⚓ Your Weekly Maritime News - 25

Exclusive Insights on Container Shipping, Market Trends, and Strategic Guidance

Greetings, Esteemed Mariners! ⚓

Welcome aboard the Maritime Mastery Express, your weekly gateway to a profound exploration of the dynamic realm of container shipping. Chart your course ahead with Maritime Insight Pro's exclusive industry intelligence, navigating through the surges of the latest news and updates! 🚢

Immerse yourself in the ocean of maritime expertise with us – where every revelation is a strategic gem waiting to be unearthed! 🌐

Today's Wisdom from the Waves; 🌊

“🌊 Life is like the ocean, it can be calm or still, and rough or rigid, but in the end, it's always beautiful." - Walt Disney

*AI's Oceanic Ballet: Michelangelo's Touch on Virtual Containership created by Maritime Analytica

🚢 Navigating Knowledge: Container Shipping Quiz Time! 🚢

*Last Week’s Answer: Robotics

1- U.S. launches joint task force to prevent Houthi attacks on container ships in Red Sea

2- Twin Canal Crises Threaten Global Christmas Trade

Drought in Panama and attacks near Suez threaten vital trade routes.

Ship delays raise concerns about shortages of goods, including electronics and Christmas items.

Panama Canal experiences its driest October since 1950, leading to reduced crossings.

Shipping companies, like Hapag-Lloyd, forced to divert routes, facing challenges from rebel attacks.

Rising costs and surcharges prompt worries about the resilience of global supply chains.

3- Maersk Vs. CMA-CGM - Shipping & Logistics - Q3/2023

4- Unveiling the True Costs of EU ETS for Shipping via Clarksons

EU ETS to include shipping from January 1.

Vessels visiting EU ports must offset CO2 emissions with EU Allowances.

Estimates show EU ETS costs for VLCCs, MRs, capesizes, and panamaxes.

For a VLCC from Ras Tanura to Rotterdam, costs estimated at $200,000 per voyage in 2023 (4% of today's freight cost).

Anticipated increase to $0.5 million (10% of freight cost) in 2026 when EU ETS is fully phased in at 100%.

5- Carriers’ EBIT Margin Performance - Q3 by Linerlytica

Financial Struggle: Liners reached breakeven, with an average EBIT margin at -0.1%.

Operational Challenges: Excluding certain liners, the industry operated at a breakeven point.

Provision Impact: Material provisions by COSCO affected the overall EBIT margin.

Inorganic Growth Factor: Evergreen's inorganic growth played a role in financial challenges.

Global Significance: The 11 liners, representing 66% of global capacity, face varied performances and a cautious outlook.

6- Red Sea Attacks Disrupt Vital Suez Route via Gravitas

Routing Challenge: Suez closure prompts 9-day, 5149km detour around Africa.

Historical Linchpin: Since 1869, Suez Canal faces disruptions amid wars and conflicts.

7- Packed Panama: Containership Chaos Continues with Rising Congestion and Transit Woes via Clarksons

Panama Canal containership port congestion persists due to draft restrictions and tighter transit rules.

As of Dec 7, 2023, the 7-day moving average for containership capacity at an anchorage is 131k TEU.

While down from late Nov-23, it remains 50% above the 2022 average.

Average waiting time at a Panama Canal anchorage exceeds 30 hours in early Dec-23, up from 22 hours in Nov-23.

Disruption and longer waiting times result from constrained transit slots and liners arriving early to unload cargo.

🚢 Cast Your Vote: Container Shipping Insights Poll! 🚢

Last Week’s Insight: 64% of our followers believe that considering the future, the adoption of sustainable and eco-friendly practices are essential for survival in the container shipping industry.

8- EU ETS Study: True Costs of Shipping Fuels Revealed

Comprehensive Comparison: ENGINE and Freight Investor Services analyze fuel prices, adjusting for calorific content and EU ETS costs.

Rotterdam's LNG Advantage: Rotterdam is attractive for LNG bunkering for dual-fuel ships compared to low-sulphur marine gasoil.

Singapore's LNG Challenge: LNG faces competition with VLSFO for dual-fuel vessels in Singapore.

Biofuel Blend Appeal: B24-VLSFO is cost-effective against LNG, especially with government rebates in Rotterdam.

EU ETS Impact: From January 1, shipping in the EU ETS requires vessels to offset CO2 emissions through EU Allowances.

9-Red Sea Shipping Halt Sparks Global Route Shift via Linerlytica

Maersk, MSC, CMA CGM, Hapag-Lloyd, HMM halt Red Sea voyages.

Cape Detour: Possible shift could extend roundtrip transit times by 30%.

Global Fleet Impact: 29.3% of global fleet, 8.25m teu capacity affected.

Teu-Mile Surge: Potential 2.5m teu increase (9% of global fleet).

Speed Crucial: Adjustments needed to minimize schedule delays.

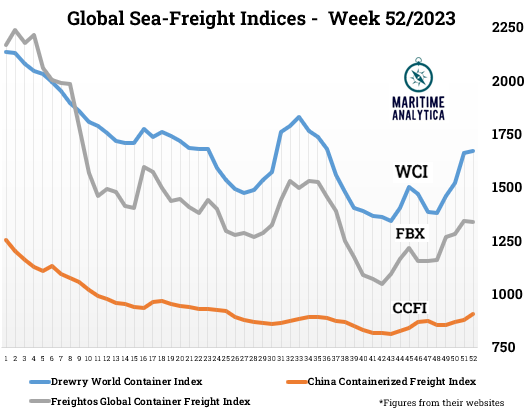

10- Global Sea-Freight Indices🚀🚀🚀

11- Global Bunker Prices

12- Carriers - Stock Performances

We read your emails, comments, and poll replies daily. Hit reply and let us know what you want more of! - Email: maritime-analytica@outlook.com

Have you missed any past newsletter? Check them out here:

For more daily news, follow up via Linkedin here:

For our exclusive market reports, online customized courses, advertisement services, and more, please complete the form:

Invite your friends to read Maritime Analytica⚓

Invite friends to read Maritime Analytica. Share the referral link for them to subscribe and earn benefits:

Share the link via text, email, or social media.

Get Free Exclusive Market Report for 5 referrals.

Receive a 60min Zoom Sectoral Chat for 10 referrals.

Obtain Exclusive Consultancy Service for 20 referrals.

Visit the leaderboard and check Substack’s FAQ for more details. Thanks for supporting Maritime Analytica!

To learn more, check out Substack’s FAQ.

Great newsletter, thank you.