⚓ Your Weekly Maritime News - 23

Exclusive Insights on Container Shipping, Market Trends, and Strategic Guidance

Hello, Maritime Mavericks! 🚢🌊

Embark on an exhilarating journey with the Maritime Analytica newsletter!

Get ready to submerge yourself in a sea of groundbreaking insights on container shipping, sprinkled with expert tactics and the most up-to-date industry buzz.

Let's plunge into it with enthusiasm! 🌊🔍

Today's Wisdom from the Waves; 🌊

"Like the ocean, life has its tides; embrace them, ride the waves, and let the challenges shape you into the magnificent sailor of your own destiny." - Jacques Cousteau

🚢 Navigating Knowledge: Container Shipping Quiz Time! 🚢

*Last Week’s Answer: Artificial Intelligence

1- Climate crisis may cost shipping billions by 2025

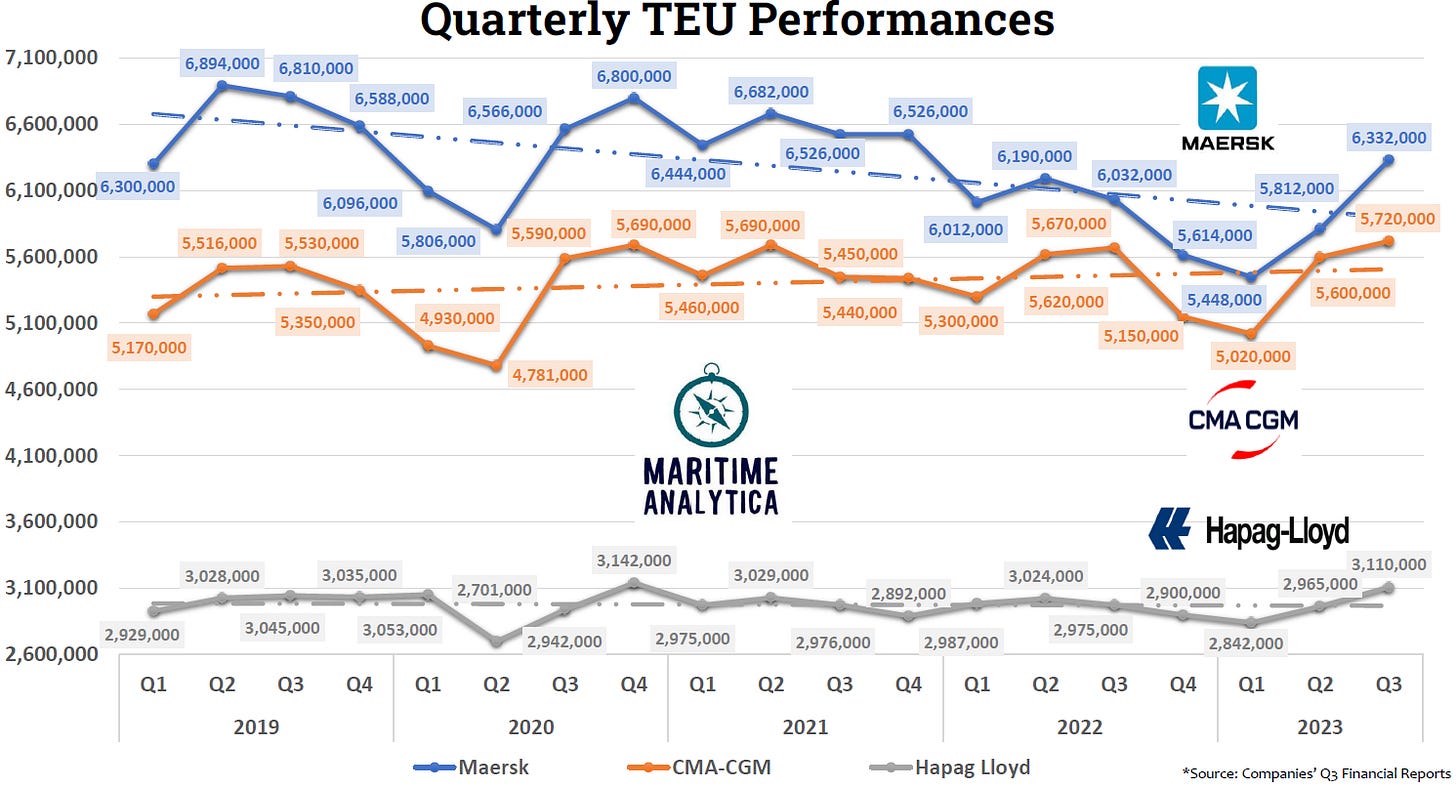

2- Maersk Vs. CMA-CGM Vs. Hapag LLoyd - TEU Performances - Q3/2023

3- Panama Canal Faces Growing Congestion Crisis via Linerlytica

Record Ship Queue: A record-breaking 22 ships, totaling 190,000 TEU, are stranded at the Panama Canal anchorage.

