Hello, Maritime Mavericks! 🚢🌊

Embark on an exhilarating journey with the Maritime Analytica newsletter!

Get ready to submerge yourself in a sea of groundbreaking insights on container shipping, sprinkled with expert tactics and the most up-to-date industry buzz.

Let's plunge into it with enthusiasm! 🌊🔍

Today's Wisdom from the Waves; 🌊

"To reach a port, we must sail—Sail, not tie at anchor—Sail, not drift." - Franklin D. Roosevelt

🚢 Navigating Knowledge: Container Shipping Quiz Time! 🚢

*Last Week’s Answer: Cold Ironing

1- Container Carriers' Operating Margins Dip to 8.9%

Average operating margins for top container carriers fell to 8.9% in Q2.

ZIM had the weakest margin at -11.2%, while COSCO excelled with 27.0%.

COSCO's success came from a 37% YoY cost reduction program.

Overall, container shipping margins varied, with Hapag-Lloyd at 18.3%, the second highest.

Margins dropped due to lower earnings per TEU and the end of annual contracts, causing rates to fall by 15-25%.

2- Panama Canal Assures Shipping Industry Amid Water Level Concerns

Panama Canal Authority (ACP) assures ongoing operations despite falling water levels.

Transit restrictions cause vessel wait times, some waiting up to 10 days.

Panama Canal remains vital for 57.5% of cargo from Asia to the US East Coast.

ACP predicts minimal impact on final goods prices, but spot rates from Shanghai to the US East Coast rose from $2,370/feu in June to $3,100/feu in mid-August.

While container carriers manage, other sectors face delays and cost increases due to canal backlogs. Maersk Americas' Lars Ostergaard Nielsen sees it as a minor concern for now.

3- Container Volumes Rebound in Q2, Carriers Improve Performance

Container volumes hit Q1 lows but saw a Q2 increase across all carriers.

ZIM, HMM, and CMA CGM reported double-digit gains in Q2.

Total Q2 operating profits (EBIT) for nine carriers reached $4.4 billion.

This marked a 36% decrease from the previous quarter's $6.9 billion and a significant drop from the $37.7 billion reported a year earlier.

4 - Innovative Hybrid Ship "Canopée" to Transform Space Program Logistics

Hybrid Breakthrough: Canopée, a pioneering hybrid ship with collapsible wing sails, readies for commercial service with the European Space Agency.

Successful Trials: After sea trials, Canopée is set to perform regular transatlantic crossings, revolutionizing cargo transport.

Six-Year Endeavor: Developed over six years, Canopée was designed to navigate challenging waters while delivering components for the Ariane program.

Fuel Efficiency: With wind power accounting for 15-40% of its operations, Canopée targets a significant 30% reduction in fuel consumption.

5- Carrier Diversification Strategies in Question

Expanding Horizons: Leading container lines, including COSCO SHIPPING Lines, A.P. Moller - Maersk, CMA CGM, Hapag-Lloyd AG-, and Ocean Network Express, diversify into logistics services beyond traditional port-to-port shipping.

Mixed Outcomes: While CMA CGM maintains stable logistics revenues, A.P. Moller - Maersk faces challenges affecting market share and profitability.

Integration Complexities: Integrating logistics services aims to avoid container shipping commoditization, but achieving desired results proves intricate.

Financial Realities: Profit-driven acquisitions amid low interest rates raise concerns about misallocated capital and long-term benefits.

Future Trajectory: Experts predict a potential shift, refocusing on core strengths, like terminal ownership and strategic investments.6- CMA CGM's $1 Billion Methanol-Powered Ships Lead the Green Wave

CMA CGM is finalizing a deal for eight 9,200-TEU methanol dual-fuel container ships to arrive by 2027, worth over $1 billion.

This marks CMA CGM's fourth methanol dual-fuel project, totaling $5.5 billion for 28 new container ships this year.

The company selected methanol over LNG for these vessels.

Shipbuilding sources confirm a rising trend in the maritime industry towards methanol fueling.

Worldwide, there are 204 methanol-fueled vessels, primarily container ships, with 177 on order and 27 existing.

