🔥Q2 Shake-Up: Maersk’s Silent Wins, $13B CMA CGM Gains, and CEO Insights! Maritime Analytica Insight-137

🌎 The World’s Most Influential Container Shipping Platform — Trusted by 200,000+ Leaders Worldwide!

🎖️Subscribe /✨Sponsorship /📊Exclusive Report /🙏Rate us /🎁Send Gift

🔥Greetings, Maritime Mavericks!

Welcome to Maritime Analytica! 🌊🚀 Your gateway to the latest shipping intelligence. Stay ahead with expert insights, market trends, and breaking maritime news.

🔥Q2 Surprise: Is Maersk Quietly Winning the Logistics War?

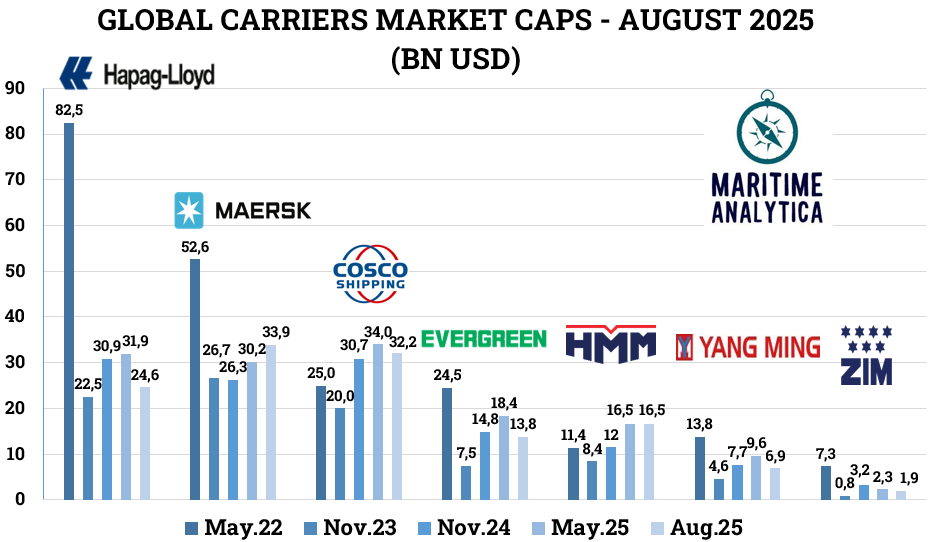

📊Global Carriers Market Cap - August 2025

🔥How Did CMA CGM Earn $13B in Q2-25 Amid Global Chaos?

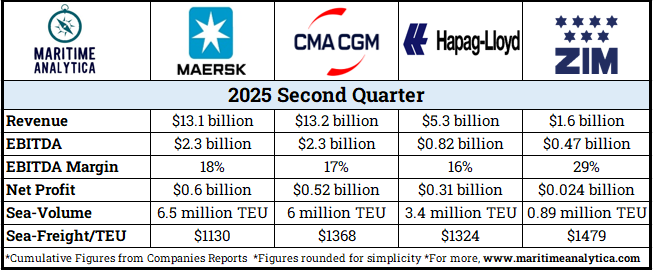

⚓Global Carriers Performances on Q2

🔥ZIM CEO Eli Glickman: 10 Must-Know Insights on Q2!