First Containership Impact: Transit restrictions begin affecting containerships, marking a critical point in the congestion crisis.

Neo-Panamax Dominance: Of the stranded vessels, 14 are neo-panamax units, highlighting the impact on larger container ships.

Escalating Challenge: The congestion situation is set to worsen, posing significant challenges to maritime traffic through the vital waterway.

🚢 Cast Your Vote: Container Shipping Insights Poll! 🚢

Last Week’s Insight: 57% of our followers believe that Emission reduction policies will have the most significant impact on the container shipping business in the near future.

4- Zim Sails Into 10%+ Alternative Fuel Club with CMA CGM and Hapag-Lloyd via Drewry

Zim reaches 13% of total fleet capacity powered by non-conventional marine bunker fuels.

Zim joins CMA CGM and Hapag-Lloyd in the exclusive group exceeding 10% alternative fuel capacity.

CMA CGM maintains leadership with 14% fleet capacity for alternative fuels, including LNG and biofuel-ready ships.

Drewry underscores the industry's ongoing journey toward decarbonization, emphasizing the need for retiring old, inefficient vessels and adopting true low or zero-carbon fuels.

Key industry questions remain about retiring polluting vessels and the full utilization of alternative-fuel-ready ships in eco-friendly modes.

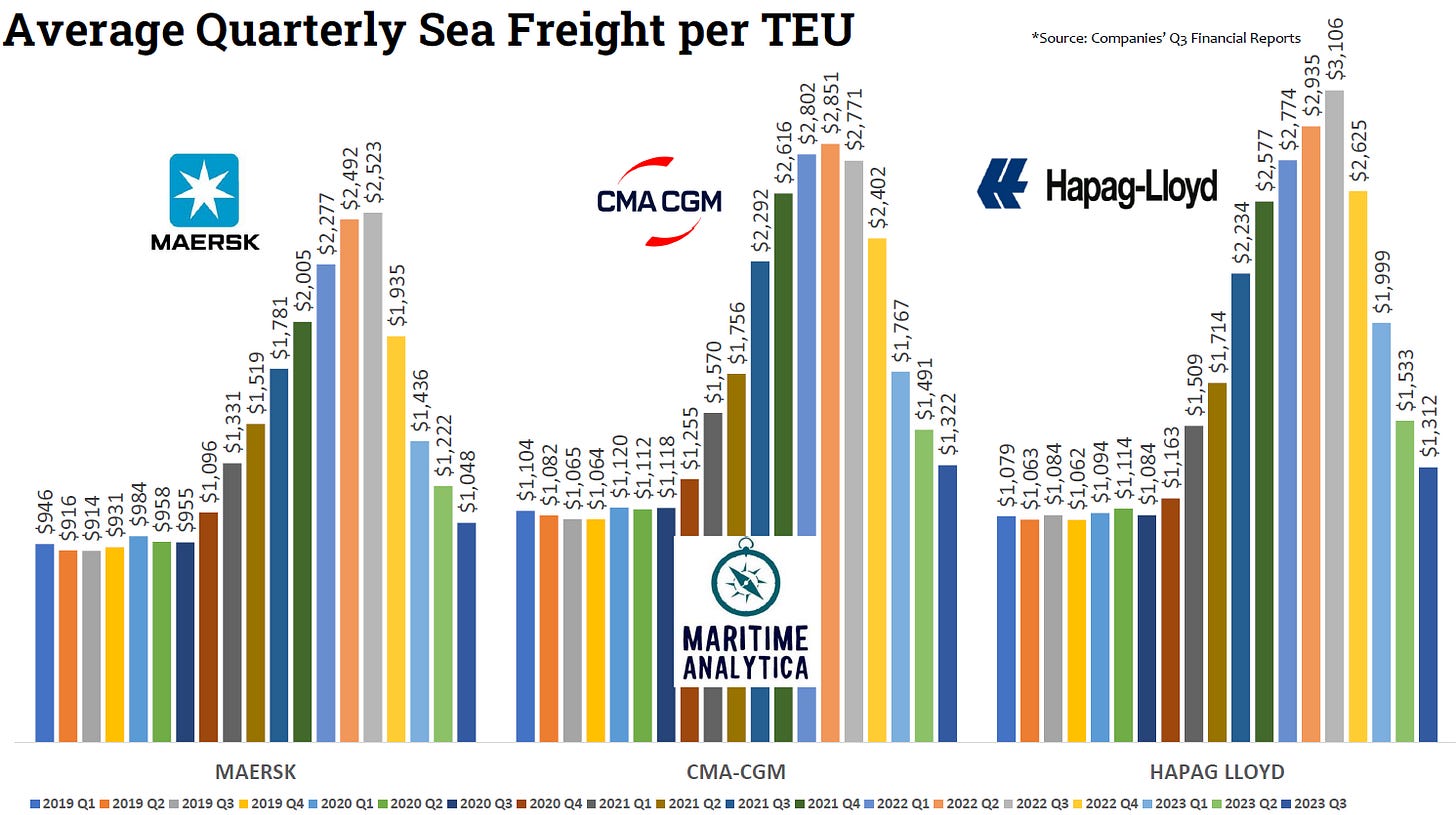

5- Maersk Vs. CMA-CGM Vs. Hapag LLoyd - Sea-Freight Performances - Q3/2023

6- Houthi Militants Attack Maersk Ship in Red Sea

7- Liner Shipping's 2024 Outlook: Navigating Troubles

Despite past concerns, US port TEU throughput rises 4.7% MoM and 11.4% YoY in October, signaling resilience.

