over other vessels — has seen some delays and added costs but has not faced significant disruptions. Reports of shippers choosing to divert orders to the West Coast or via the Suez have been minimal."

Oeyvind Lindeman, CEO of Navigator Gas: "Panama Canal issues are 'clearly a positive from a shipping capacity point of view.'"

Clarksons Securities AS: "Panamax spot rates averaged $13,600 per day on Wednesday, down 5% from the same time last year and down 60% from the same time in 2021."

2- Container Freight Rate Trends & Outlook

Lars Jensen, Vespucci Maritime CEO: "The stronger rate environment is driven by carriers’ desire to focus more on profitability than a fight over market share through cutting pricing... a fall in rates was unlikely."

Peter Sand, Xeneta chief analyst: "Carriers, for their part, can see as clearly as ever the impact of a fundamentally weak trade resulting in spot-rate warfare... those selling space at the current level are bleeding cash for every box they bring on board."

Alphaliner: "During the pandemic, missed sailings were the consequence of port congestion... blanked sailings had become common practice for a different reason. Limiting capacity should remove some pressure on spot freight rates."

Jefferies: "Spot rates remain elevated on the transpacific routes... Asia-Europe rates are holding on too much of their recent gains."

Linerlytica: "Transpacific freight rates have led the recent gains on the back of rising demand and capacity cutbacks, with Asia-Europe rates also managing to retain most of their recent gains despite more shaky market conditions."

3- Shipping CEOs' 2022 Compensation Revealed

Rolf Habben Jansen, Hapag-Lloyd: $3.155 million, up 2% from 2021, with 65% cash + 35% stock.

Søren Skou, AP Moller-Maersk: $6.162 million, down 7% from 2021, with 71% cash + 29% stock.

Eli Glickman, Zim: $6.005 million, down 39% from 2021, with 43% cash + 57% stock.

Gary Vogel, Eagle Bulk: $7.004 million, up 78% from 2021, with 73% stock + 27% cash.

Lois Zabrocky, International Seaways: $5.409 million, up 78% from 2021, with 45% cash + 65% stock.

John C. Wobensmith, Genco Shipping & Trading: $4.95 million, up 89% from 2021, with 36% cash + 64% stock.

Sam Norton, Overseas Shipholding Group: $2.732 million, up 2% from 2021, with 55% cash + 45% stock.

Jacob Meldgaard, Torm: $2.234 million, down 8% from 2021, stock & cash undisclosed.

4 - Russia's Arctic Crude Shipments to China

Russia's initial Arctic crude shipments from Baltic Sea delayed by thick ice.

Northern Sea Route, 40% shorter than Suez Canal, tested since 2010 with successful past voyages.

Recent shipments faced 10-day delays in icy East Siberian Sea, potentially erasing fuel cost savings.

Russia aims to increase cargo volumes via the route: 36 million mt in 2023 (32 million mt in 2022), 80 million mt in 2024.

Icebreakers and technical challenges still make this a secondary export route compared to traditional methods.

5- G7 Yield Ground as BRICS Surge & Impact on Shipping

BRICS nations (Brazil, Russia, India, China, South Africa) reshape global dynamics, affecting trade & shipping.

Sanctions from Russia's Ukraine actions disrupt trade routes, impacting carriers' choices.

Developing countries hesitate to oppose Russia, leading to a complex geopolitical scene.

China and Russia aim to strengthen BRICS, challenging Western dominance in international bodies.

Proxy battles in shipping, especially at the International Maritime Organization, may rise with BRICS's influence.

6- Containership Industry Trends

Bigger Ship Boom: Deliveries of 12,000+ TEU containerships set to grow by 17% in 2023 and 16% in 2024.

Cascading Shifts: Larger vessels moving to trade lanes using smaller units due to shifting freight rates and container trade patterns.

Rising Demolition: Demolition of 45 containerships (88k TEU) in 2023 surpasses 2021/2022 levels, projected to hit 188k TEU for the year.

Orderbook Records: Containership orderbook hits 923 units (7.7m TEU), 28% of fleet; focus on larger ships, especially 12-16.999 TEU category.

2024 Forecast: Anticipated 691k TEU containership demolition in 2024 due to market dynamics, aging fleet, and environmental rules.

7- Container Shipping Markets - Current Status

8- Hapag-Lloyd Among Bidders for HMM

Hapag-Lloyd competes among bidders for South Korea's HMM, largest liner company.

LX Group, Harim Holdings, and Dongwon Holdings Group also submit bids for HMM's shares.

