Hello, Maritime Mavericks! 🚢🌊

Embark on an exhilarating journey with the Maritime Analytica newsletter!

Get ready to submerge yourself in a sea of groundbreaking insights on container shipping, sprinkled with expert tactics and the most up-to-date industry buzz.

Let's plunge into it with enthusiasm! 🌊🔍

Today's Wisdom from the Waves; 🌊

"Twenty years from now, you will be more disappointed by the things that you didn't do than by the ones you did do. So, throw off the bowlines. Sail away from the safe harbor. Catch the trade winds in your sails. Explore. Dream. Discover." - Mark Twain

Navigating Knowledge: Container Shipping Quiz Time! 🚢

*Last Week’s Answer: Carbon Fiber

1- Containerization: The Most Influential Invention That You've Never Heard Of

2- MSC's Bold Move: Container Shipping's Destiny in Flux

MSC could reshape container shipping by leading a scrapping spree, influencing industry trends.

Despite a market downturn, MSC is aggressively buying ships, solidifying its position with 34 acquisitions worth $929.5 million this year.

With deep pockets and extensive reserves, MSC's strategy may not align with other carriers, potentially reshaping the market landscape.

Analyst Daniel Nash notes MSC's financial strength allows them to endure market challenges and make strategic moves in ship buying and selling.

Speculation arises that if MSC decides to scrap a significant part of its fleet, it could signify a market cycle bottom, impacting the container shipping.

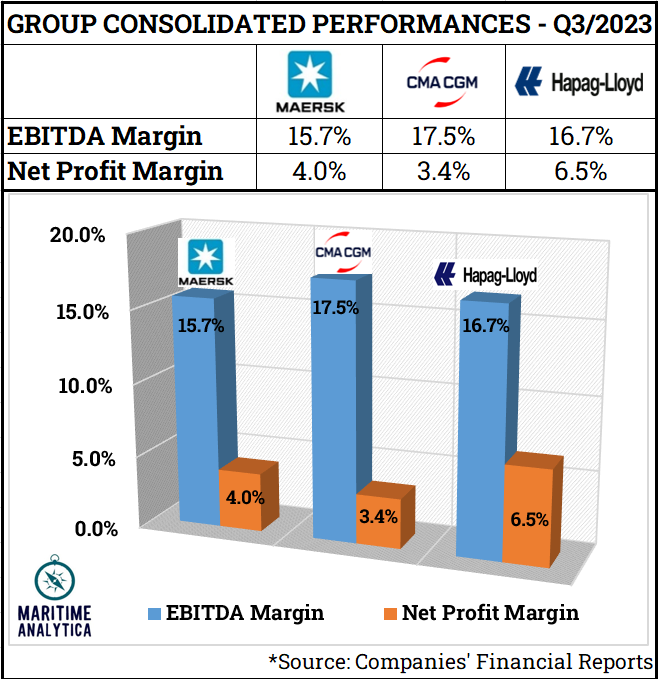

3- A.P. Moller - Maersk vs CMA CGM vs Hapag-Lloyd AG - Group Performances - Q3/2023

4- Hapag LLoyd CEO R H. Jansen: We May Hit The Bottom

“The volume is not the real problem. The problem is that rates are too low.”

“Rates are hovering around the 2019 level, which is a real problem because costs are definitely higher, which means rates are unsustainable.”

“Supply growth will outstrip demand growth, but I don’t think the market is as unbalanced as is being said.”

“Some capacity will be absorbed by inserting additional capacity to deal with CII and there will be more scrapping. Hapag-Lloyd itself would likely recycle 25 to 40 ships.”

“Slow steaming would also take up some of the excess capacity.”

“I don’t have a crystal ball, but the facts are that we are running well below costs on a number of trades.”

“I’m happy with the way we have done it, which has been to structurally take these services out of the market.”

“Pricing is a matter of perception. When I look at the short-term rates that we book and charge in recent weeks, I do see some recovery.”

5- Overcapacity Struggle: 2028 Earliest for Market Balance by Sea-Intelligence

Current downcycle signals excess capacity in 2023 and likely 2024.

Optimistic scenario eyes 2028 balance with controlled growth assumptions.

Over-supply persists until 2028, worst in 2024, one-third absorbed by 2026.

2019-level balance by 2028 implies an 8-year span, akin to the post-financial crisis cycle.

Uncertainties may push balance to 2030 or beyond.

6- Scrubbers Save $12B in Shipping, Spark Environmental Concerns

Sea-Intelligence analysis reveals $12 billion savings in container shipping due to scrubbers, focusing on the period since the 2020 global sulfur cap.

Scrubber discharge into the ocean raises environmental concerns, with studies indicating significant contaminants in water samples.

Open-loop scrubbers, predominant globally, face calls for stricter regulations on discharge water.