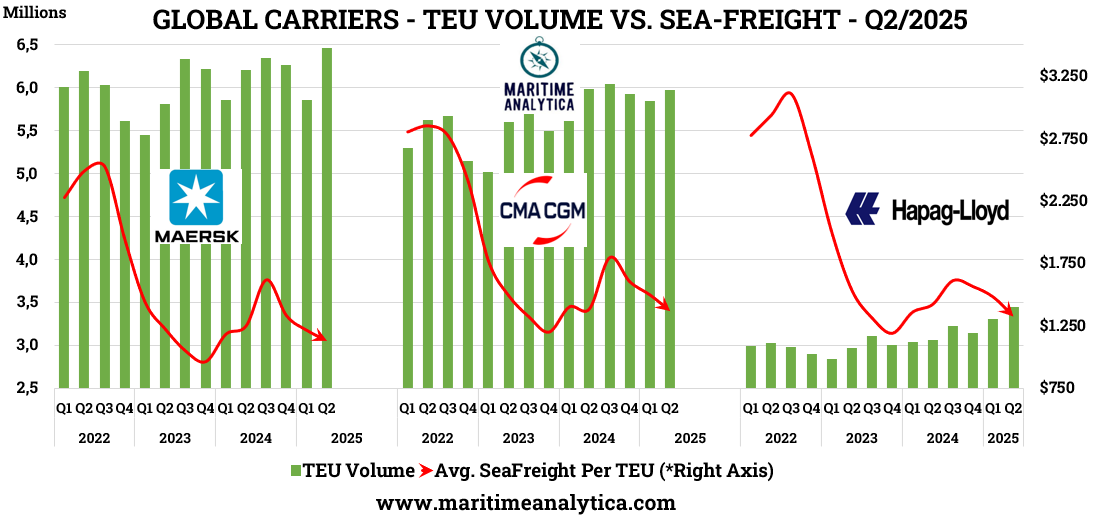

🛳️Global Carriers on Q2 - TEU Vs. Sea-Freight

🔥Hapag-Lloyd CEO Rolf Habben Jansen on Q2'25: "Margins Under Siege”

🌍Top 10 Shipping Lines - August 2025

🔥Breaking: Maersk CEO Vincent Clerc: "The Great Supply Chain Reset"

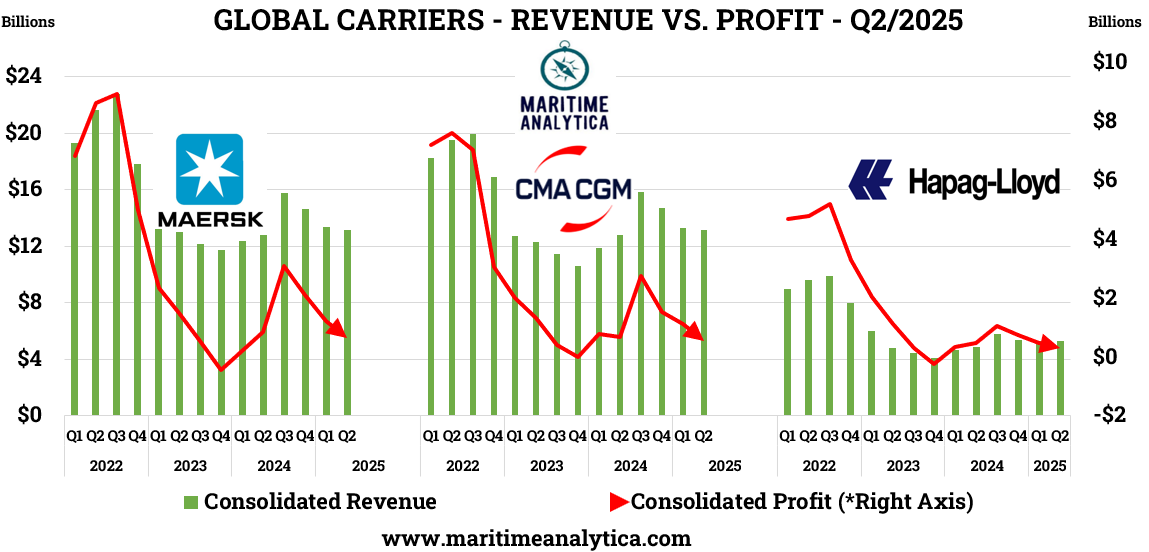

⚓Global Carriers on Q2 - Revenue Vs. Profit

🔥 Q2 Surprise: Is SITC Quietly Expanding Its Containership Empire?

🌊🚀Together, we can navigate a sea of knowledge and discovery. Share the wisdom, share the journey!

🔥Ready to Stay Ahead on Container Shipping?

🔥Q2 Surprise: Is Maersk Quietly Winning the Logistics War?

