Ahoy, Nautical Navigators! ⚓

Step aboard the Maritime Marvels Express, your ticket to a weekly deep dive into the dynamic seascape of container shipping. Stay ahead of the tide with Maritime Analytica's exclusive industry scoop, riding the waves of the latest news and updates! 🌊

Dive into the sea of maritime wisdom with us – where every insight is a treasure waiting to be discovered! 🌟

Today's Wisdom from the Waves:

🌊 "The sea, once it casts its spell, holds one in its net of wonder forever." - Jacques Cousteau 🐠

🚢 Navigating Knowledge: Container Shipping Quiz Time! 🚢

*Last Week’s Answer: Reduced Wind Resistance

1- Maersk CEO: Q3 results in line with expectations

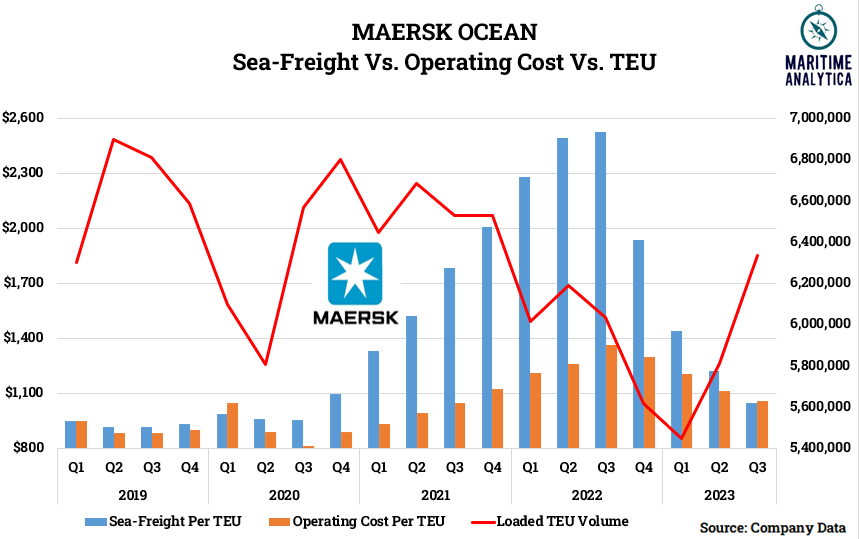

2- Maersk Sea-Freight Vs. Operating Cost Vs. TEU

3- Major Carriers Increase Ownership Share in 2023Q3, MSC Dominates with 52% via MDS

Share of capacity owned by major carriers rises in 2023Q3 compared to the same period in 2022.

MSC (Mediterranean Shipping Company) sees a significant increase, now owning 52% of its fleet, up from 42% in 2022Q3.

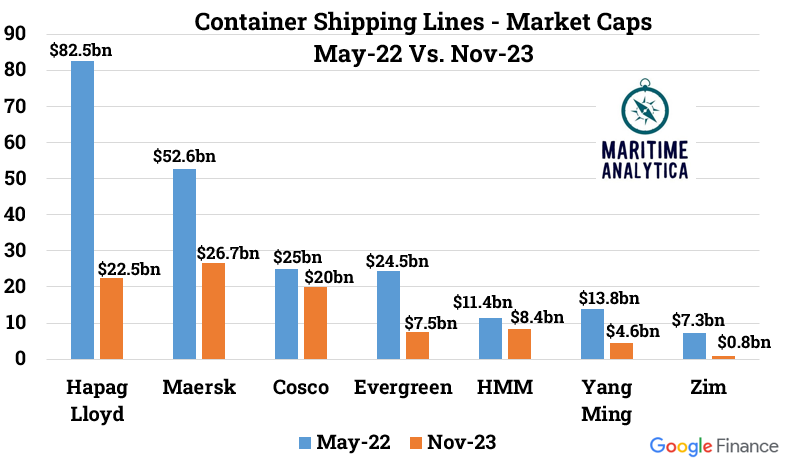

4- The Fall of Market Caps for Container Shipping Sector

5- ZIM Joins CMA CGM and Hapag-Lloyd in 10%+ Alternative Fuel Adoption via Drewry

ZIM achieves 13% alternative fuel capacity with new LNG-powered ships.

CMA CGM leads with 14%, including LNG and biofuel-capable vessels; Hapag-Lloyd follows at 12%.

Drewry underscores slow progress in decarbonizing container shipping, citing old, inefficient vessels.

Questions persist about the timing of retiring polluting ships and transitioning to green operations.

5- ZIM's Gamble on Giant Ships for Cost Efficiency:

ZIM plans to replace chartered tonnage with 50% larger vessels in 2024.

Despite no reduction in charter costs, the move aims to decrease cost per TEU through increased overall capacity.

ZIM faces the challenge of filling larger ships to realize cost benefits.

2024 expected to be challenging, but optimism for improved cost structures in 2025 with new vessels and cost reductions.

6- Containership Speeds Dip in October Amidst Industry Challenges via Clarksons

Average containership speeds declined by -0.4% month-on-month in October 2023.

