Greetings, Maritime Enthusiasts! 🌊

Join us on a weekly maritime adventure as we chart the waters of container shipping, delivering the latest industry news and insights. Dive into the world of maritime knowledge with us! ⚓🔭

Remember, great content becomes even greater when shared. If you find our newsletter valuable, consider being the lighthouse in your network – guiding your friends and colleagues to the treasure trove of insights we offer. Sharing is caring, and it's the wind in our sails.

Together, we can navigate a sea of knowledge and discovery. Share the wisdom, share the journey! 🌊🚀

Today's Wisdom from the Waves; 🌊

"The ocean stirs the heart, inspires the imagination, and brings eternal joy to the soul." - Robert Wyland 🌅⚓"

🚢 Navigating Knowledge: Container Shipping Quiz Time! 🚢

*Last Week’s Answer: X-Ray Scanning

1- 5 Take Aways from Industry Expert Lars Jensen on Q4

Spot rates are currently below pre-pandemic levels in Asia, Europe, and the Atlantic.

The global container trade index is still higher than pre-pandemic, but it doesn't match carrier profitability.

Costs for carriers were 29% higher in Q2 compared to pre-pandemic levels.

Carriers have been cutting costs for three quarters, but Q4 is expected to see costs rise significantly more than rates.

Multiple carriers may operate at a loss in Q4 due to this cost-rate imbalance.

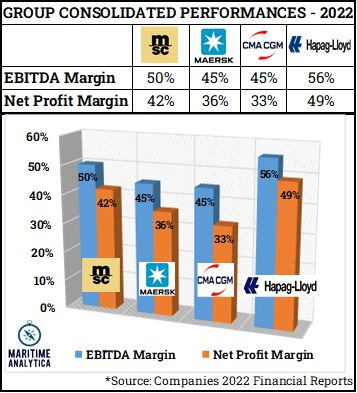

2- 🚢 Top Ocean Carriers' Profit Margins🚀 in 2022

3- Containership Fleet: Record Average Age of 14.2 Years

Average containership age reaches 14.2 years, the oldest among major shipping sectors.

Over 20% of the fleet is 20 years or older, signaling a need for retirement.

Scrapping is expected to rise in 2024, balancing the fleet's age.

Most retired ships are smaller feeder and sub-Panamax vessels.

The industry sees a surge in large Ultra Large Container Ships (ULCS) for efficiency and sustainability.

4- EU Incorporates Shipping in Emissions Trading System

The EU has officially included shipping in the EU ETS to tackle carbon emissions.

A phased approach over three years will be implemented, with full coverage by 2027.

Non-compliance could result in fines and potential port call refusal.

Revenue will support maritime decarbonization via an Innovation Fund.

The EU will auction emission allowances, affecting shipowners and operating costs.

Maersk Broker Advisory Services predicts substantial cost increases, with potential carbon taxation exceeding $1.3 million for specific routes.

🚢 Cast Your Vote: Container Shipping Insights Poll! 🚢

Last Week's Insight: 80% of our followers believe that EU Emissions Trading System (ETS) surcharge will “increase shipping costs” in 2024.

5- Week 43 - CCFI - WCI - VLSFO Price

6 - CMA CGM's Guide to the EU Emissions Trading System for Shipping

EU Emissions Trading System (EU ETS): EU's plan to combat global warming includes reaching carbon neutrality by 2050, with a -55% emissions target by 2030.

EU ETS Basics: Established in 2005, it's the world's largest cap-and-trade emissions system, with a decreasing cap on greenhouse gases.

Shipping's Role: EU ETS extended to shipping from Jan 1, 2024, for emissions reduction and low-carbon fuel adoption.

Impact on Customers: Shipping lines to report and purchase emissions allowances progressively. CMA CGM will introduce surcharges based on carbon allowance market values.

7- Container Shipping Lines - Stock Performances

8- Drewry East-West Contract Rates Continue 13-Month Decline, Favoring Shippers

The Drewry East-West contract index, reflecting shipping rates, decreased by 2% in October, marking a year-long trend.

Average contract rates on East-West routes are now 73% lower than a year ago and only 11% above pre-pandemic levels in December 2019.

The container shipping sector remains a "buyer's market," offering cost-saving opportunities for shippers.

9- ONE Still Profitable Despite Challenging Market

ONE reported net income of $187 million for July-September, down 97% from the previous year but better than pre-pandemic performance.

Despite the tepid peak season and falling rates, ONE's results outperform the pre-pandemic period.

The company forecasts net income of $851 million for the upcoming fiscal year, showing resilience in the face of industry challenges.

10- Matson Continues to Shine Amid Challenging Container Shipping Market

Matson, a niche container shipping operator, reported net income of $119.9 million for Q3 2023, up 48% sequentially and significantly better than pre-COVID results.

The company's expedited China-U.S. service offers a strong value proposition to air freight customers.

Matson's ability to outperform competitors demonstrates resilience in a challenging market.