⚓ Your Weekly Maritime News - 24

Exclusive Insights on Container Shipping, Market Trends, and Strategic Guidance

Set Sail, Sea Explorers! ⚓

Welcome aboard the Nautical Navigator's Journal, your weekly expedition into the fascinating realm of container shipping. Cruise confidently with Maritime Insights' exclusive industry highlights, riding the currents of the latest news and updates! 🌊

Dive into the ocean of maritime wisdom with us – where every revelation is a pearl waiting to be uncovered! 🌟

Today's Wisdom from the Waves:

🌊 "The ocean stirs the heart, inspires the imagination, and brings eternal joy to the soul." - Robert Wyland 🐋

🚢 Navigating Knowledge: Container Shipping Quiz Time! 🚢

*Last Week’s Answer: Economic Speed

1- Houthi Attacks Disrupt Red Sea Trade: U.S. Forms Defense Coalition

Houthi militants target ships to Israel, prompting MSC and Hapag-Lloyd route cancellations.

U.S. initiates a 10-nation defense coalition to enhance security in the affected Red Sea region.,

2- CMA CGM Receives Largest LNG-Powered Ship

Hudong-Zhonghua delivers 13,000 TEU LNG container ship to CMA CGM.

Vessel features cutting-edge energy-saving tech, including LNG dual-fuel system and EGR system reducing methane slip by 50%.

Design incorporates a wind deflector, saving 2%-4% fuel, and stern devices for improved propulsion efficiency.

CMA CGM Bahia is the largest dual-fuel container ship on the South American route.

Part of CMA CGM's $2.3 billion order for six LNG-powered vessels.

3- Maersk Vs. CMA-CGM Vs. Hapag LLoyd - Shipping Performances - Q3/2023

4- Container Ship Boom: 2023 Sets Record with 2m TEU Deliveries by Clarksons

Container fleet deliveries as of December 1, 2023: 316 units, totaling 2m TEU.

97% increase compared to full-year 2022 deliveries of approximately 1m TEU.

Projected full-year 2023 deliveries expected to hit just under 2.2m TEU.

This marks the first time in history that over 2m TEU in a single year.

Previous record, set in 2015, was 1.7 m TEU.

🚢 Cast Your Vote: Container Shipping Insights Poll! 🚢

Last Week’s Insight: 53% of our followers believe that among the emerging services, Autonomous Vehicles for Transport has the potential to reshape the container shipping landscape significantly.

5- Maersk Vs. CMA-CGM - Logistics - Q3/2023

6- Freight Rates Hit 2019 Lows Despite Rising Costs

Container volumes dip 2% YoY; average freight rates reach 2019 levels in September and continue sliding.

Liner operators face challenges from a growing fleet (5% YoY, 19% vs. 2019) and lower container volumes (-2% vs. 2022, +1% vs. 2019).

Lower sailing speeds offset supply growth, but congestion remains a hurdle.

Average freight rates drop 56% YoY, staying 19% higher than 2019: likely further decline since September 2023.

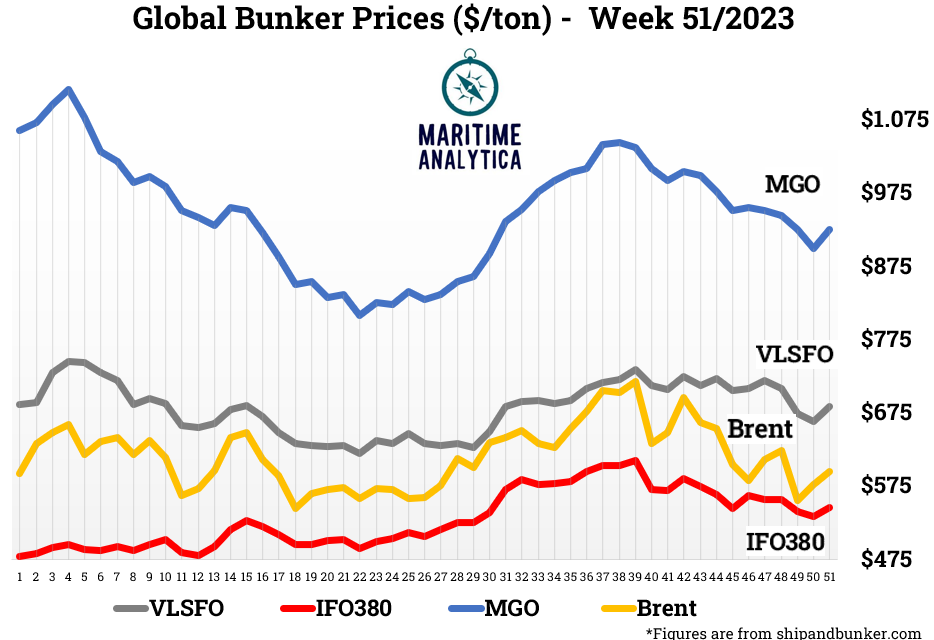

Liner operators grapple with higher costs (VLSFO +5% vs. 2019, HFO +22% vs. 2019), while chartering new ships falls 73% YoY but remains 65% higher than 2019; current rates are 25% above the 2019 average in December.

7- Maersk Suspends Shipping Route through Red Sea

8- Inactive Vessel Capacity Plummets via Linerlytica

Inactive vessel capacity sharply declines, with just 74 ships and 128,000 TEU currently idled.

Drop observed in both idled fleet and capacity in drydock over the week.

Anticipated factors like attacks south of Suez and congestion at Panama expected to absorb capacity.

Rapid redeployment of idled containerships noted despite challenges.

9- Deepsea Shipping Dynamics: Mediterranean Surges, Northern Europe Holds Steady

Between 2019Q3 and 2023Q3, Deepsea capacity to Mediterranean ports spikes by almost 30%.

Northern European ports experience a slight decrease of -0.4% in offered capacity during the same period.

Main carriers, Hapag-Lloyd & ONE, reduce capacity on deepsea routes to/from North Europe.

MSC and CMA-CGM emerge as key drivers, significantly increasing capacity to/from the Mediterranean.

10- Global Sea-Freight Indices🚀

11- Global Bunker Price 🛢️

12- Global Charter Indices🚢

13- Carriers - Stock Performances

We read your emails, comments, and poll replies daily. Hit reply and let us know what you want more of! - Email: maritime-analytica@outlook.com

Have you missed any past newsletter? Check them out here:

For more daily news, follow up via Linkedin here:

For our exclusive market reports, online customized courses, advertisement services, and more, please complete the form:

Invite your friends to read Maritime Analytica⚓

Invite friends to read Maritime Analytica. Share the referral link for them to subscribe and earn benefits:

Share the link via text, email, or social media.

Get Free Exclusive Market Report for 5 referrals.

Receive a 60min Zoom Sectoral Chat for 10 referrals.

Obtain Exclusive Consultancy Service for 20 referrals.

Visit the leaderboard and check Substack’s FAQ for more details. Thanks for supporting Maritime Analytica!

To learn more, check out Substack’s FAQ.

Good presentation with useful graphs...