7- Hapag-Lloyd Excluded from Second Round of HMM Bidding Process:

- Hapag-Lloyd, the only foreign bidder for South Korea's HMM, has been excluded from the second round of the privatization process.

- State creditors Korea Development Bank (KDB) and Korea Ocean Business Co (KOBC) made the decision amid concerns about selling HMM to a non-Korean entity.

- Other bidders, including Harim Group, LX Holdings, and Dongwon Group, remain in the second round.

- Due diligence will continue, with a preferred bidder expected to be announced by early November.

8 - Container Shipping Faces Overcapacity Concerns

Supply Glut Warnings: Concerns arise over potential overcapacity in container shipping due to a growing orderbook.

Tonnage Influx: Over 1 million TEU from 159 new vessels added, resulting in a 4.6% annual increase in global fleet capacity since Q2 2022.

Market Impact: Different trade corridors affected differently by the influx of new vessels.

China-Centric Growth: 82% of new vessels allocated to routes connecting China and emerging manufacturing countries in the Far East.

Managing Overcapacity: Carriers respond with strategies like slow steaming, additional services, and increased scrapping to control deployed capacity.

9- Gabon Coup Disrupts Shipping as Ports Remain Closed

Gabon Ports Closed: Coup and border closures led by senior military officials halt port operations.

Stranded Vessels: Hapag-Lloyd's Dallas Express among ships stranded, awaiting updates.

CMA CGM Diversion: Border closures prompt vessel Spirit of Hong Kong to divert to Cameroon's Kribi port.

Maritime Flag Operations: Gabon's maritime flag operations continue, but the status of its administration is unclear.

"Dark Fleet" Operations: Gabon's commercial ship registry experiences increased registrations due to "dark fleet" activities, mainly involving older tankers lifting Russian oil.

10- Container Ship Charter Rates Decline Across Sizes

Container ship charter rates are falling across all sizes, especially for vessels under 3,000 TEU.

Tonnage providers are moving ships to the Atlantic for longer charters.

Liner operators are holding off on chartering, possibly due to weak Q2 results.

Regional feeder vessels have seen steep rate drops, down almost 25% since June.

Recent fixtures include charter extensions with varying rates and durations.

Message from the Founder

Hello, Maritime Enthusiasts,

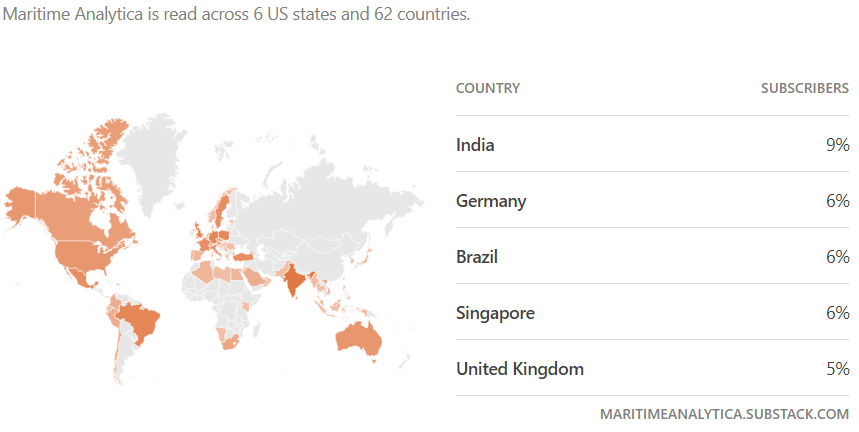

I hope you're enjoying the maritime insights we provide through our weekly newsletter. It's amazing that, with your support, we've reached maritime enthusiasts in 62 countries in just 7 weeks. This rapid growth has exceeded my expectations, and I am sincerely grateful.

If you've found value in our newsletter, could you consider sharing it with friends, peers, or colleagues who might also find it beneficial? Your endorsement is invaluable and can help expand our maritime community.

Additionally, your feedback is essential in shaping our content. Our goal is to customize the newsletter to your preferences. Please take a moment to share your thoughts and suggestions by replying to this email or using the link below. I eagerly await your input.

Thank you for joining us on Maritime Analytica's journey. Together, let's continue our voyage toward knowledge and excellence!

Warm regards,

SAM, Founder, Maritime Analytica