Ahoy, Nautical Adventurers! ⚓🌊

Prepare to set sail on an exhilarating voyage through the maritime universe. Your unwavering passion for the sea is our guiding star, propelling us to uncover fresh horizons and deliver the most thrilling updates tailored just for you.

As we embark on this journey together, we'll dive deep into the boundless ocean of maritime wisdom, exploring every wave, uncovering hidden treasures, and sharing the maritime wonders that await us! 🚢🔍✨

Today's Wisdom from the Waves; 🌊

"Those who live by the sea can hardly form a single thought of which the sea would not be part." - Hermann Broch

🚢 Navigating Knowledge: Container Shipping Quiz Time! 🚢

*Last Week’s Answer: RFID (Radio-Frequency Identification)

1- Who has the world’s largest fleet from 1980 to 2023?

🚢 Cast Your Vote: Container Shipping Insights Poll! 🚢

*Last Week’s Insight: 82% of our followers believe that “Fuel Prices” has the greatest impact on container shipping costs.

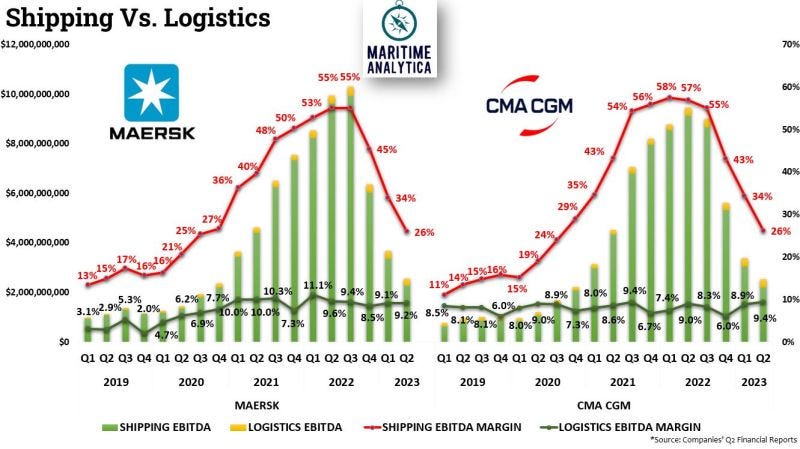

2- Maersk Vs CMA-CGM - Shipping & Logistics Performances - Q2/2023

Both shows similar tendency in terms of profit margins of shipping and logistics.

Despite of their enormous investments & acquisitions on logistics, their profits from logistics are still low comparing to shipping (yellow vs green)

Logistics EBITDA margins shows stability throughout the years.

3- Shipping Rates Decline: Drewry Composite Index Falls

Composite index drops by 1.1% to $1,389.5 this week.

Compared to the same week last year, it's down by a significant 62.3%.

Current index sits 2% below pre-pandemic rates of 2019.

Year-to-date average at $1,738/40’, $940 lower than the 10-year average.

East-West spot rates expected to remain stable in the coming week.

4 - Record Low Ship Speeds in 2023 for Containerships

Containerships have experienced a year of disappointing earnings.

Container ship speeds reached a record low in 2023, down 3% from 2022, hitting a low of 13.7 knots in February.

Bulk carrier speeds also dropped by 2% during the year, reaching a new low of 10.9 knots in July and August.

These slowdowns are influenced by factors like reduced congestion and compliance with new green regulations.

5 - MSC's Dominance in Carrier Rankings Expands

MSC's fleet surges to 5.36 million teu, up from 4.61 million TEU in January.

Newbuild deliveries contribute significant boost of 557,000 TEU to their fleet.

The gap between MSC and Maersk widens to a staggering 1.24 million TEU.

MSC consistently grows at an impressive monthly rate of 83,000 TEU, solidifying their leading position in the carrier industry.

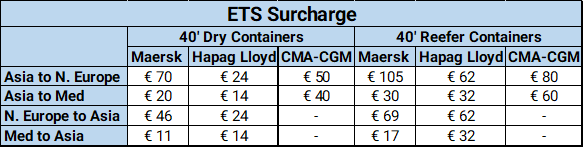

6 - ETS Implementation Nears: Key Misalignments Revealed

- Carbon taxation (ETS) in the EU set to begin in 3 months.

- Uncertainty surrounds the exact cost of ETS.

- Maersk, Hapag-Lloyd and CMA-CGM hint at preliminary surcharge data.

- Methodological issues in calculating ETS cost per container.

- Legal restrictions prevent carriers from agreeing on surcharge formula, leading to misalignment.

7 - Tackling Empty Container Repositioning Costs in Shipping

The shipping industry grapples with costly empty container repositioning, especially on major trade routes.

Asia's consistent need for empty containers has contributed to this challenge since 2010.

The pandemic-induced boom in 2021 exacerbated the issue, with around 40 million containers repositioned.

Drewry estimates "empty miles" cost the industry at least $16 billion annually.

Diversifying global manufacturing can help reduce this problem, cut costs, and boost efficiency.

8 - Alternative Fuel Ship Orders Surge in Maritime Industry

August: Added 21 LNG-fueled ships.

September: 8 more LNG-fueled ship orders.

Methanol orders rebounded in September with 12 new orders.

Strong demand and interest in LNG, methanol fuels.

Growing focus on ammonia as an emerging alternative fuel.

9 - Ocean Freight Rates Sink Despite Capacity Cuts

Ocean shipping rates are decreasing across major routes, including Asia-N. Europe and Asia-Mediterranean, reaching their lowest levels since 2019.

Transpacific rates to the East Coast have hit their lowest point since 2018 at $2,249/FEU, while West Coast rates remain above 2019 levels.

Despite significant blanked sailing campaigns and slow sailing speeds, ocean rates continue to fall.

The industry faces challenges with declining ocean rates, while a cautious approach is taken regarding peak season prospects.

10- Aging European Feeder Fleet Faces Renewal Crisis

Aging Fleet: European feeder vessels aging fast.

Limited Renewal: Few new vessels ordered, especially under 1,000 TEU.

Asian-Built Shift: Larger Asian vessels replacing European feeders.

Possible Consolidation: Transition may require route consolidation.

Eco-Friendly Trends: New vessels larger & ecofriendly with alternative fuels.