Greetings, Maritime Enthusiasts! 🚢

Welcome aboard the journey of Maritime Analytica's weekly odyssey, where we plunge deep into the world of container shipping, ensuring you're well-informed with the latest industry news and updates! 🌊

Do you have extraordinary maritime stories to share? Whether you've overcome challenges or celebrated triumphs, your narratives enrich our journey. Share your story with us! 📩 We'll showcase it in our newsletter, inspiring the entire Maritime Analytica Community.

It's time to immerse yourself in the captivating realm of maritime insights! 🔍

Today's Wisdom from the Waves; 🌊

“🚢 Ships are the nearest things to dreams that hands have ever made.” - Robert N. Rose

🚢 Navigating Knowledge: Container Shipping Quiz Time! 🚢

*Last Week’s Answer: Russia and Canada

1- Global Freight Recession to Continue in 2024: CNBC Supply Chain Survey

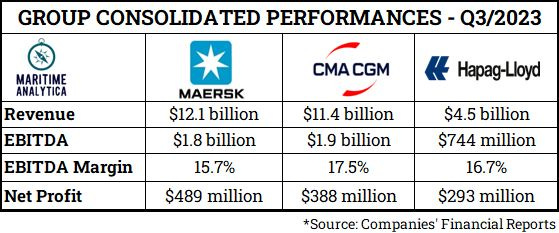

2- A.P. Moller - Maersk vs CMA CGM vs Hapag-Lloyd AG - Group Performances - Q3/2023