US retailers cautious amid high inventory and increased mortgage rates, impacting the outlook for peak sales.

Unpredictable trends in China-US containerized trade influenced by economic policies, retail dynamics, and the Panama Canal bottleneck.

Potential tariff plans by Donald Trump and Europe's Carbon Border Adjustment Mechanism add uncertainties to global trade.

Liner companies face challenges from previous newbuilding orders, with freight rates showing slight improvement on transpacific routes but remaining tough on Asia-Europe lanes.

8-OOCL and HMM Release EU ETS Surcharges Amidst Market Uncertainty

OOCL and HMM disclose EU ETS surcharge figures in line with major carriers.

OOCL opts for monthly adjustments, while CMA CGM adapts quarterly based on dynamic EU allowance prices.

Unpredictable EUA prices until 2025 make surcharge predictions challenging.

Experts remain optimistic, viewing EU ETS costs as manageable challenges for the shipping sector.

Pending EU ETS law details, especially regarding non-EU ports, contribute to industry uncertainties.

9- UMAS: $200 Gap for Zero-Emission Shipping per Container

UMAS reveals $150-$450 per TEU cost difference for zero-emission vessels on transpacific routes by 2030.

Total Cost of Operation (TCO) for SZEF vessels could be 2-4 times conventional fuels by 2030, emphasizing early commitments.

Future fuels may cost 2-3 times more. Early adoption by cargo owners is crucial for a zero-emission shipping market.

Discussions stress coordinated efforts for global decarbonization. UNCTAD policy calls for universal regulations and supports a carbon levy.

Shipping leaders call for an end date for fossil-only newbuilds, urging IMO to accelerate the shift to green fuels.