Shares owned by state entities KDB and Korea Ocean Business Corp valued at $3.9 billion (KRW 5 trillion).

Surprisingly, SM Group refrains from bidding despite initial interest.

KDB to assess bidder eligibility, conduct due diligence for two months, aiming to close sale by year-end; industry wary of HMM's potential foreign acquisition.

9- WindWings: Sailing into the Future of Shipping

Wind propulsion grows in shipping, though fleet adoption remains limited.

Wind power aligns with greenhouse gas reduction goals & Paris Agreement.

Regulatory support and revamped structures needed for faster adoption.

Combined wind propulsion, speed reduction, zero-emission fuels can cut emissions 28-47% by 2030.

WindWings sails by BAR Technologies, with Cargill, MC Shipping Inc., and Yara Marine Technologies, save 1.5 tons of fuel daily, cut 4.65 tones CO2: signal sustainability commitment, ongoing monitoring for broader use.

10- Russia's Black Sea Trade Thrives Against Sanction

Despite sanctions, Russia's sea trade is thriving, with cargo increasing by 9.3% to 526.8 million tonnes from January to July.

The growth is driven by the Black Sea, including parts of Ukraine under Russian control, and the Azov/Black Sea area boosting Russia's ports.

Dry goods handling in the region is up 30% YoY to 83.4 million tonnes, including grain, minerals, fertilizers, coal, and coke.

Liquid cargo also rises by 9.9% to 91.5 million tonnes, showing Russia's trade strength despite sanctions.

Despite tensions, Russia explores exporting grain with Turkey and Qatar, maintaining trade despite disagreements.

*Photo: Treacherous waters: a ship is seen near the Kerch bridge, which links Russia to Russian-occupied Crimea. Taken by Federal Agency for Marine and River Transport (Rosmorrechflot)

Message from the Founder

Hello Maritime Enthusiasts,

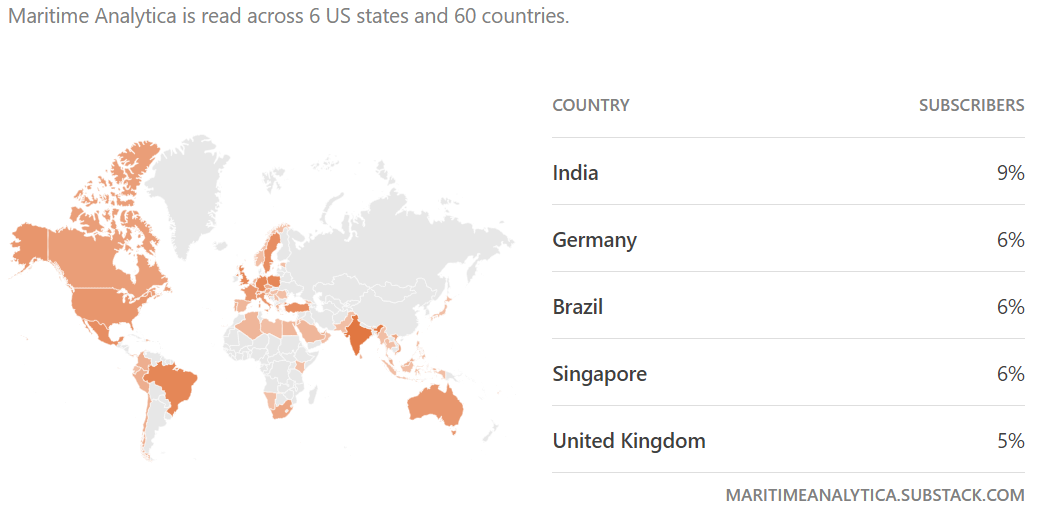

I trust you're enjoying the maritime insights we deliver through our weekly newsletter. It's truly remarkable that, with your support, we've connected with maritime enthusiasts in 60 countries within just 6 weeks. This rapid growth has exceeded my expectations, and I'm sincerely thankful.

If you've found value in our newsletter, could you consider sharing it with friends, peers, or colleagues who might also benefit? Your endorsement is invaluable and can further expand our maritime community.

Furthermore, your feedback is crucial in shaping our content. Our goal is to tailor the newsletter to your preferences. Please spare a moment to share your thoughts and suggestions by replying to this email or using the link below. I eagerly await your input.

Thank you for joining us on Maritime Analytica's journey. Together, let's continue our voyage towards knowledge and excellence!

Warm regards,

SAM,

Founder, Maritime Analytica