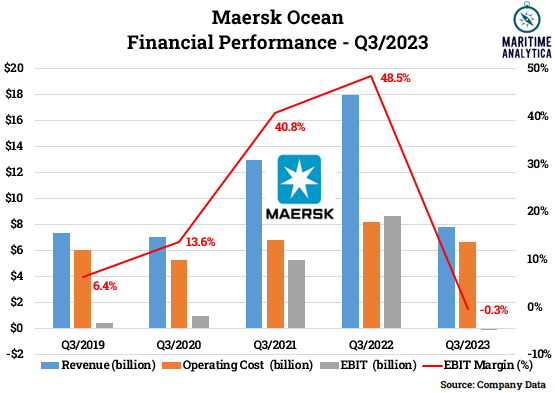

3- Maersk Ocean Financial Performance - Q3/2023

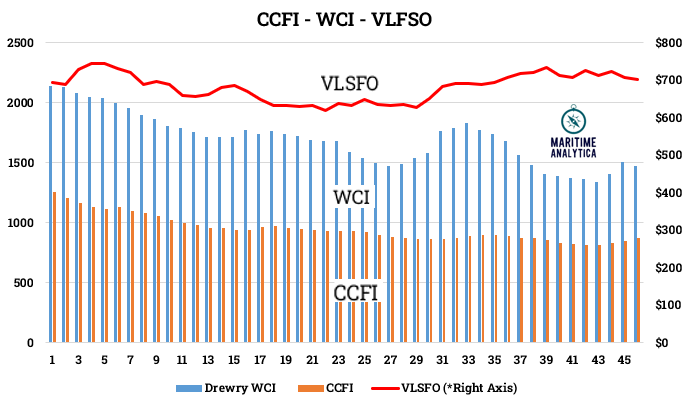

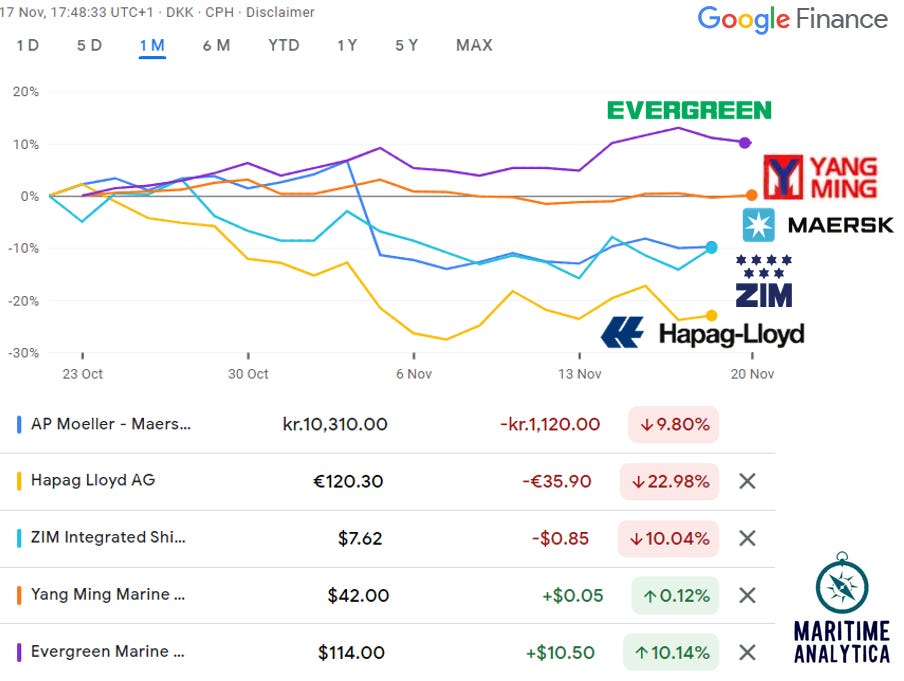

4- Shipping Industry Faces Struggles in Choppy Waters:

The shipping industry is in turmoil, with average margins down by nearly 75% in the past year.

Overcapacity and softer demand paint a bleak picture for 2024, with a predicted 93% decline in operating profit.

The industry's market cap has fallen by $135 billion in the last 18 months, leaving just three companies with a market cap over $10 billion.

Shipping rates have plummeted, making it difficult for companies to implement rate increases and leading to a challenging outlook.

5- Data Contradicts Nearshoring Surge: Supply Chains Not Getting Shorter via Sea-Intelligence

Container sailing distances into North America increased post-pandemic.

Europe saw a gradual rise in sailing distances, debunking nearshoring expectations.

Container volume data shows declines in intra-Europe and nearly 50% less intra-North America volumes.

Overall, data doesn't support a widespread move to shorter supply chains via nearshoring.

🚢 Cast Your Vote: Container Shipping Insights Poll! 🚢

Last Week's Insight: 42% of our followers believe that new technologies such as AI, ML and IoT have the biggest opportunities for container shipping companies in the next 5-10 years.

6- Ship Demolitions Lag: Only 66 Units Scrapped in 2023 Despite Market Pressure by Clarksons

Only 66 units with a total capacity of 125,000 TEU have been sold for demolition in 2023, well below the 2009-2019 annual average of 299,000 TEU.

Issues obtaining letters of credit and some ships remaining under 2021/2022 charters have contributed to this lower demolition rate.

Charter rates and asset prices in 2023 have remained relatively high despite growing market pressure.

7- Maersk's Rate Cutting Strategy Backfires with -$27M Q3/2023 EBIT Loss via Linerlytica

Maersk reported a -$27 million EBIT loss in 3Q 2023.

Maersk added new capacity and cut rates to regain market share.

This rate-cutting strategy contributed to a dramatic drop in market rates in the 3rd quarter. Despite having 68% of its volumes on fixed contracts, Maersk's average freight rates fell by 14% QoQ.

Company anticipates a worsened EBIT loss in the Q4 and plans to address the situation through headcount cuts and capex reductions while maintaining their logistics integrator strategy.

Maersk's Logistics business faced challenges with low returns on invested capital and declining organic revenue for the past four quarters.

8- Global Container Trade Declines, Regional Markets Show Resilience by Clarksons

Global seaborne container trade down by -1.7% YoY (Jan/Sep-23).

Regional improvements: Far East to Indian Subcontinent/Middle East (+17.4% YoY), Latin America (+13.8% YoY), Africa (+20.3% YoY).

Mainlane container trades face macroeconomic 'headwinds.'

Transatlantic volumes down -9.3% YoY (Jan/Sep-23).

Transpacific peak-leg volumes decline by -10.7% YoY (Jan/Sep-23).