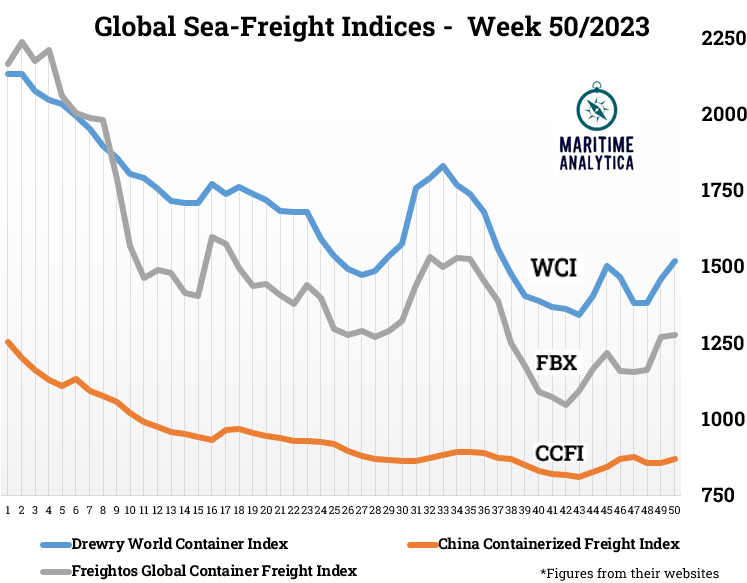

10- Global Sea-Freight Indices📈

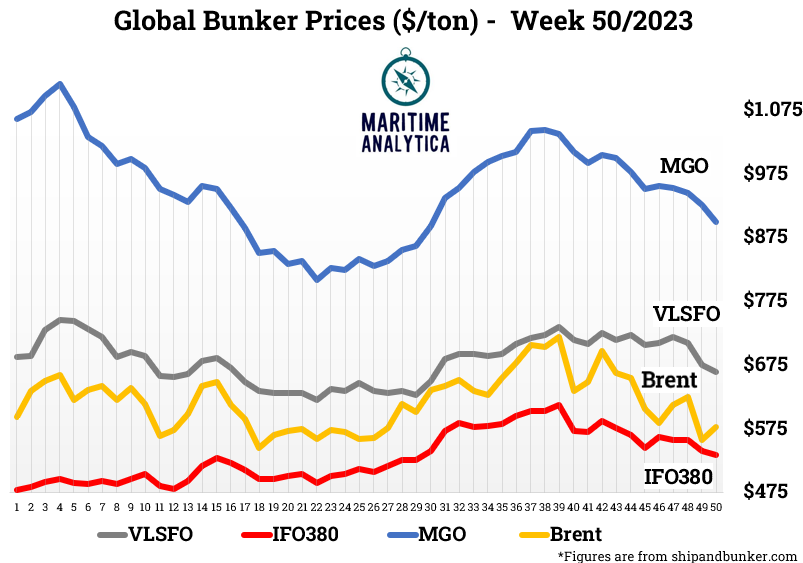

11- Global Bunker Prices📉

12- Global Charter Indices📉

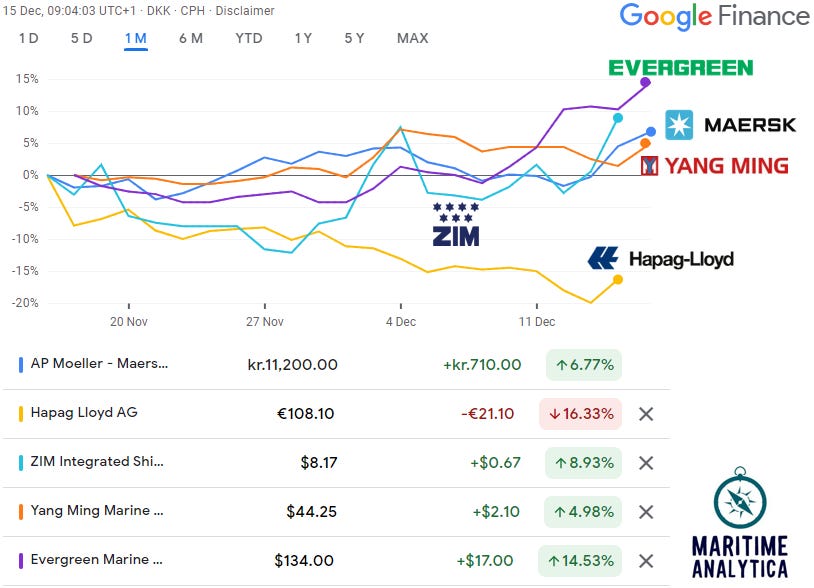

13- Carriers - Stock Performances 🆙

We read your emails, comments, and poll replies daily. Hit reply and let us know what you want more of! - Email: maritime-analytica@outlook.com

Have you missed any past newsletter? Check them out here:

For more daily news, follow up via Linkedin here:

For Exclusive Market Report Q3/2023 and Online Courses, please fill into the form here:

Invite your friends to read Maritime Analytica⚓

Invite friends to read Maritime Analytica. Share the referral link for them to subscribe and earn benefits:

Share the link via text, email, or social media.

Get Free Exclusive Market Report for 5 referrals.

Receive a 60min Zoom Sectoral Chat for 10 referrals.

Obtain Exclusive Consultancy Service for 20 referrals.

Visit the leaderboard and check Substack’s FAQ for more details. Thanks for supporting Maritime Analytica!

To learn more, check out Substack’s FAQ.

In terms of the content and page organisation, the best container shipping newsletter in the world. Thank you.