🚨ZIM at a Crossroads: Buyout, Merger — or Survival?

🔥One vote. Three futures. One of the most important strategic moments for container shipping in 2025.

🎖️Join Us / ✨Media Kit / 📊2026 Outlook / 🎥YouTube / 🏛️About Us

🔥 Greetings, Maritime Mavericks!

On December 26, ZIM’s shareholders will decide the company’s fate.

Three paths are now on the table:

Go private

Be sold to a competitor

Or remain public and independent

This is no longer rumor. This is now a board-level reality.

❓ What’s Really Happening?

🔥 Why This Moment Is So Sensitive?

🧠 Option 1 — Going Private

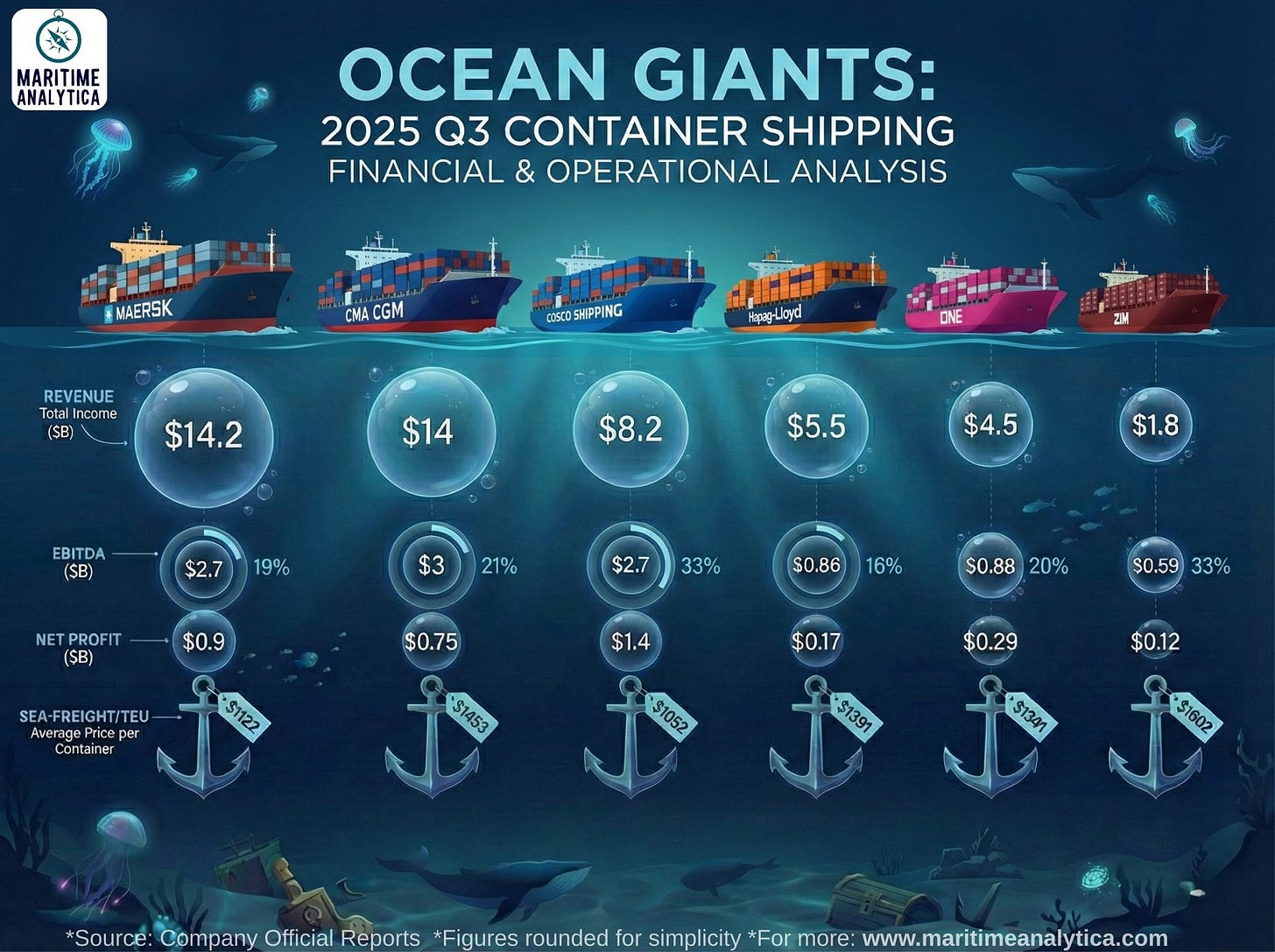

🔗 Option 2 — Sold to a Giant (Maersk, MSC, Hapag LLoyd,?)

🧾 Option 3 — Stay Public

📌 The Strategic Truth

🎯 Final CEO Take

Let’s dive in…

❓ What’s Really Happening?

ZIM’s CEO Eli Glickman and owner Rami Ungar want to take the company private.

The first reported price: $19–$20 per share.

ZIM is sitting on $3 billion cash — about $25 per share.

The board said: too low.

So, they hired Evercore to explore all strategic options.

Now the fight moves to the shareholder meeting.