Year-to-date figures reveal speeds averaging -2.8% lower than in 2022.

Lower speeds coincide with a challenging year for container trade growth, increased fleet capacity, and spot freight rates falling below historical averages.

'Capacity management' strategies are prompted, and potential impacts from IMO decarbonization regulations, like CII, are considered.

🚢 Cast Your Vote: Container Shipping Insights Poll! 🚢

Last Week's Insight: 43% of our followers believe that “there is a room for improvement” for a full-scale digital transformation in the container shipping industry, while another 43% think that it is in “early-stages” now.

7- Top 10 Container Shipping Lines' Capacity by Ship Age via MDS Transmodal Ltd

- Capacity offered on ships of 20+ years old account for more than 12% of total fleet capacity.

- MSC Mediterranean Shipping Company, the largest line, is currently deploying the highest proportion of vessels built at least 20 years ago

8- Drewry Predicts Second Year of Decline in Seaborne Reefer Trade

Drewry's report anticipates a 0.5% decline in seaborne reefer trade for 2023, following a 0.8% decrease in the previous year.

Climate impacts on fruit crops, weak Chinese demand, and geopolitical tensions contribute to the downward trend.

Beef exports in the meat segment are affected by subdued consumer demand from China.

Fish and seafood sector experiences lower demand due to marine heat waves affecting catches in the Atlantic throughout 2023.

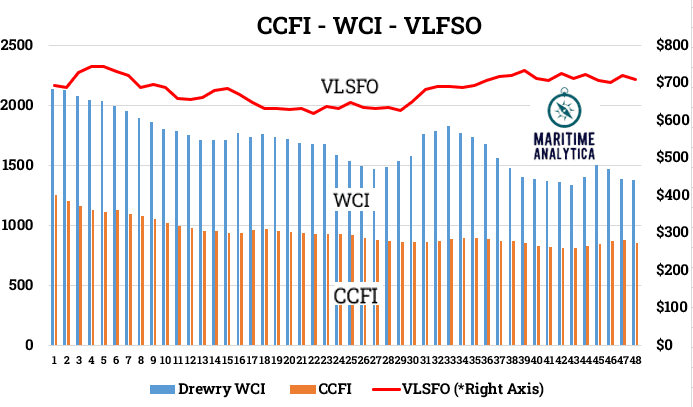

9- Week 48 - CCFI - WCI - VLSFO

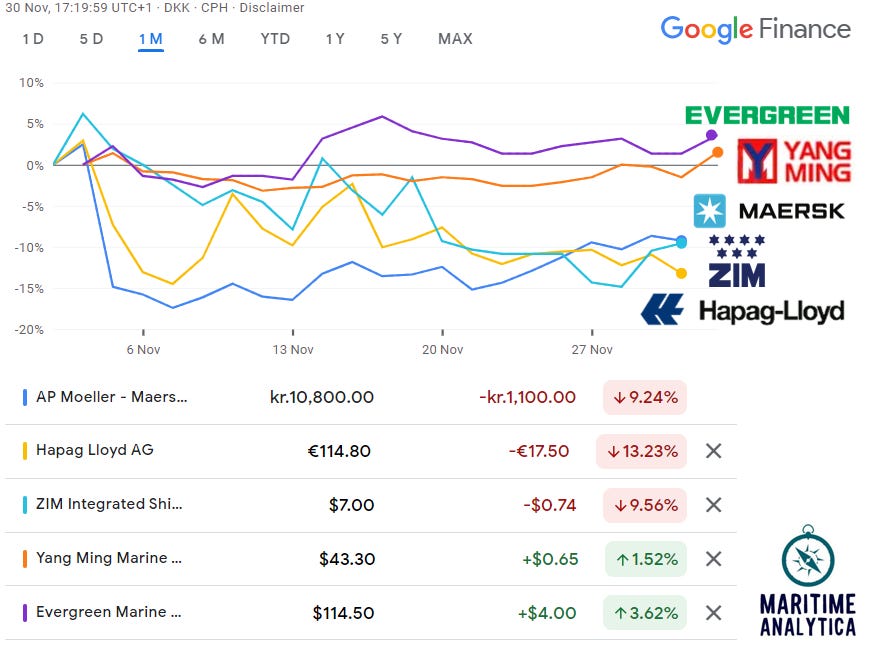

10- Container Shipping Lines - Stock Performances

We read your emails, comments, and poll replies daily. Hit reply and let us know what you want more of! - Email: maritime-analytica@outlook.com

Have you missed any past newsletter? Check them out here:

For more daily news, follow up via Linkedin here:

Invite your friends to read Maritime Analytica⚓

Invite friends to read Maritime Analytica. Share the referral link for them to subscribe and earn benefits:

Share the link via text, email, or social media.

Get Free Exclusive Market Report for 5 referrals.

Receive a 60min Zoom Sectoral Chat for 10 referrals.

Obtain Exclusive Consultancy Service for 20 referrals.

Visit the leaderboard and check Substack’s FAQ for more details. Thanks for supporting Maritime Analytica!

To learn more, check out Substack’s FAQ.