Greetings, Maritime Enthusiasts! 🚢

Welcome aboard the journey of Maritime Analytica's weekly odyssey, where we plunge deep into the world of container shipping, ensuring you're well-informed with the latest industry news and updates! 🌊

It's time to immerse yourself in the captivating realm of maritime insights! 🔍

Today's Wisdom from the Waves; 🌊

"Man cannot discover new oceans unless he has the courage to lose sight of the shore." - André Gide

🚢 Navigating Knowledge: Container Shipping Quiz Time! 🚢

*Last Week’s Answer: Automated Stacking Cranes (ASCs)

1- Exploring a World of Diverse Ship Types

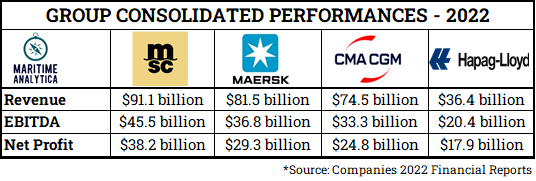

2- MSC’s Golden Age Revealed

3- Container Demand Snapshot - Xeneta/CTS - Aug 2023

Far East outbound exports hit record high.

Strong uptick in Far East to US and Inbound North America.

Far East to Europe pips month-on-month, but YTD shows growth.

European imports split: down 4.0% in North Europe, up 17.4% in East-Med.

Global demand falls 3.3% YOY; Reefer demand rises 1.6%, Dry down 3.7%.

🚢 Cast Your Vote: Container Shipping Insights Poll! 🚢

Last Week's Insight: 44% of our followers think that Cost Fluctuations are the most pressing challenge they face in container shipping today.

4- Goldman Sees Stormy Seas Ahead for Shipping Industry

Shipping downturn to be lengthier and more severe than expected.

Freight rates and earnings to continue to decline.

New vessel orders complicate capacity management.

Global economic shakeup looms.

The analyst downgraded A.P. Moller-Maersk to a sell rating, expecting "2023-27 EBITDA estimates fall by 8% on average, reflecting lower freight rates."

5- MOL to Enhance Seafarer Wellbeing with Starlink Service on Over 200 Vessels

Japanese MOL to equip 233 ocean-going vessels with Starlink.

Aiming to have 140 vessels with the system by the end of fiscal year 2023.

Starlink offers high-speed, low-latency connectivity via low-orbit satellites.

Trials showed up to a 50-fold increase in communication speed for seafarers.

MOL emphasizes improving crew wellbeing due to a seafarer shortage.

6- LNG Dominates, Methanol Surges

LNG is the most prevalent alternative fuel, primarily favored by CMA-CGM and MSC, representing 75% of the total fleet.

Methanol-powered containerships are gaining ground, propelled to second place by recent newbuild orders.

CMA-CGM, Evergreen, and Maersk are leading in the adoption of methanol-powered vessels, collectively holding a 77% share in this category.

7- Global Container Trade in August 2023 by Drewry/CTS

Overall, global seaborne container trade fell by 3.5% compared to 2022.

More than half of 49 trade routes improved since June, when 30 trades down.

Middle East/Indian exports decreased by 11.7% across all routes.

Far East exports saw a 5.5% reduction on intercontinental routes.

Imports were down across all ME/ISC routes with a -13.6% overall change, while sub-Saharan imports experienced a more significant 15.7% drop.

8- Containership Capacity Soars with 7.7% Growth in 2023

Containership fleet capacity set to grow by 7.7% in 2023.

Record-breaking newbuilding deliveries of 2.1 million TEUs expected.

2023 on track to surpass the 2016 record of 1.7 million TEUs.

Projected 6.7% fleet capacity growth in 2024, alongside demolition uptick.

Anticipated 2.6 million TEUs to be delivered in 2024.

9- The impact of CBER expiry on shipping overplayed

CBER (EU Consortia Block Exemption Regulation) expiry on April 25, 2024, has been exaggerated in the liner shipping market.

Out of 43 consortia in the EU in 2020, only 13 meet the requirements for the block exemption.