🎖️Subscribe /✨Sponsorship /📊Exclusive Report /🙏Rate us /🎁Send Gift

🔥COSCO Takes Lead; Maersk Closes Gap

August leaders: COSCO $34.0B, Maersk $33.9B, Hapag-Lloyd $24.6B.

HMM doubles since 2023; Evergreen slips from May rebound.

Cycle peak 2022 evaporates; Hapag-Lloyd down seventy percent.

Yang Ming softens; ZIM dips from May, smallest by far.

🏅Maritime Analytica: “Capital prefers integrated scale and policy-backed resilience. Expect COSCO–Maersk valuation duel, Korea’s HMM momentum, and Taiwanese corrections. Hedge rate volatility; overweight logistics adjacencies and efficiency tech winners through 2026 selectively.i

🔥How Did CMA CGM Earn $13B in Q2-25 Amid Global Chaos?

🎖️Subscribe /✨Sponsorship /📊Exclusive Report /🙏Rate us /🎁Send Gift

🔥Maersk & CMA CGM Lead Q2 Battle

Maersk $13.1B revenue, highest sea volume: 6.5M TEU.

CMA CGM top earner: $13.2B, highest freight rates $1,368/TEU.

ZIM margins lead at 29%, despite only $1.6B revenue.

Hapag-Lloyd stable: $5.3B revenue, $1,324/TEU freight rate.

🏅Maritime Analytica: “Pricing power shifts toward niche carriers with better yield management like ZIM. Expect Maersk, CMA CGM to dominate scale, but margin-driven players will shape 2025 freight strategies.”

🔥ZIM CEO Eli Glickman: 10 Must-Know Insights on Q2 and Global Shipping!

🎖️Subscribe /✨Sponsorship /📊Exclusive Report /🙏Rate us /🎁Send Gift

🔥Freight Rates Collapse as Volumes Hold

Maersk Q2 volume stable at ~6.5M TEU; freight down sharply.

CMA CGM freight declines; volumes resilient around 6M TEU.

Hapag-Lloyd volumes rise, but pricing remains under pressure.

Carriers balance capacity; spot rates face structural headwinds.

🏅Maritime Analytica: “Despite steady TEU volumes, falling freight rates threaten margins. Expect intensified blank sailings, capacity resets, and aggressive contract renegotiations as carriers defend profitability into 2026.”

🔥Hapag-Lloyd CEO Rolf Habben Jansen on Q2'25: "Margins Under Siege, Volumes on the Rise!"

🎖️Subscribe /✨Sponsorship /📊Exclusive Report /🙏Rate us /🎁Send Gift

🔥MSC Dominates Global Capacity Leadership

MSC leads with 6.8M TEU, 933 ships, holding 20.8% share.

Maersk ranks second: 4.6M TEU, 744 ships, 14.1% global share.

CMA CGM & COSCO compete closely: 4.0M vs. 3.5M TEU capacity.

HMM, ZIM, Yang Ming gain ground but remain niche players.

🏅Maritime Analytica: “Scale drives dominance, but MSC’s aggressive fleet expansion signals looming overcapacity. Expect freight volatility, intensified alliances, and contract battles shaping the container shipping landscape through 2026.”

🔥Breaking: Maersk CEO Vincent Clerc: "The Great Supply Chain Reset"

🎖️Subscribe /✨Sponsorship /📊Exclusive Report /🙏Rate us /🎁Send Gift

🔥Profits Collapse Despite Steady Revenues

Maersk revenue Q2’25 ~$13B; profits fell below $1B.

CMA CGM tracks similar trend, steep margin contraction since 2022.

Hapag-Lloyd’s profits near breakeven; recovery remains uncertain.

Industry shifts from peak gains to survival strategies.

🏅Maritime Analytica:”Earnings erosion signals the end of pandemic-era super profits. Expect cost optimization, asset redeployment, and vertical integration strategies as carriers brace for a margin-compression cycle into 2026.”

🔥 Q2 Surprise: Is SITC Quietly Expanding Its Containership Empire?

🎖️Subscribe /✨Sponsorship /📊Exclusive Report /🙏Rate us /🎁Send Gift

info@maritimeanalytica.com / www.maritimeanalytica.com