⚓ Your Weekly Maritime News - 🌟 Special Edition - Thank You for 100 Subscribers Just in a Week!

Greetings, Maritime Enthusiasts! 🚢🌊

We're excited to reach 100 subscribers just in a week. Your support is invaluable. Enjoy our free Special Edition.

📢 Share the News! 📢 As we grow together, we really need you to share our newsletter with your esteemed network of colleagues, peers, and fellow maritime enthusiasts.

🚀 Your Input Matters! 🚀 We value your opinions a lot, and we want to hear from you! Please tell us what premium content you would like to see in our future newsletters. Your feedback will shape our offerings and ensure that we provide the insights you find most valuable.

1- TEU Performance - Q1/2023

Maersk tends to lose its market share since Q1/2019 due to its increasing focus on integrated logistics, while others have had no significant changes.

2- Sea-Freight Performance - Q1/2023

Hapag Lloyd stands out from others in terms of peak sea-freight levels, with ($3106/TEU in Q3/2022). Therefore, its average sea-freight level in Q1/2023 is still higher than that of the others.

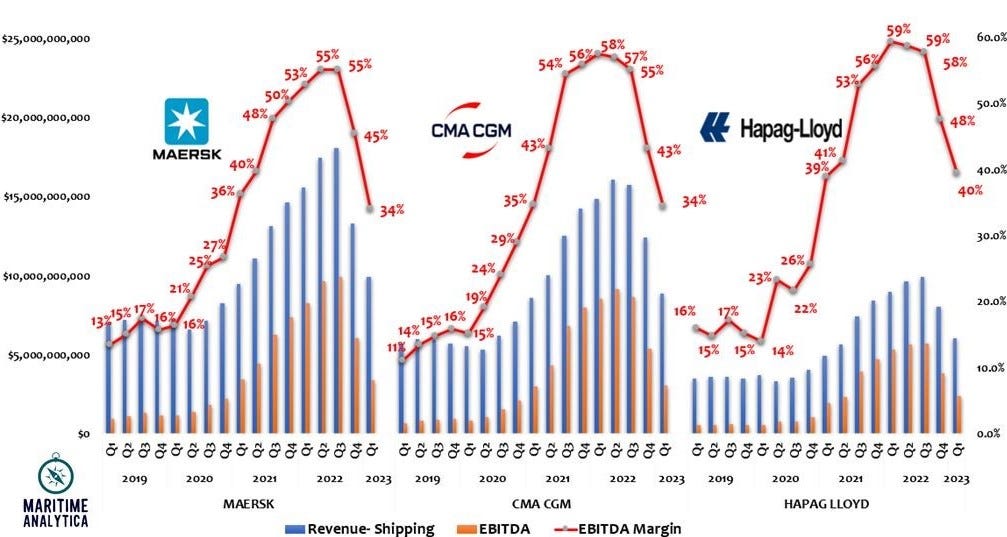

3- Shipping Performances - Q1/2023

Hapag Lloyd's higher seafreight levels result in a higher EBITDA margin, while Maersk & CMA-CGM show similar profitabilities.

4- Logistics Performances - Q1/2023

Maersk has had higher pay-offs from its huge logistics investments in terms of EBITDA margin, while CMA-CGM has had no significant changes except for its revenue.

5- Shipping Vs. Logistics Performances - Q1/2023

Despite billions of USD investments on Land, their profits from logistics are still significantly smaller when compared to their profits from shipping.