Despite environmental debates, over 5,400 ships (5% of global fleet) now use scrubbers.

NASA study suggests the 2020 sulfur cap has improved atmospheric conditions despite concerns.

7- Container Shipping Crisis Looms in 2024 via Linerlytica

Critical Capacities: Post-Golden Week, container capacities surge to unsustainable levels.

Carrier Dilemma: Carriers face tough choices – implement disruptive blank sailings or navigate high-capacity risks.

Grim 2024 Outlook: Predictions include reduced demand, oversupply, and potential industry losses of $15bn.

Financial Warning: Drewry forecasts a 93% profit decline for 2023, dropping to $20bn.

Container Crunch: Despite a growing fleet, the industry struggles with low scrapping and idling amid declining rates.

🚢 Cast Your Vote: Container Shipping Insights Poll! 🚢

Last Week's Insight: 53% of our followers believe that integrated logistics services are extremely important for container shipping companies.

8- Hapag-Lloyd Leads as Evergreen Joins in Revealing ETS Surcharge Estimates

Evergreen discloses ETS surcharge estimates, contributing to the industry's emerging picture.

Diverse rates across carriers highlighted in the table, with Maersk using per feu and others opting for TEU.

Ocean Score calculates potential €6.5bn cost for 126m tones of CO2 emissions based on current EU Allowance prices.

Hapag-Lloyd stands out with notably cheaper surcharge estimates, using industry-proven Clean Cargo Emission Calculation Methodology.

ONE releases second-lowest ETS surcharge estimates, emphasizing flexibility with quarterly adjustments based on market fluctuations and emissions changes.

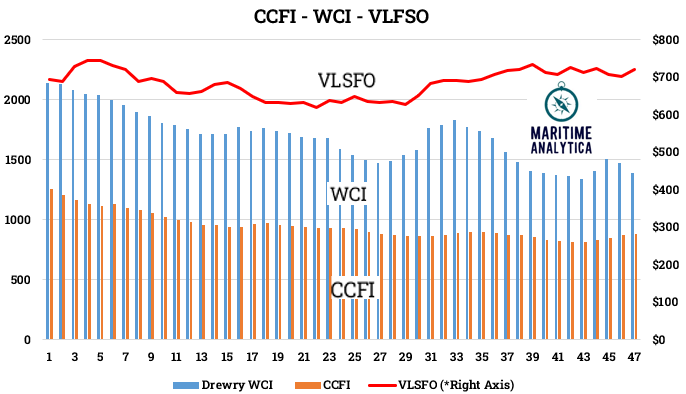

9- Week 47 - CCFI - WCI - VLSFO

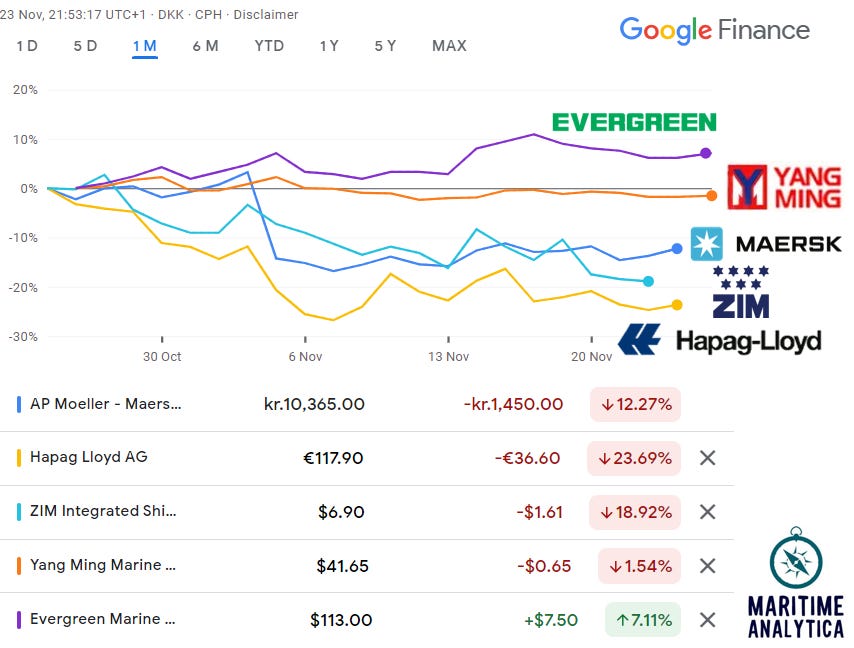

10- Container Shipping Lines - Stock Performances

We read your emails, comments, and poll replies daily. Hit reply and let us know what you want more of! - Email: maritime-analytica@outlook.com

Have you missed any past newsletter? Check them out here:

For more daily news, follow up via Linkedin here: